- Taiwan

- /

- Semiconductors

- /

- TWSE:3711

Introducing ASE Technology Holding (TPE:3711), A Stock That Climbed 23% In The Last Year

It's been a soft week for ASE Technology Holding Co., Ltd. (TPE:3711) shares, which are down 12%. Looking on the brighter side, the stock is actually up over twelve months. But to be blunt its return of 23% fall short of what you could have got from an index fund (around 36%).

View our latest analysis for ASE Technology Holding

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

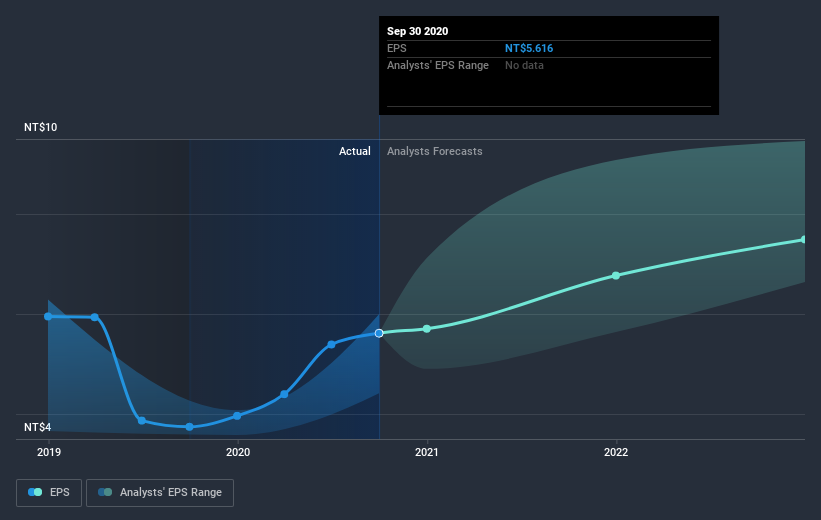

ASE Technology Holding was able to grow EPS by 50% in the last twelve months. It's fair to say that the share price gain of 23% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about ASE Technology Holding as it was before. This could be an opportunity.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that ASE Technology Holding has improved its bottom line lately, but is it going to grow revenue? Check if analysts think ASE Technology Holding will grow revenue in the future.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for ASE Technology Holding the TSR over the last year was 27%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're happy to report that ASE Technology Holding are up 27% over the year (even including dividends). The bad news is that's no better than the average market return, which was roughly 36%. However, that falls short of the 38% gain it has made, for shareholders, in the last three months. It's worth taking note when returns accelerate, as it can indicate positive change in the underlying business, and winners often keep winning. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for ASE Technology Holding that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading ASE Technology Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3711

ASE Technology Holding

Provides semiconductors packaging and testing, and electronic manufacturing services in the United States, Taiwan, Asia, Europe, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives