- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8240

Excelliance MOS And 2 Other Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In a global market environment characterized by climbing U.S. stock indexes and heightened inflation expectations, investors are closely monitoring economic indicators and policy decisions that could influence future returns. As growth stocks continue to outperform value shares, dividend stocks present an attractive option for those seeking steady income amidst market volatility. In this context, selecting dividend stocks with strong fundamentals can enhance portfolio stability and provide potential income streams in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.37% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.93% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1984 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

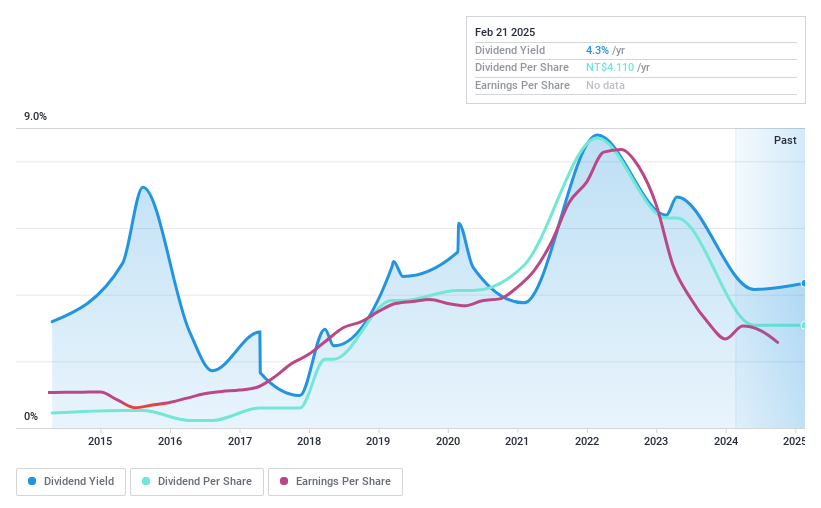

Excelliance MOS (TPEX:5299)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Excelliance MOS Corporation manufactures and sells power components and integrated circuits in Taiwan, with a market cap of NT$4.79 billion.

Operations: Excelliance MOS Corporation generates its revenue from the Power Supply Systems segment, which accounts for NT$1.71 billion.

Dividend Yield: 4.4%

Excelliance MOS's dividend payments have been volatile over the past decade, with an unstable track record. Despite this, dividends are currently covered by earnings and cash flows, with payout ratios of 84.7% and 79.6%, respectively. The company's Price-To-Earnings ratio of 19.4x is attractive compared to the TW market average of 21.6x, although its dividend yield of 4.37% falls slightly below the top quartile in the TW market at 4.38%.

- Unlock comprehensive insights into our analysis of Excelliance MOS stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Excelliance MOS is priced higher than what may be justified by its financials.

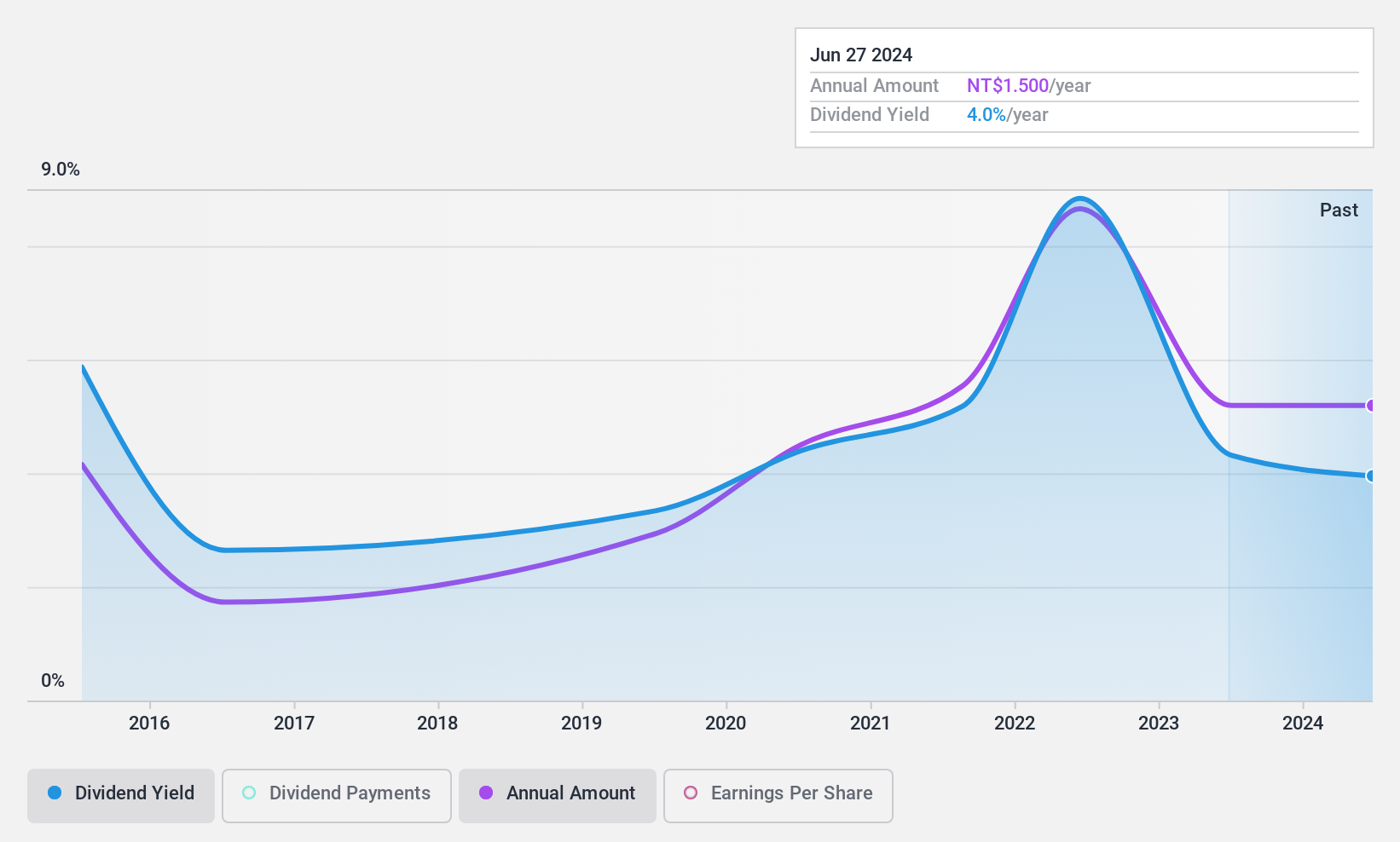

Wah Hong Industrial (TPEX:8240)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wah Hong Industrial Corp. is involved in the development, production, and sale of composite materials and advanced plastic compounds both in Taiwan and internationally, with a market capitalization of NT$4.66 billion.

Operations: Wah Hong Industrial Corp.'s revenue is primarily derived from its operations in Taiwan (NT$3.78 billion), East China (NT$4.06 billion), and South China (NT$1.40 billion).

Dividend Yield: 3.2%

Wah Hong Industrial's dividend payments have been volatile over the last decade, and its track record is unstable. However, dividends are well covered by earnings and cash flows with payout ratios of 46.2% and 66.5%, respectively. The company's Price-To-Earnings ratio of 14.5x is below the TW market average, offering potential value despite a lower dividend yield of 3.22%. Recent proposed changes to company bylaws may impact future shareholder decisions.

- Take a closer look at Wah Hong Industrial's potential here in our dividend report.

- Our expertly prepared valuation report Wah Hong Industrial implies its share price may be too high.

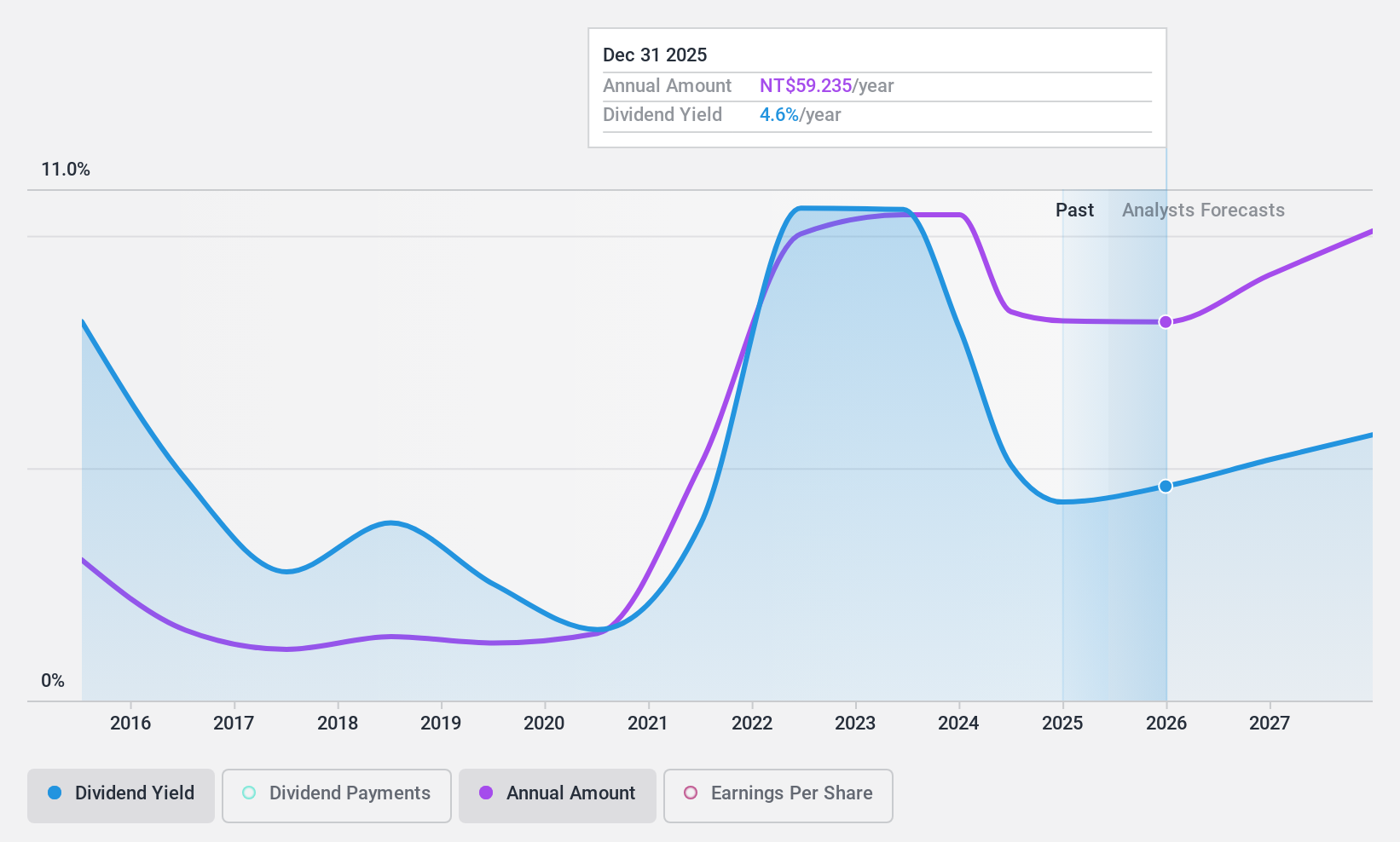

MediaTek (TWSE:2454)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MediaTek Inc. is involved in the research, development, production, manufacture, and marketing of multimedia integrated circuits (ICs) across Taiwan and internationally, with a market cap of approximately NT$2.45 trillion.

Operations: MediaTek Inc.'s revenue is primarily derived from its Multimedia and Mobile Phone Chips and Other Integrated Circuit Design Products segment, which generated NT$530.59 billion.

Dividend Yield: 3.9%

MediaTek's dividend payments have been volatile over the past decade, with a payout ratio of 87.2% covered by earnings and a cash payout ratio of 70.9%. Despite an earnings growth of 38.2% last year, its dividend yield is below the top tier in Taiwan at 3.86%. Recent sales increased to TWD 51.14 billion in January, up from December's TWD 41.68 billion, indicating strong revenue momentum amidst ongoing strategic developments.

- Click here to discover the nuances of MediaTek with our detailed analytical dividend report.

- The analysis detailed in our MediaTek valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Delve into our full catalog of 1984 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wah Hong Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8240

Wah Hong Industrial

Engages in the development, production, and sale of composite materials and advanced plastic compounds in Taiwan and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives