- Taiwan

- /

- Semiconductors

- /

- TWSE:3413

Foxsemicon Integrated Technology (TWSE:3413) Has Announced That It Will Be Increasing Its Dividend To NT$14.50

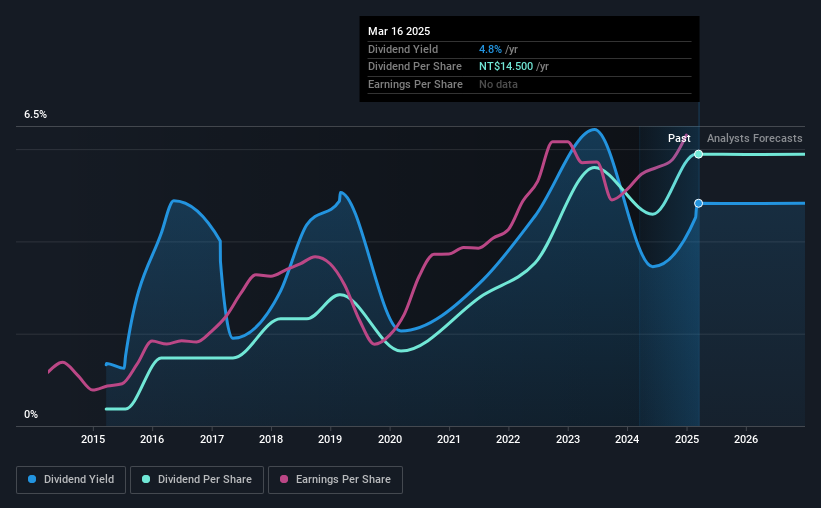

Foxsemicon Integrated Technology Inc. (TWSE:3413) has announced that it will be increasing its dividend from last year's comparable payment on the 18th of July to NT$14.50. This takes the dividend yield to 4.8%, which shareholders will be pleased with.

Check out our latest analysis for Foxsemicon Integrated Technology

Foxsemicon Integrated Technology's Projected Earnings Seem Likely To Cover Future Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Based on the last dividend, Foxsemicon Integrated Technology is earning enough to cover the payment, but then it makes up 610% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Over the next year, EPS is forecast to expand by 29.0%. If the dividend continues on this path, the payout ratio could be 54% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2015, the dividend has gone from NT$0.907 total annually to NT$14.50. This works out to be a compound annual growth rate (CAGR) of approximately 32% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. We are encouraged to see that Foxsemicon Integrated Technology has grown earnings per share at 26% per year over the past five years. The company's earnings per share has grown rapidly in recent years, and it has a good balance between reinvesting and paying dividends to shareholders, so we think that Foxsemicon Integrated Technology could prove to be a strong dividend payer.

Our Thoughts On Foxsemicon Integrated Technology's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Foxsemicon Integrated Technology (of which 1 is a bit concerning!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3413

Foxsemicon Integrated Technology

Engages in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration in Taiwan, the United States, China, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026