- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6187

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of escalating Middle East tensions and robust U.S. job growth, investors are closely monitoring the performance of key indices like the S&P 500 and Nasdaq Composite, both showing significant year-to-date gains despite geopolitical uncertainties. In this environment, identifying promising high-growth tech stocks involves looking for companies that demonstrate resilience and adaptability to market shifts, coupled with innovative capabilities that align with evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.11% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1278 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Vericel (NasdaqGM:VCEL)

Simply Wall St Growth Rating: ★★★★★☆

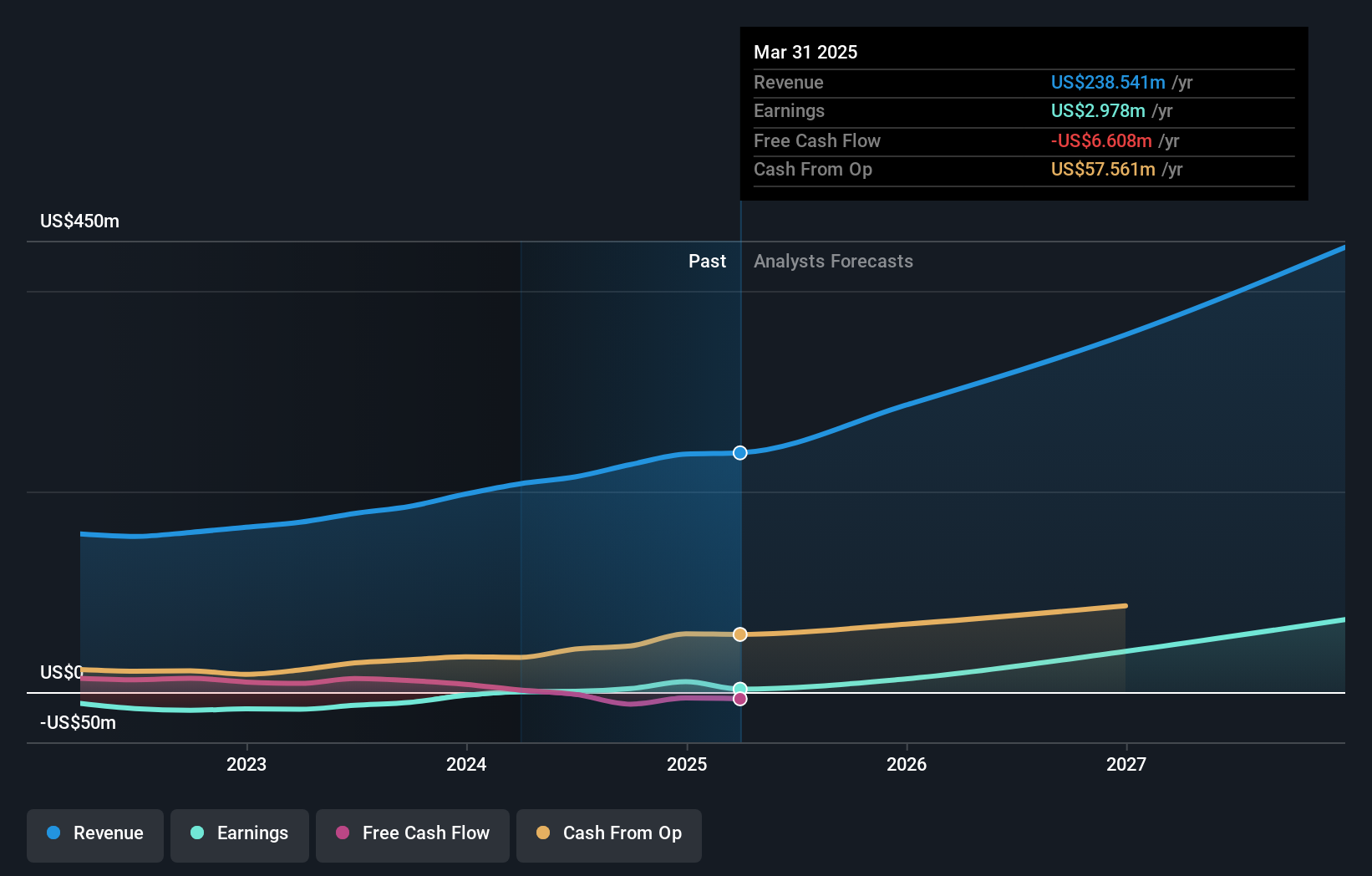

Overview: Vericel Corporation is a commercial-stage biopharmaceutical company focused on the research, development, manufacture, and distribution of cellular therapies for sports medicine and severe burn care markets in North America, with a market cap of $2.13 billion.

Operations: Vericel generates revenue primarily from its biotechnology segment, amounting to $214.52 million. The company operates within the sports medicine and severe burn care sectors in North America.

Vericel's recent FDA approval for MACI Arthro, a less invasive knee repair technique, underscores its innovative edge in biotech. This advancement not only expands the treatment's label but also targets an additional 20,000 patients annually within a $3 billion market. Coupled with strategic expansions to include high-volume surgeons, Vericel is poised to capture significant market share. Financially, the company has shown resilience with a 22% year-over-year revenue increase in Q2 2024 and is projected to sustain robust growth with earnings expected to surge by 51.6% annually. These developments reflect Vericel’s strong positioning for future growth amidst evolving medical technologies and increasing demand for minimally invasive procedures.

- Click here and access our complete health analysis report to understand the dynamics of Vericel.

Gain insights into Vericel's historical performance by reviewing our past performance report.

All Ring Tech (TPEX:6187)

Simply Wall St Growth Rating: ★★★★★★

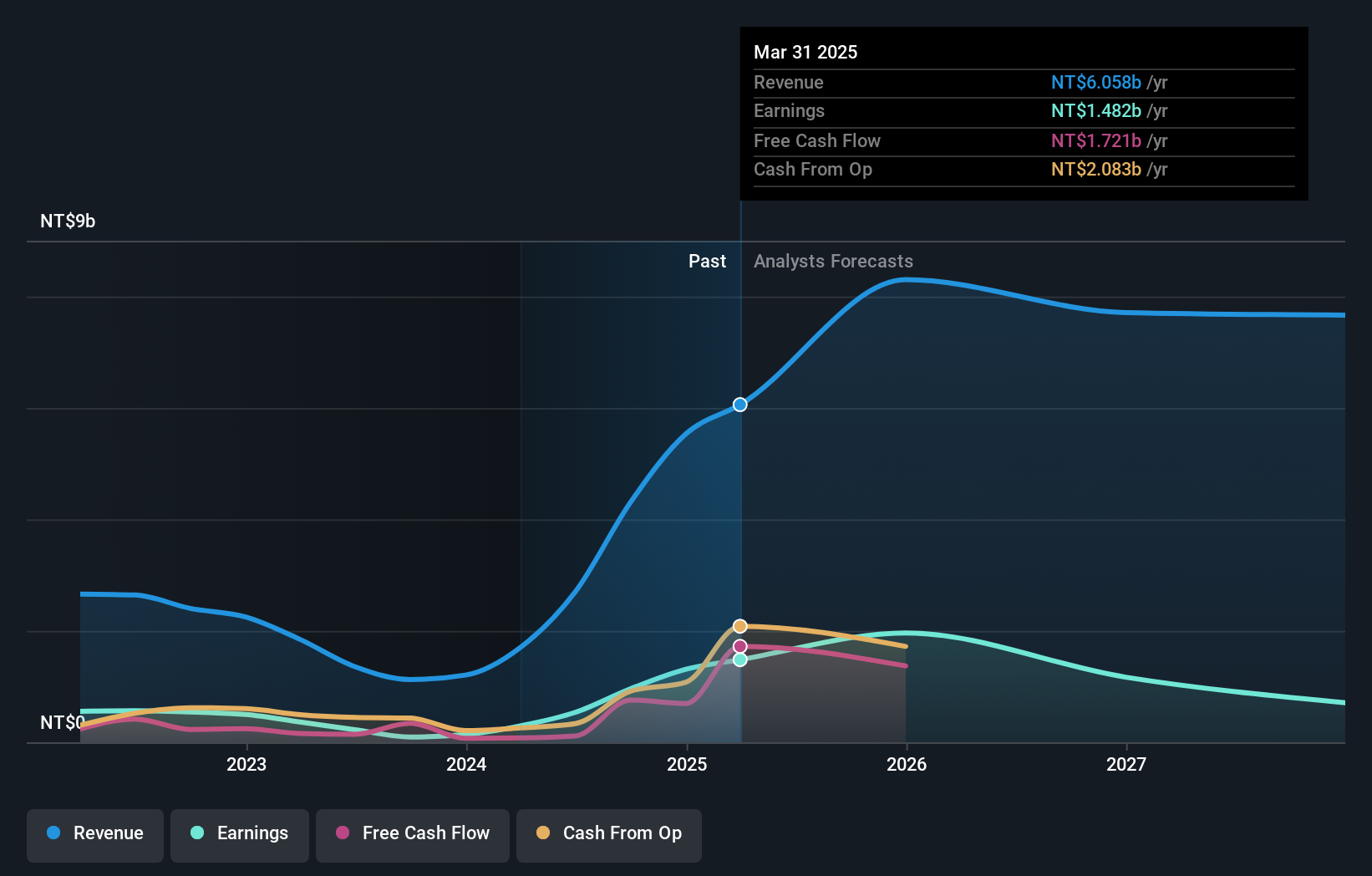

Overview: All Ring Tech Co., Ltd. specializes in the design, manufacture, and assembly of automation machines in Taiwan and China, with a market capitalization of NT$43.82 billion.

Operations: All Ring Tech Co., Ltd. generates revenue primarily through its subsidiaries, with All Ring Technology Co., Ltd. contributing NT$2.81 billion and WAN Run Jing Ji Co., Ltd. adding NT$614.98 million to the total revenue stream. The company operates within the automation machinery sector across Taiwan and China, focusing on design, manufacturing, and assembly processes.

All Ring Tech has demonstrated notable financial and operational growth, with a 22.8% annual revenue increase forecasted, outpacing the broader Taiwan market's 12%. This growth is complemented by an impressive earnings surge of 27.4% per year, significantly higher than the market average of 19.1%. The company's commitment to innovation is evident in its R&D spending trends, which have strategically intensified to harness emerging technological advancements. Recent capital-raising activities through private placements and equity offerings totaling over TWD 2 billion underscore a strategic reinvestment back into core business segments to fuel further expansion and technological development. These moves signal All Ring Tech’s robust positioning within the tech sector amidst rapid industry evolutions and escalating market demands.

- Delve into the full analysis health report here for a deeper understanding of All Ring Tech.

Understand All Ring Tech's track record by examining our Past report.

Giga-Byte Technology (TWSE:2376)

Simply Wall St Growth Rating: ★★★★★☆

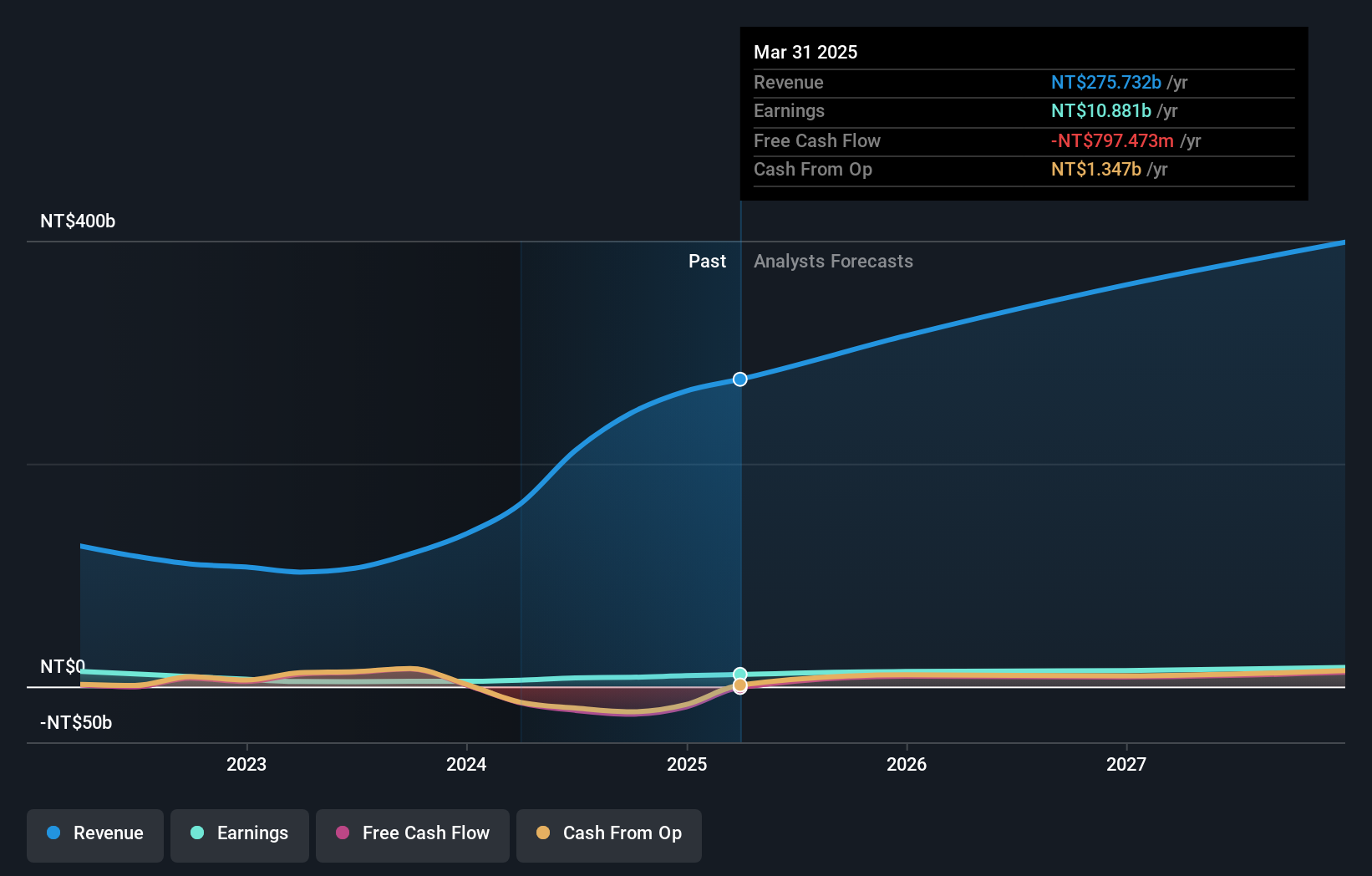

Overview: Giga-Byte Technology Co., Ltd. and its subsidiaries are involved in the manufacturing, processing, and trading of computer peripherals and component parts across Taiwan, Europe, the United States, Canada, China, and other international markets with a market cap of NT$176.18 billion.

Operations: Giga-Byte Technology generates revenue primarily from its Brand Business Division, which accounts for NT$211.10 billion, significantly overshadowing the Other Business Group's contribution of NT$594.08 million. The company's operations span multiple international markets, focusing on computer peripherals and component parts.

Giga-Byte Technology has been actively pushing the boundaries of motherboard technology, as evidenced by their recent launch of the X870E and X870 series, optimized for AMD's latest processors. These innovations are not just about power but also about enhancing user experience with features like AI-powered overclocking and advanced thermal solutions, indicating a strong focus on high-performance computing needs. Financially, Giga-Byte's commitment to R&D is clear with an 18.7% annual revenue growth forecasted and earnings expected to surge by 22.3% annually. This strategic emphasis on developing cutting-edge technology while maintaining robust financial health showcases Giga-Byte’s potential to adapt and thrive in the dynamic tech landscape.

Key Takeaways

- Discover the full array of 1278 High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6187

All Ring Tech

Engages in the design, manufacture, and assembly of automation machines in Taiwan and China.

Solid track record with excellent balance sheet.