- Taiwan

- /

- Semiconductors

- /

- TWSE:2388

Discover 3 Undiscovered Gems in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of easing trade tensions and fluctuating economic indicators, the Asian market stands out with its dynamic landscape and potential for growth. In this environment, identifying promising stocks involves looking for companies that can thrive amid market volatility by leveraging strong fundamentals, innovative strategies, and resilience to external shocks.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Global Lighting Technologies | NA | -5.54% | -11.92% | ★★★★★★ |

| Hong Tai Electric Industrial | NA | 10.19% | 6.78% | ★★★★★★ |

| Lemtech Holdings | 48.75% | -1.28% | -3.58% | ★★★★★★ |

| Grade Upon Technology | NA | 10.27% | 66.81% | ★★★★★★ |

| Fuling Technology | 12.25% | 15.82% | 20.63% | ★★★★★★ |

| Techshine ElectronicsLtd | 4.78% | 15.06% | 17.63% | ★★★★★☆ |

| Shenzhen Farben Information TechnologyLtd | 13.86% | 20.51% | 3.44% | ★★★★★☆ |

| Beijing Bashi Media | 72.78% | -1.47% | -15.16% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 3.40% | 15.35% | 13.21% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.72% | 20.30% | -23.01% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Sanil Electric (KOSE:A062040)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanil Electric Co., Ltd. is a company that manufactures and sells transformers both in Korea and internationally, with a market cap of ₩1.70 billion.

Operations: Sanil Electric generates revenue primarily from the sale of transformers in both domestic and international markets. The company has a market cap of ₩1.70 trillion.

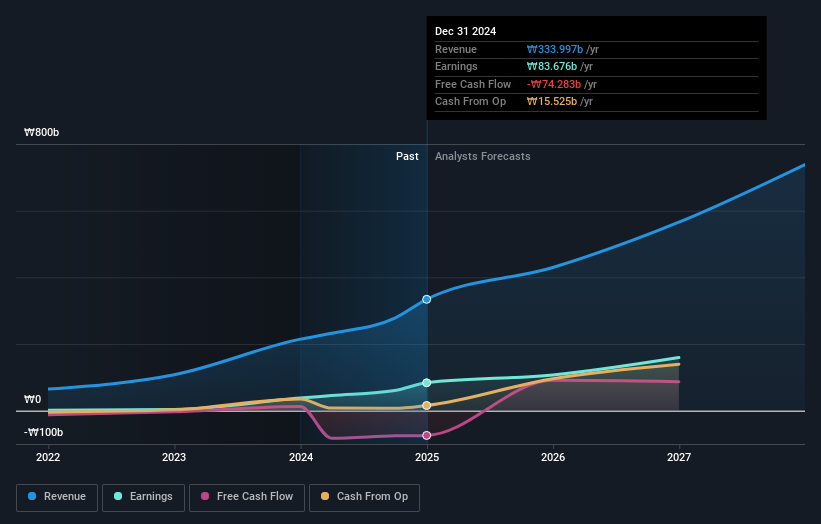

Sanil Electric, a nimble player in the electrical sector, has shown impressive financial health with its interest payments well covered by EBIT at 1209 times. Over five years, the company slashed its debt to equity ratio from 71.4% to just 0.2%, indicating robust fiscal management. Earnings surged by 121% last year, outpacing the industry average of 17%. Despite these strengths, free cash flow remains negative; however, their profitability ensures a stable cash runway. With earnings projected to grow annually by over 32%, Sanil Electric seems poised for continued expansion in an evolving market landscape.

- Click here to discover the nuances of Sanil Electric with our detailed analytical health report.

Gain insights into Sanil Electric's past trends and performance with our Past report.

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector with a market capitalization of CN¥6.69 billion.

Operations: The company generates revenue primarily from its biotechnology operations, with a market capitalization of CN¥6.69 billion.

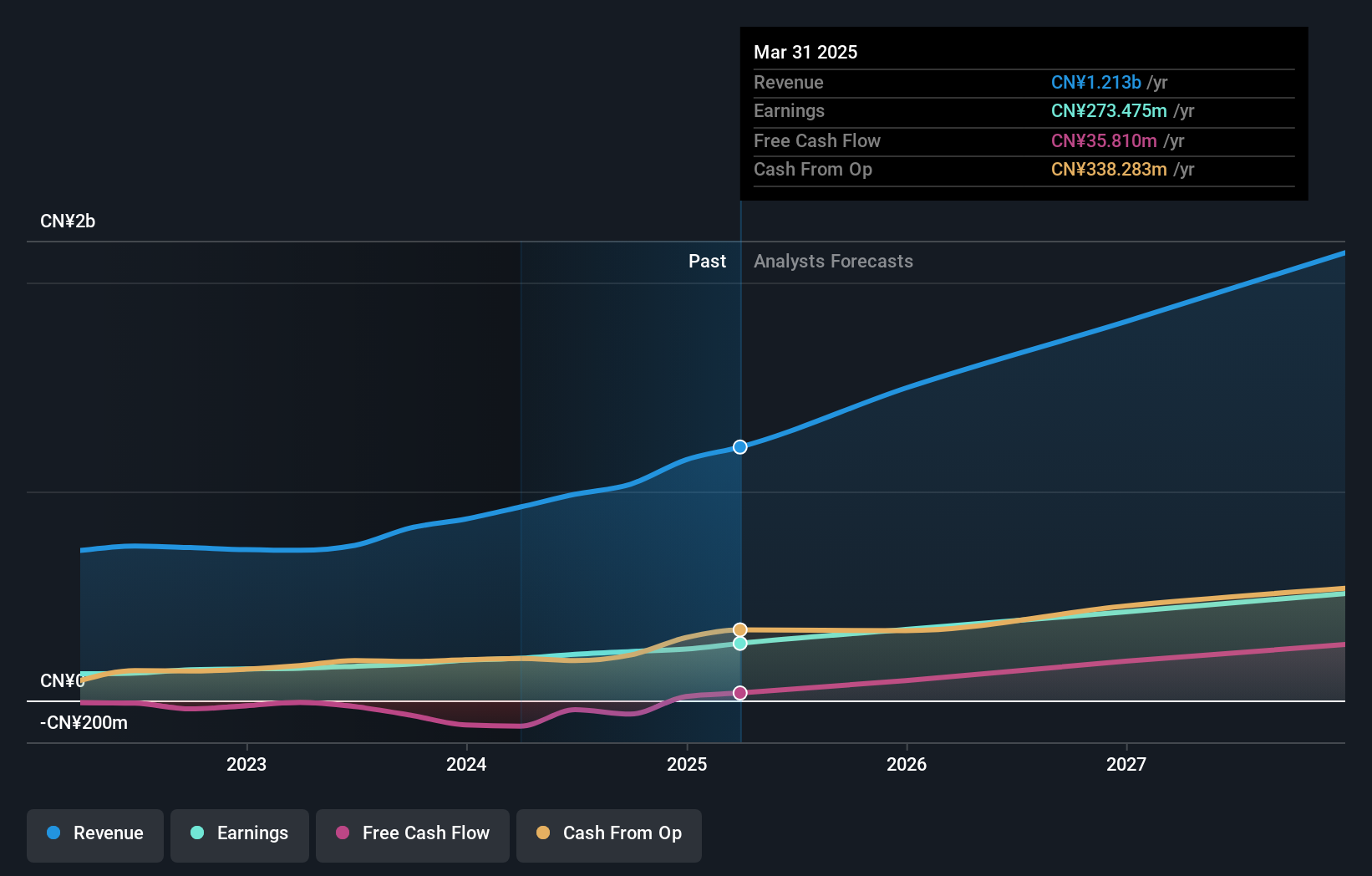

Shandong Bailong Chuangyuan Bio-Tech, a smaller player in the biotech sector, showcases impressive financial health with earnings growth of 29.2% over the past year, outpacing the -6.4% decline in its industry. The company's price-to-earnings ratio of 26.8x is favorable compared to China's market average of 36.8x, suggesting potential undervaluation relative to peers. Over five years, debt management has been strong with a reduction from 9% to 4.5%, and it holds more cash than total debt, ensuring stability despite negative free cash flow trends recently observed due to significant capital expenditures impacting liquidity dynamics.

VIA Technologies (TWSE:2388)

Simply Wall St Value Rating: ★★★★★★

Overview: VIA Technologies, Inc. is involved in the programming, designing, manufacturing, and sale of semiconductors and PC chip sets with a market capitalization of NT$41.65 billion.

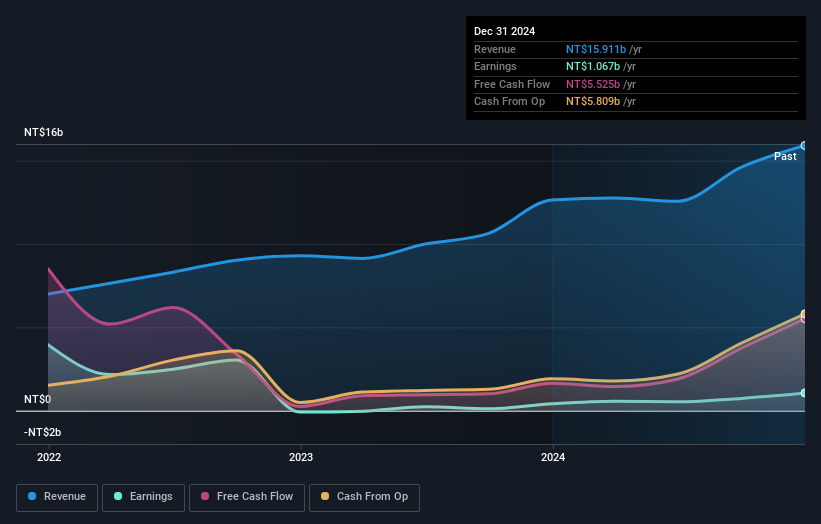

Operations: VIA Technologies generates revenue primarily from the design, manufacturing, and trading of computer integrated circuit (IC) products, amounting to NT$15.91 billion.

VIA Technologies, a notable player in the semiconductor industry, has shown impressive financial performance with earnings growth of 159.9% over the past year, significantly outperforming the industry's 25%. The company's debt-to-equity ratio has improved dramatically from 71.6% to just 7.5% in five years, indicating strong financial management. Recent annual sales reached TWD 15.91 billion (approx US$0.52 billion), up from TWD 12.64 billion last year, while net income rose to TWD 1.07 billion (approx US$35 million) compared to TWD 410 million previously—suggesting robust operational efficiency and potential for further growth in its niche market segment.

- Get an in-depth perspective on VIA Technologies' performance by reading our health report here.

Evaluate VIA Technologies' historical performance by accessing our past performance report.

Make It Happen

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2674 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade VIA Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2388

VIA Technologies

VIA Technologies, Inc. engage in the programming, designing, manufacturing, and sale of semiconductors and PC chip sets.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives