Unveiling Hidden Gems Undiscovered Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism following the Federal Reserve's recent rate cut and ongoing political uncertainties, smaller-cap stocks have been particularly impacted, with indices like the S&P MidCap 400 and Russell 2000 experiencing notable declines. In this environment, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and growth potential amid fluctuating economic indicators and broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ABG Sundal Collier Holding | 18.07% | 0.55% | -4.76% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Lavipharm | 39.21% | 9.47% | -15.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Value Rating: ★★★★★☆

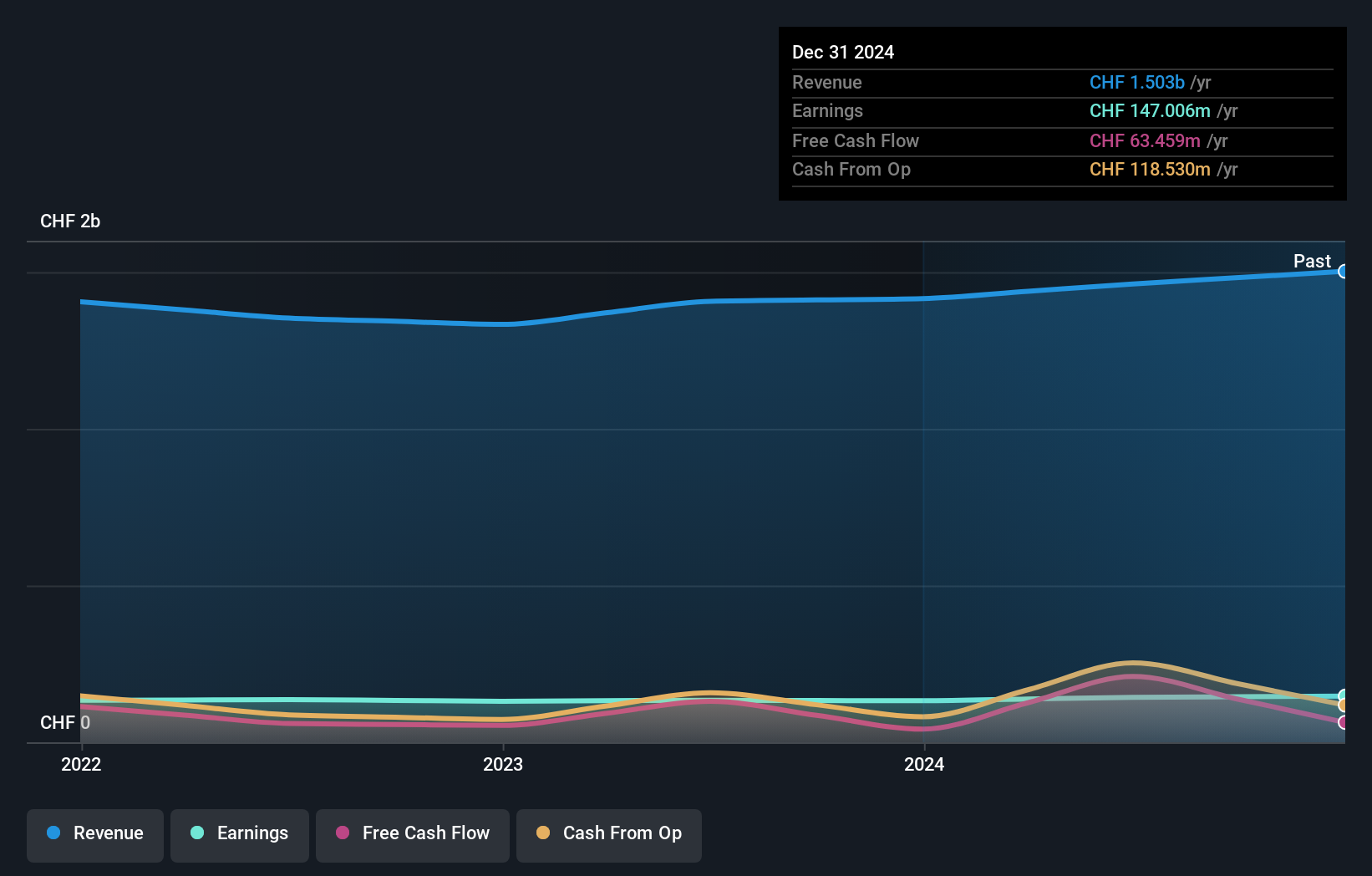

Overview: Vaudoise Assurances Holding SA offers a range of insurance products and services mainly in Switzerland, with a market cap of CHF1.42 billion.

Operations: The company generates revenue through its insurance products and services in Switzerland. It has a market cap of CHF1.42 billion.

Vaudoise Assurances, a relatively small player in the insurance sector, has been making waves with its strong financial performance. Its earnings grew by 7% over the past year, outpacing the industry average of 3%. This growth is supported by high-quality earnings and a debt-free balance sheet for five years now. Trading at nearly 62% below its estimated fair value, it presents a compelling case for undervaluation. Additionally, with positive free cash flow and no concerns about interest coverage or cash runway due to profitability, Vaudoise appears well-positioned within its niche market.

Tsuburaya Fields Holdings (TSE:2767)

Simply Wall St Value Rating: ★★★★★★

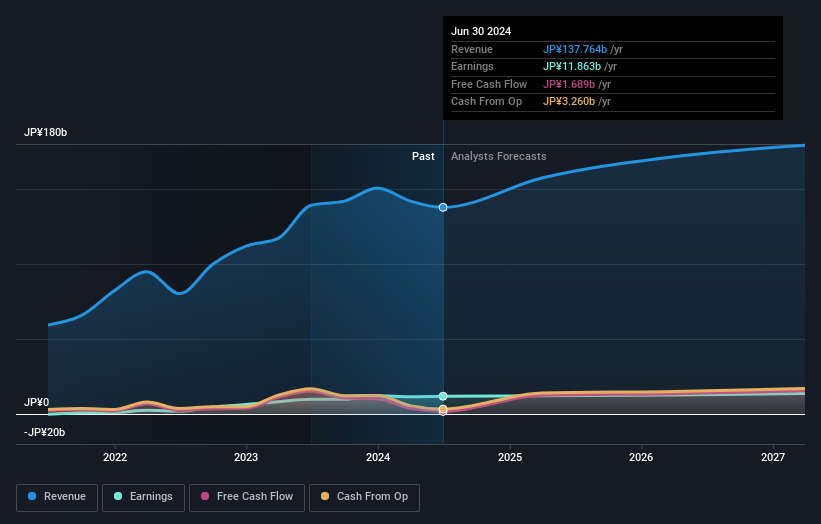

Overview: Tsuburaya Fields Holdings Inc. operates in content-related businesses across Japan and has a market capitalization of ¥110.47 billion.

Operations: Tsuburaya Fields Holdings generates revenue primarily from its PS Business Segment, contributing ¥103.77 billion, and the Content & Digital Business Segment, adding ¥15.92 billion. The company's financial performance is influenced by these segments without considering adjustments or other allocations.

Tsuburaya Fields Holdings, a small player in the leisure industry, is showing promising signs of growth. With earnings increasing by 4.5% over the past year and outperforming the industry's 0.5% growth, it seems to be on an upward trajectory. The company trades at a significant discount, about 71% below its estimated fair value, suggesting potential undervaluation. Its interest payments are well-covered with EBIT covering them 361 times over, indicating strong financial health despite recent share price volatility. Additionally, its debt-to-equity ratio has improved from 34.8% to 27.8% over five years, reflecting prudent financial management.

- Get an in-depth perspective on Tsuburaya Fields Holdings' performance by reading our health report here.

Gain insights into Tsuburaya Fields Holdings' past trends and performance with our Past report.

Greatek Electronics (TWSE:2441)

Simply Wall St Value Rating: ★★★★★★

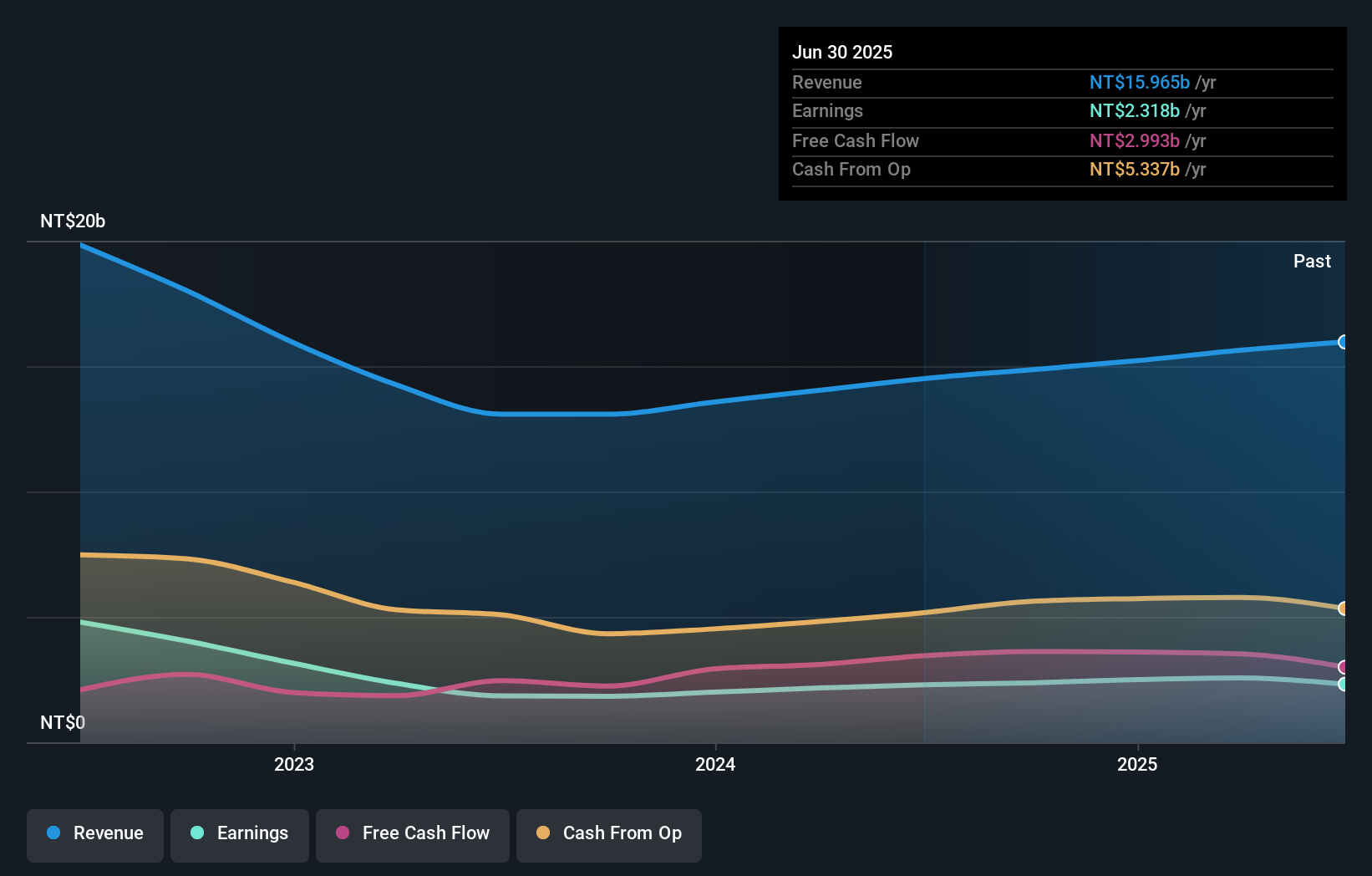

Overview: Greatek Electronics Inc. is involved in the packaging and testing of integrated circuits across Taiwan, Asia, America, Europe, and Africa with a market cap of NT$33.39 billion.

Operations: Greatek Electronics generates revenue primarily from its semiconductor segment, amounting to NT$14.85 billion.

Greatek Electronics, a compact player in the semiconductor industry, has shown impressive earnings growth of 29% over the past year, outpacing the industry average of 6%. With a price-to-earnings ratio at 14x, it offers better value compared to Taiwan's market average of 21x. The company is debt-free and boasts high-quality earnings. Recent results for Q3 show sales at TWD 3.86 billion and net income at TWD 673 million, both up from last year. For nine months ending September, sales reached TWD 11.33 billion with net income climbing to TWD 1.92 billion from TWD 1.55 billion previously.

Next Steps

- Click here to access our complete index of 4621 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsuburaya Fields Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2767

Tsuburaya Fields Holdings

Engages in the content-related businesses in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives