- Taiwan

- /

- Semiconductors

- /

- TWSE:2330

Is There an Opportunity in TSMC After Exemption From New US Chip Tariffs?

Reviewed by Simply Wall St

If you have been watching Taiwan Semiconductor Manufacturing lately, you are not alone. Investors everywhere are weighing what to do with this global chip giant’s stock, especially after its recent moves and headline-making news. In the last year, TSMC’s shares have climbed more than 20%, and over the past three years, the stock has soared over 130%, outpacing many of its peers. So, what is driving this momentum, and could it still be undervalued?

Even with a few bumps, such as this month's minor price dip and some headlines about internal trade secret disputes, TSMC’s long-term story is one of innovation and resilience. Recent decisions to phase out older 6-inch wafer production signal a focus on efficiency and preparing for future growth. The company’s exemption from new U.S. chip tariffs has helped ease fears of major competitive setbacks. Meanwhile, industry rivals like Intel are still trying to catch up technologically, reinforcing TSMC’s strong position.

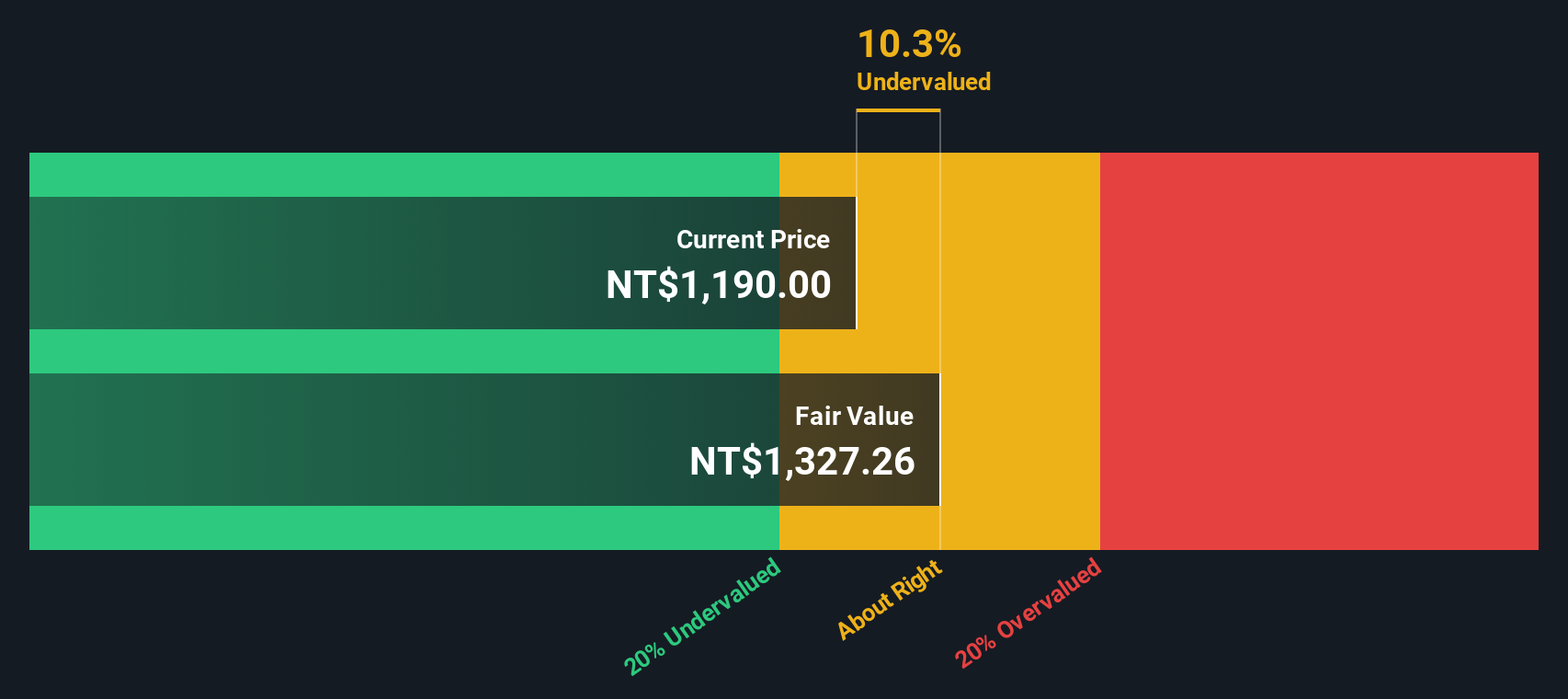

Of course, price movement is only part of the story. As keen investors know, understanding whether TSMC is attractively priced right now means taking a closer look at valuation. According to our valuation framework, TSMC scores a 4 out of 6, suggesting it is currently undervalued in most critical areas. But how much weight should you really give these metrics with so much happening in the semiconductor sector?

Let’s take a look at the key valuation methods investors use for TSMC. Stay tuned—at the end, I will share what I believe is the most overlooked and powerful lens for determining if this chip titan is a buy today.

Taiwan Semiconductor Manufacturing delivered 20.5% returns over the last year. See how this stacks up to the rest of the Semiconductor industry.Approach 1: Taiwan Semiconductor Manufacturing Cash Flows

The Discounted Cash Flow (DCF) model projects a company’s future cash earnings and then discounts those projections back to today’s value. This process helps estimate what a business is actually worth at present, based on its potential to generate cash in the years ahead.

For Taiwan Semiconductor Manufacturing, the latest twelve months Free Cash Flow stands at just over NT$803 billion. Projections indicate robust annual growth, with expected cash flow reaching more than NT$3.6 trillion by 2035. Analysts expect a healthy climb and evaluate the numbers using a two-stage free cash flow to equity model.

Applying these long-range estimates and discounting them to present value, the DCF model calculates an intrinsic value for TSMC shares of about NT$1,409. This is 19.4% below the current trading price, suggesting the market is not fully crediting the company’s future cash potential.

In summary, the DCF analysis highlights significant value that is not yet reflected in TSMC’s stock price, which may interest long-term investors.

Result: UNDERVALUED

Approach 2: Taiwan Semiconductor Manufacturing Price vs Earnings

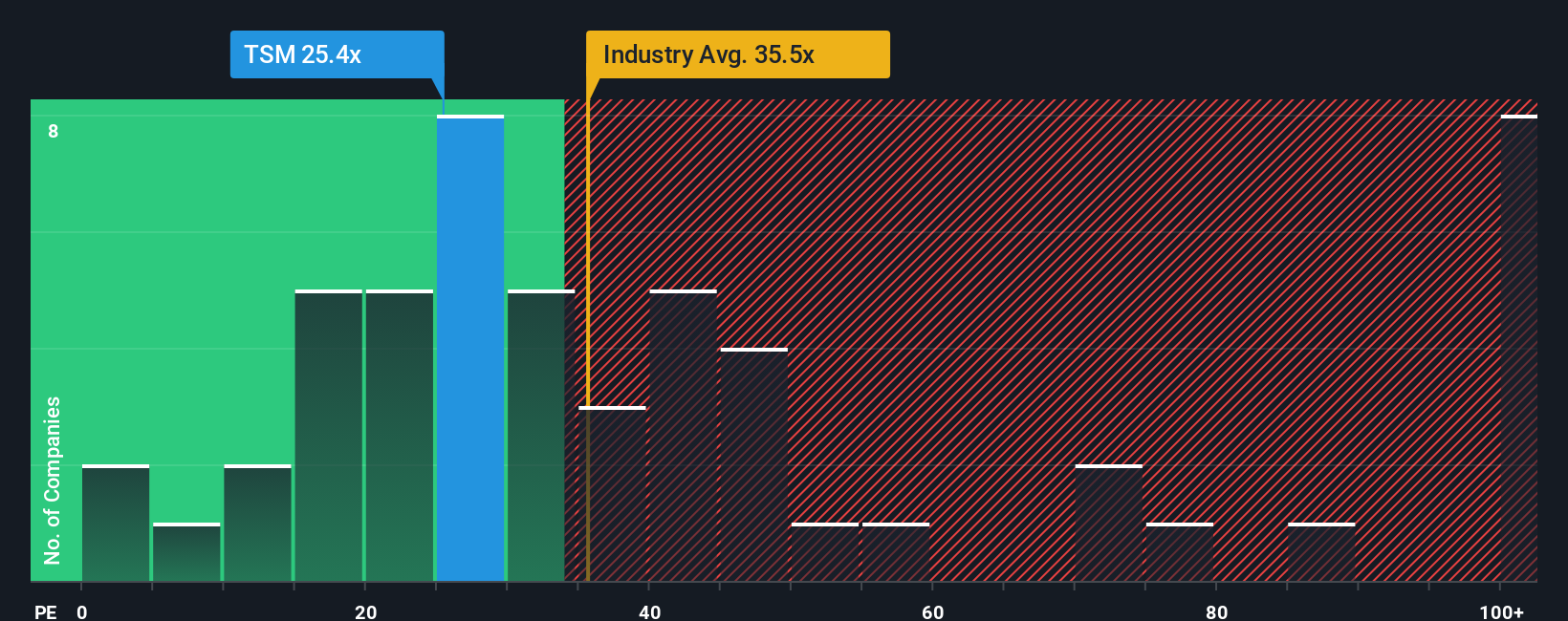

The price-to-earnings (PE) ratio is a commonly used valuation metric for profitable companies like Taiwan Semiconductor Manufacturing. It shows what investors are willing to pay today for a portion of a company’s future earnings, making it especially relevant for established businesses that generate consistent profits.

What counts as a "normal" PE ratio depends on growth prospects and risk levels. Companies with expectations of higher earnings growth or those considered lower risk typically justify above-average PE multiples. Firms with stronger growth stories or greater earnings stability often command a premium, while slower growth or higher risks can result in a lower multiple compared to industry peers.

Currently, TSMC trades at a PE ratio of 20x. This is lower than both its key peer average of 26x and the broader semiconductor industry average of 29x. Simply Wall St’s proprietary Fair Ratio, which considers TSMC’s growth outlook, profitability, and risk profile, is 35x. Because the company’s actual PE is substantially below the Fair Ratio, this may indicate the stock is undervalued based on earnings potential and sector comparisons.

Result: UNDERVALUED

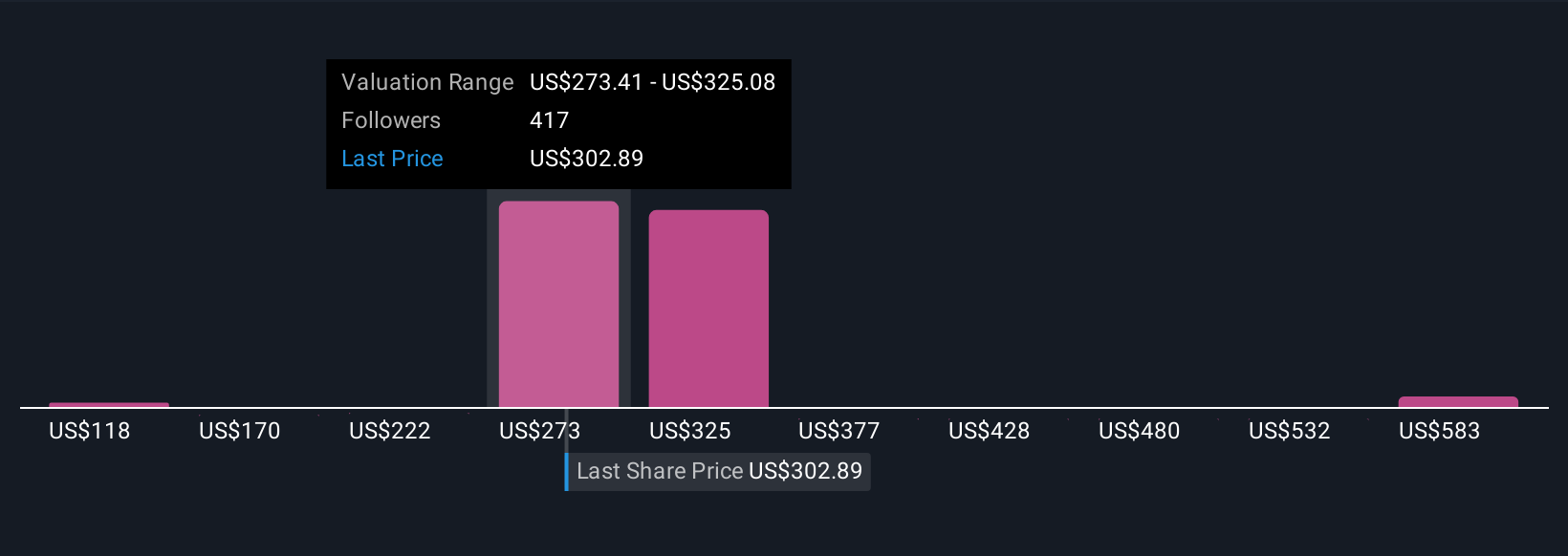

Upgrade Your Decision Making: Choose your Taiwan Semiconductor Manufacturing Narrative

A Narrative is simply your personal story about a company that links its future prospects, including what you believe about its growth, margins, and risks, to your own assumptions about fair value.

Unlike relying on raw numbers alone, Narratives help you connect TSMC’s business drivers and industry changes to a set of concrete financial forecasts. This makes your logic for buying or selling more transparent and actionable.

On the Simply Wall St platform, millions of investors can easily build, compare, and update Narratives. This allows them to turn their view of the company’s future into a dynamic fair value based on their own reasoning as new information such as earnings or news becomes available.

This approach gives you a clear tool to track whether TSMC’s current share price is above or below what your Narrative says it is worth. In this way, you know exactly when your logic signals that it may be time to buy or sell, with every update and market move.

For example, one investor’s optimistic Narrative might see surging AI chip demand and a fair value of NT$1,800 per share. Another, focused on margin risks and overseas costs, might use the same platform to estimate a fair value as low as NT$1,100.

Do you think there's more to the story for Taiwan Semiconductor Manufacturing? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2330

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026