- Taiwan

- /

- Semiconductors

- /

- TWSE:3450

The five-year decline in earnings for Elite Advanced Laser TWSE:3450) isn't encouraging, but shareholders are still up 397% over that period

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Elite Advanced Laser Corporation (TWSE:3450) shares for the last five years, while they gained 351%. This just goes to show the value creation that some businesses can achieve. Also pleasing for shareholders was the 40% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

While the stock has fallen 8.8% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Elite Advanced Laser

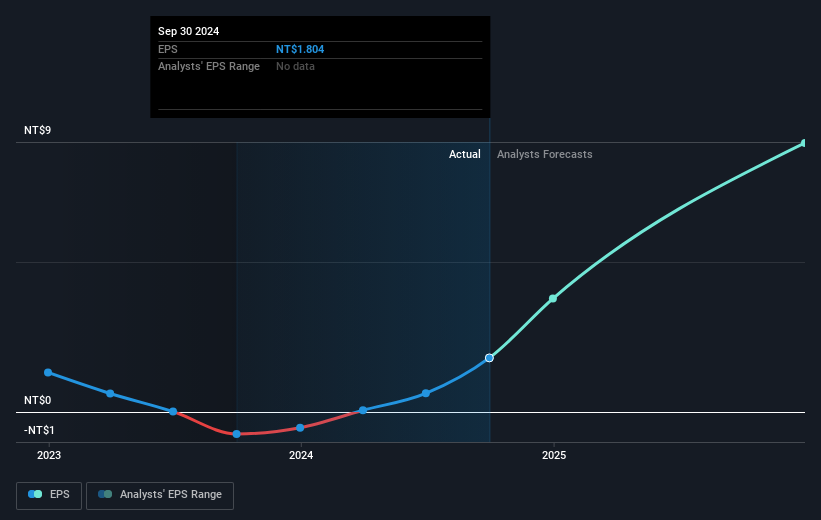

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Elite Advanced Laser moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Elite Advanced Laser has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Elite Advanced Laser's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Elite Advanced Laser's TSR of 397% over the last 5 years is better than the share price return.

A Different Perspective

We're pleased to report that Elite Advanced Laser shareholders have received a total shareholder return of 301% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 38% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Elite Advanced Laser better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Elite Advanced Laser you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Elite Advanced Laser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3450

Elite Advanced Laser

Provides electronic manufacturing services in Taiwan.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives