February 2025's Top Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

In February 2025, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic signals, with U.S. stocks experiencing slight declines amid concerns over potential trade disruptions. Despite these challenges, the resilience of certain sectors and positive earnings reports from many companies highlight opportunities for investors to explore stocks that may be priced below their estimated value. In such an environment, identifying undervalued stocks involves looking for companies with strong fundamentals that have been overlooked due to broader market volatility or temporary setbacks.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.71 | US$37.36 | 49.9% |

| DIP (TSE:2379) | ¥2269.00 | ¥4528.79 | 49.9% |

| Alarum Technologies (TASE:ALAR) | ₪3.356 | ₪6.68 | 49.7% |

| Celsius Holdings (NasdaqCM:CELH) | US$21.28 | US$42.43 | 49.8% |

| Solum (KOSE:A248070) | ₩17630.00 | ₩35136.90 | 49.8% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.19 | CN¥30.00 | 49.4% |

| S&U (LSE:SUS) | £16.25 | £32.33 | 49.7% |

| Similarweb (NYSE:SMWB) | US$11.87 | US$23.62 | 49.7% |

| Neosperience (BIT:NSP) | €0.53 | €1.06 | 49.9% |

| Kyndryl Holdings (NYSE:KD) | US$41.15 | US$81.37 | 49.4% |

Let's explore several standout options from the results in the screener.

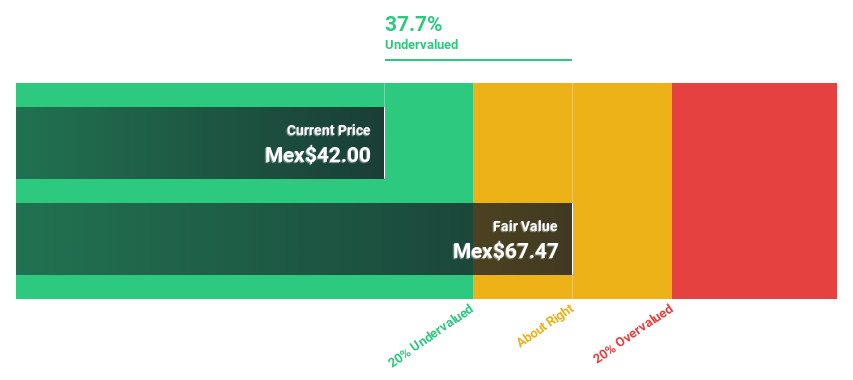

Megacable Holdings S. A. B. de C. V (BMV:MEGA CPO)

Overview: Megacable Holdings S. A. B. de C. V., along with its subsidiaries, operates in the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems with a market cap of approximately MX$35.79 billion.

Operations: The company generates revenue from its operations in cable television, internet, and telephone signal distribution systems.

Estimated Discount To Fair Value: 33.4%

Megacable Holdings S.A.B. de C.V. is trading at MX$42.83, significantly below its estimated fair value of MX$64.29, suggesting undervaluation based on cash flows. Despite revenue growth forecasts of 7.5% annually—above the Mexican market average—earnings growth is expected to outpace this at 20.7% per year, surpassing market expectations. However, concerns arise as dividends are not well covered by earnings or free cash flows and interest payments exceed earnings coverage capacity.

- The analysis detailed in our Megacable Holdings S. A. B. de C. V growth report hints at robust future financial performance.

- Navigate through the intricacies of Megacable Holdings S. A. B. de C. V with our comprehensive financial health report here.

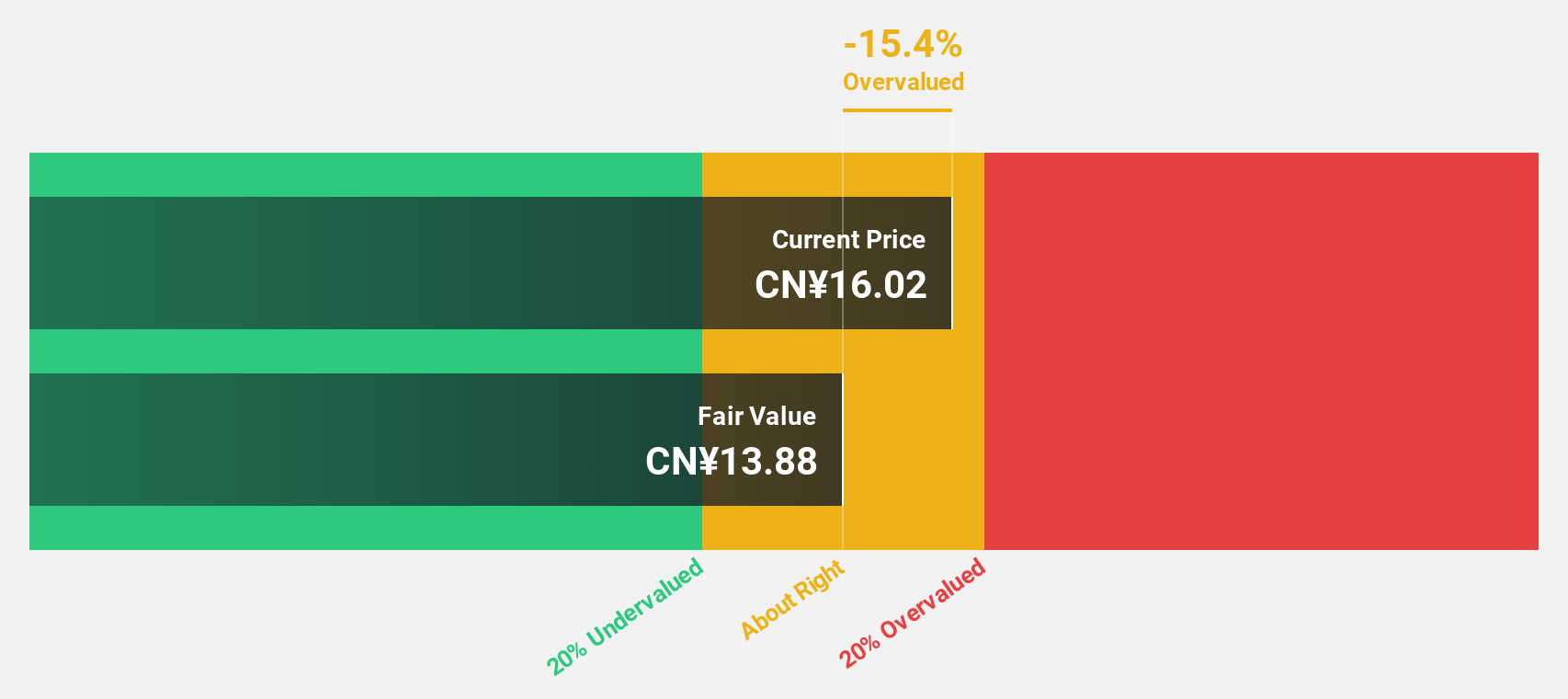

Hunan Jiudian Pharmaceutical (SZSE:300705)

Overview: Hunan Jiudian Pharmaceutical Co., Ltd. engages in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥7.83 billion.

Operations: The company generates revenue primarily from its Medicine Manufacturing segment, which amounts to CN¥2.95 billion.

Estimated Discount To Fair Value: 47.4%

Hunan Jiudian Pharmaceutical, trading at CN¥16.88, is significantly undervalued compared to its estimated fair value of CN¥32.07 based on discounted cash flows. Earnings are forecast to grow at 24.9% annually over the next three years, slightly below the Chinese market average but still robust. Despite a strong recent earnings growth of 36.8%, revenue growth is projected at 17.5% per year, outpacing the broader market yet slower than earnings growth expectations.

- Our comprehensive growth report raises the possibility that Hunan Jiudian Pharmaceutical is poised for substantial financial growth.

- Click here to discover the nuances of Hunan Jiudian Pharmaceutical with our detailed financial health report.

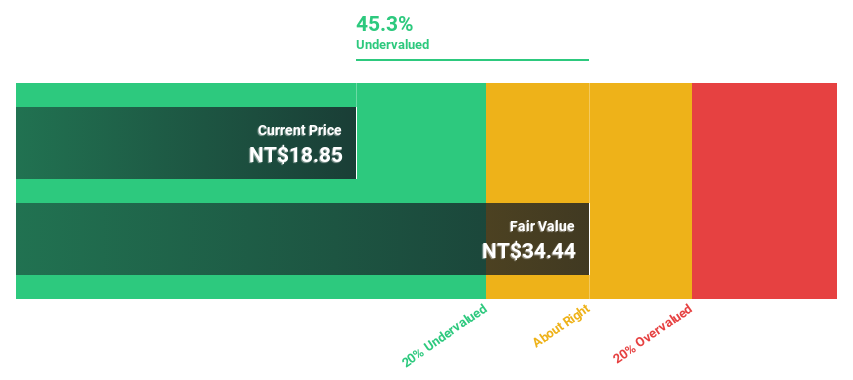

Winbond Electronics (TWSE:2344)

Overview: Winbond Electronics Corporation designs, develops, manufactures, and markets VLSI integrated circuits for various microelectronic applications globally and has a market cap of NT$65.48 billion.

Operations: The company generates revenue from three main segments: Logical Products (NT$32.81 billion), Flash Memory Product (NT$27.67 billion), and Customized Memory Solution Products (NT$19.85 billion).

Estimated Discount To Fair Value: 48.7%

Winbond Electronics is trading at NT$16, significantly below its estimated fair value of NT$31.16, suggesting undervaluation based on discounted cash flows. Revenue growth is projected at 16% annually, surpassing the Taiwan market average. Recent profitability and substantial earnings growth forecasts of over 136% per year highlight potential value. The introduction of TrustME W77T Secure Flash for automotive applications may enhance future cash flows by tapping into emerging technology markets.

- Upon reviewing our latest growth report, Winbond Electronics' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Winbond Electronics.

Next Steps

- Navigate through the entire inventory of 914 Undervalued Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:MEGA CPO

Megacable Holdings S. A. B. de C. V

Engages in the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives