- Taiwan

- /

- Semiconductors

- /

- TWSE:3035

Faraday Technology Corporation's (TWSE:3035) P/E Still Appears To Be Reasonable

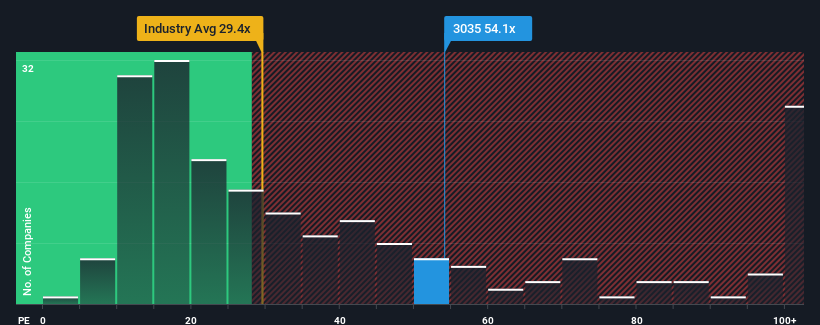

Faraday Technology Corporation's (TWSE:3035) price-to-earnings (or "P/E") ratio of 54.1x might make it look like a strong sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 20x and even P/E's below 14x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Faraday Technology could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Faraday Technology

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Faraday Technology's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's bottom line. Even so, admirably EPS has lifted 53% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 80% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 15% each year, which is noticeably less attractive.

In light of this, it's understandable that Faraday Technology's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Faraday Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Faraday Technology that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3035

Faraday Technology

Operates as a fabless ASIC/SoC and silicon intellectual property (IP) provider in China, Taiwan, Japan, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026