- Taiwan

- /

- Semiconductors

- /

- TWSE:6706

We're Not So Sure You Should Rely on FittechLtd's (TPE:6706) Statutory Earnings

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing FittechLtd (TPE:6706).

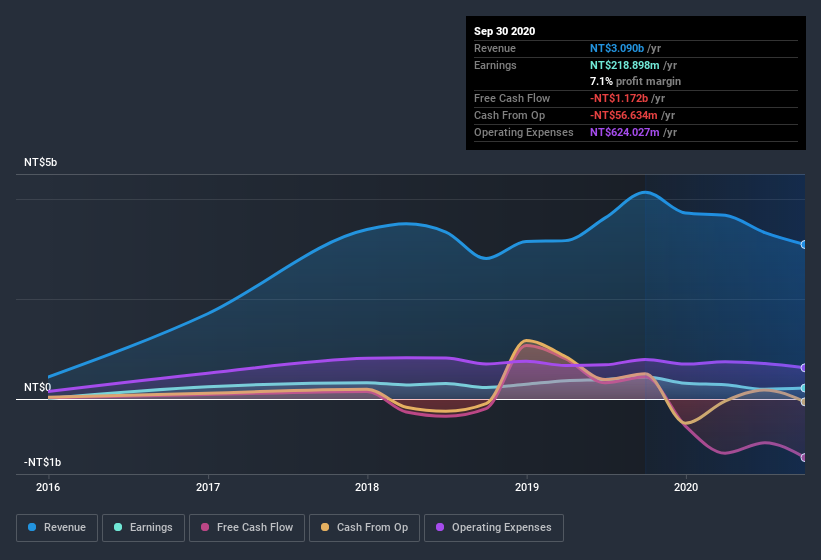

It's good to see that over the last twelve months FittechLtd made a profit of NT$218.9m on revenue of NT$3.09b. The chart below shows how it has grown revenue over the last three years, but that profit has declined.

View our latest analysis for FittechLtd

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. So today we'll look at what FittechLtd's cashflow tells us about its earnings, as well as examining how issuing shares is impacting shareholder value. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of FittechLtd.

A Closer Look At FittechLtd's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

FittechLtd has an accrual ratio of 0.74 for the year to September 2020. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. Over the last year it actually had negative free cash flow of NT$1.2b, in contrast to the aforementioned profit of NT$218.9m. It's worth noting that FittechLtd generated positive FCF of NT$435m a year ago, so at least they've done it in the past. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. FittechLtd expanded the number of shares on issue by 11% over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of FittechLtd's EPS by clicking here.

A Look At The Impact Of FittechLtd's Dilution on Its Earnings Per Share (EPS).

Unfortunately, FittechLtd's profit is down 29% per year over three years. Even looking at the last year, profit was still down 50%. Sadly, earnings per share fell further, down a full 54% in that time. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if FittechLtd's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On FittechLtd's Profit Performance

As it turns out, FittechLtd couldn't match its profit with cashflow and its dilution means that shareholders own less of the company than the did before (unless they bought more shares). For the reasons mentioned above, we think that a perfunctory glance at FittechLtd's statutory profits might make it look better than it really is on an underlying level. If you'd like to know more about FittechLtd as a business, it's important to be aware of any risks it's facing. For example, FittechLtd has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Our examination of FittechLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade FittechLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6706

Fittech

Provides automatic equipment and system integration services in Taiwan and internationally.

Mediocre balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion