- Taiwan

- /

- Semiconductors

- /

- TWSE:2330

3 Stocks That May Be Trading Below Their Estimated Fair Value

Reviewed by Simply Wall St

As global markets navigate heightened geopolitical tensions and unexpected economic shifts, investors are closely monitoring the impact on various sectors. Despite these challenges, opportunities may arise in stocks that are trading below their estimated fair value, presenting potential for growth when market conditions stabilize. Identifying such stocks involves assessing their fundamentals and market position relative to current events, making them appealing options for those seeking value in a volatile environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$182.97 | CA$361.57 | 49.4% |

| Associated Banc-Corp (NYSE:ASB) | US$21.02 | US$41.74 | 49.6% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.41 | US$168.65 | 50% |

| Zhejiang Great Shengda PackagingLtd (SHSE:603687) | CN¥7.11 | CN¥14.16 | 49.8% |

| JD Sports Fashion (LSE:JD.) | £1.3865 | £2.75 | 49.7% |

| Symbotic (NasdaqGM:SYM) | US$23.84 | US$47.66 | 50% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7490.00 | ₩14930.31 | 49.8% |

| Super Group (JSE:SPG) | ZAR23.28 | ZAR46.16 | 49.6% |

| Feytech Holdings Berhad (KLSE:FEYTECH) | MYR0.87 | MYR1.73 | 49.7% |

| MTU Aero Engines (XTRA:MTX) | €284.20 | €567.26 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

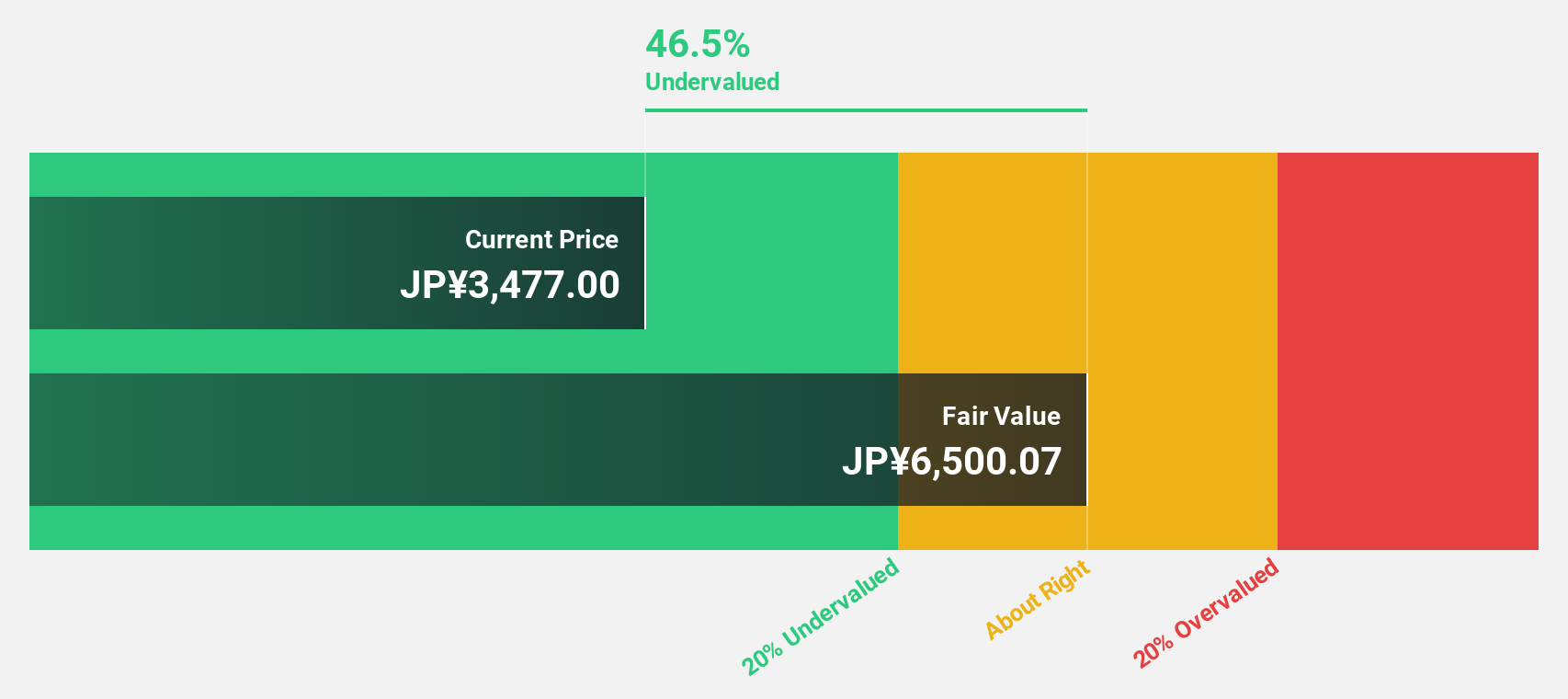

Daiichi Sankyo Company (TSE:4568)

Overview: Daiichi Sankyo Company, Limited is a pharmaceutical manufacturer and seller operating in Japan, North America, Europe, and internationally with a market cap of ¥9.23 trillion.

Operations: The company generates revenue of ¥1.69 trillion from its pharmaceutical operations across various regions.

Estimated Discount To Fair Value: 24.6%

Daiichi Sankyo appears undervalued based on cash flow analysis, trading at ¥4,897, below its estimated fair value of ¥6,492.1. Recent developments include a completed share buyback program worth approximately ¥120 billion and significant advancements in their oncology pipeline with ENHERTU receiving Priority Review in the US. The company's revenue is projected to grow by 12.9% annually, outpacing the Japanese market average of 4.2%, highlighting potential for future growth.

- Our comprehensive growth report raises the possibility that Daiichi Sankyo Company is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Daiichi Sankyo Company's balance sheet health report.

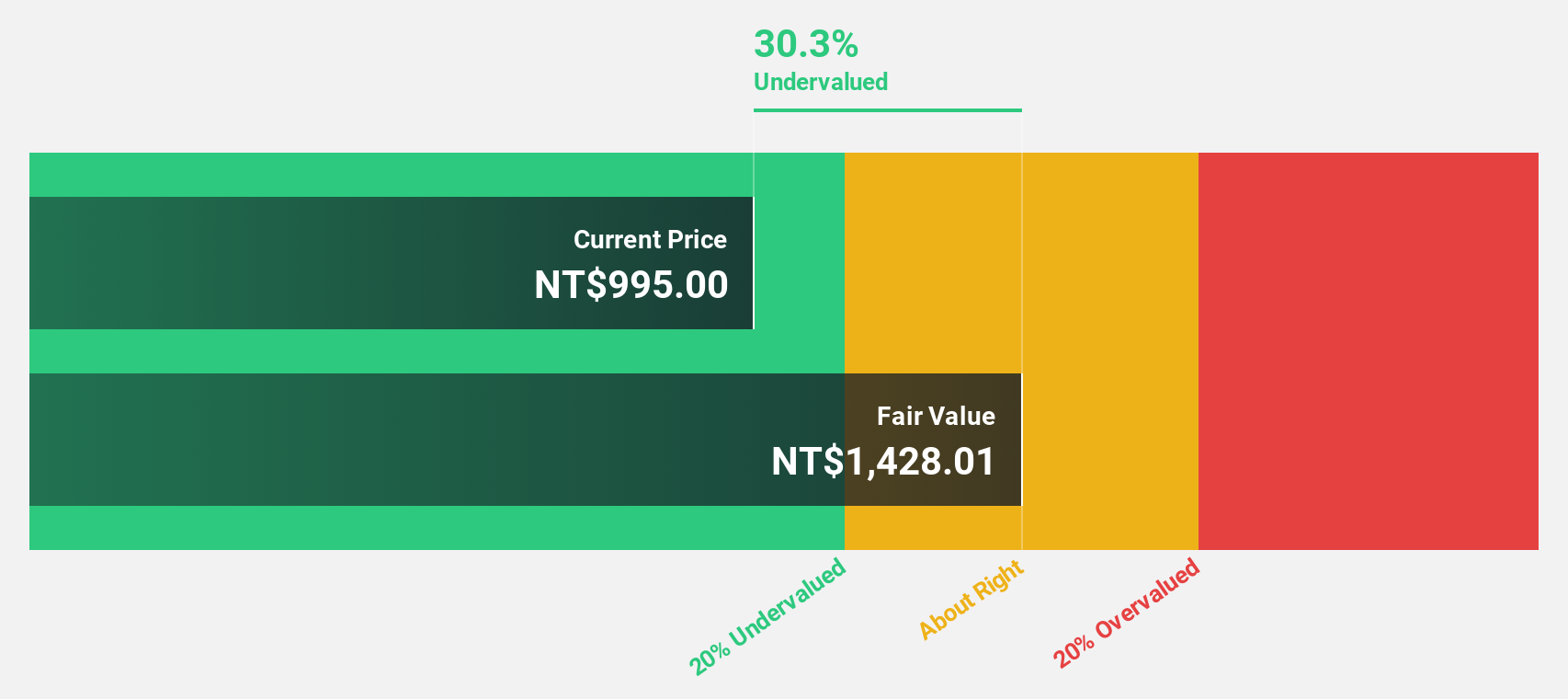

Taiwan Semiconductor Manufacturing (TWSE:2330)

Overview: Taiwan Semiconductor Manufacturing Company Limited, along with its subsidiaries, is engaged in the manufacturing, packaging, testing, and selling of integrated circuits and semiconductor devices globally; it has a market cap of NT$25.34 trillion.

Operations: The company's revenue is primarily derived from its Foundry segment, which generated NT$2.44 billion.

Estimated Discount To Fair Value: 25.5%

Taiwan Semiconductor Manufacturing is trading at NT$1,005, significantly below its estimated fair value of NT$1,349.29. Its earnings are projected to grow at 19.16% annually, surpassing the Taiwan market average of 19.1%. Recent collaborations with Amkor Technology in Arizona aim to enhance semiconductor packaging capabilities and speed up product cycles. Despite slower revenue growth forecasts compared to industry benchmarks, TSMC's strategic partnerships and undervaluation present potential opportunities for investors focused on cash flow analysis.

- Our earnings growth report unveils the potential for significant increases in Taiwan Semiconductor Manufacturing's future results.

- Unlock comprehensive insights into our analysis of Taiwan Semiconductor Manufacturing stock in this financial health report.

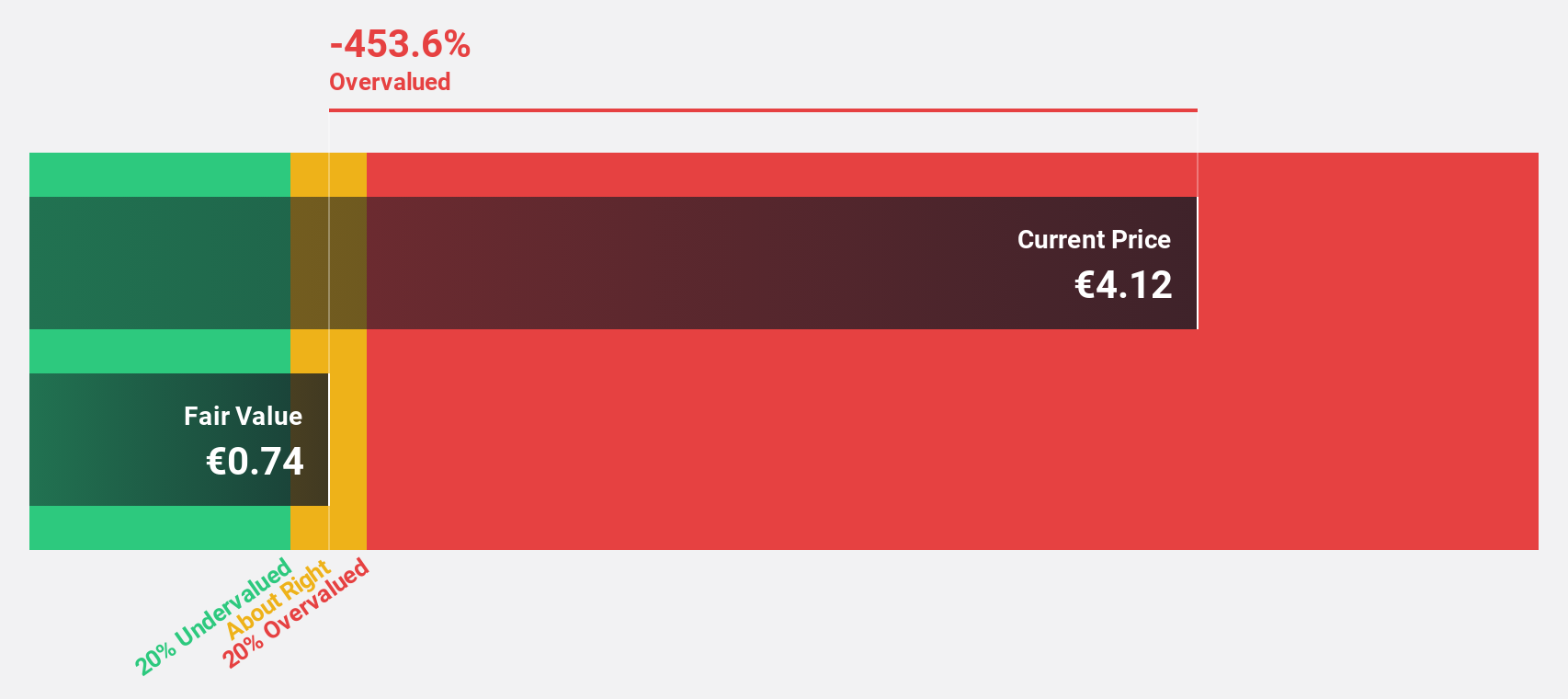

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific with a market cap of €3.16 billion.

Operations: The company's revenue segments are comprised of €9.80 billion from Automotive Technologies, €2.43 billion from Vehicle Lifetime Solutions, and €4.10 billion from Bearings & Industrial Solutions.

Estimated Discount To Fair Value: 30%

Schaeffler is trading at €4.86, about 30% below its estimated fair value of €6.94, highlighting its undervaluation based on discounted cash flow analysis. Although net profit margins have decreased from 3.5% to 1.9%, earnings are forecast to grow significantly at 37.62% annually, outpacing the German market's average growth rate of 20.2%. Recent executive changes and conference presentations might influence investor sentiment and strategic direction moving forward.

- Our expertly prepared growth report on Schaeffler implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Schaeffler with our detailed financial health report.

Seize The Opportunity

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 948 more companies for you to explore.Click here to unveil our expertly curated list of 951 Undervalued Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2330

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.