- Taiwan

- /

- Semiconductors

- /

- TWSE:6698

Do Its Financials Have Any Role To Play In Driving FineMat Applied Materials Co., Ltd.'s (TPE:6698) Stock Up Recently?

FineMat Applied Materials' (TPE:6698) stock is up by a considerable 15% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study FineMat Applied Materials' ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for FineMat Applied Materials

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for FineMat Applied Materials is:

1.6% = NT$28m ÷ NT$1.7b (Based on the trailing twelve months to December 2020).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.02 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

FineMat Applied Materials' Earnings Growth And 1.6% ROE

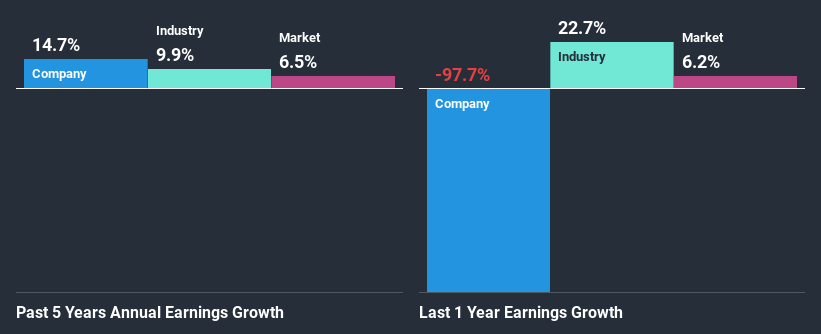

As you can see, FineMat Applied Materials' ROE looks pretty weak. Not just that, even compared to the industry average of 11%, the company's ROE is entirely unremarkable. However, the moderate 15% net income growth seen by FineMat Applied Materials over the past five years is definitely a positive. We believe that there might be other aspects that are positively influencing the company's earnings growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared FineMat Applied Materials' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 9.9%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if FineMat Applied Materials is trading on a high P/E or a low P/E, relative to its industry.

Is FineMat Applied Materials Making Efficient Use Of Its Profits?

FineMat Applied Materials has a three-year median payout ratio of 47%, which implies that it retains the remaining 53% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Along with seeing a growth in earnings, FineMat Applied Materials only recently started paying dividends. Its quite possible that the company was looking to impress its shareholders.

Conclusion

On the whole, we do feel that FineMat Applied Materials has some positive attributes. Despite its low rate of return, the fact that the company reinvests a very high portion of its profits into its business, no doubt contributed to its high earnings growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 2 risks we have identified for FineMat Applied Materials.

When trading FineMat Applied Materials or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6698

FineMat Applied Materials

Develops, manufactures, and sells high precision metal masks and other metal products in Mainland China, Taiwan, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives