- Taiwan

- /

- Semiconductors

- /

- TWSE:3545

FocalTech Systems Co., Ltd.'s (TPE:3545) Stock Is Rallying But Financials Look Ambiguous: Will The Momentum Continue?

FocalTech Systems (TPE:3545) has had a great run on the share market with its stock up by a significant 80% over the last three months. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Specifically, we decided to study FocalTech Systems' ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for FocalTech Systems

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for FocalTech Systems is:

6.6% = NT$479m ÷ NT$7.3b (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.07.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

FocalTech Systems' Earnings Growth And 6.6% ROE

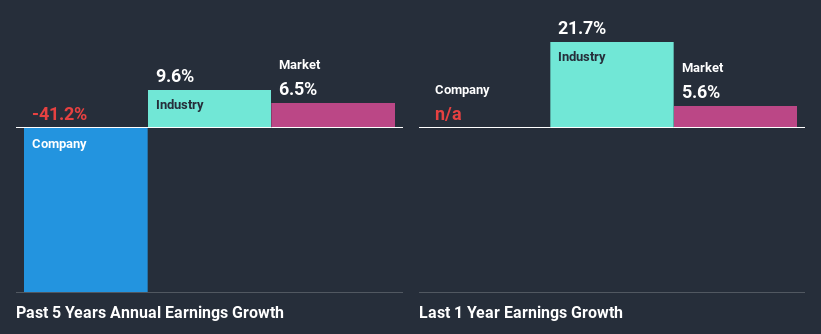

When you first look at it, FocalTech Systems' ROE doesn't look that attractive. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 11%. For this reason, FocalTech Systems' five year net income decline of 41% is not surprising given its lower ROE. However, there could also be other factors causing the earnings to decline. Such as - low earnings retention or poor allocation of capital.

However, when we compared FocalTech Systems' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 9.6% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is FocalTech Systems fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is FocalTech Systems Using Its Retained Earnings Effectively?

Despite having a normal LTM (or last twelve month) payout ratio of 27% (where it is retaining 73% of its profits), FocalTech Systems has seen a decline in earnings as we saw above. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Moreover, FocalTech Systems has been paying dividends for five years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer consistent dividends even though earnings have been shrinking. Looking at the current analyst consensus data, we can see that the company's future payout ratio is expected to rise to 77% over the next three years. Still, forecasts suggest that FocalTech Systems' future ROE will rise to 18% even though the the company's payout ratio is expected to rise. We presume that there could some other characteristics of the business that could be driving the anticipated growth in the company's ROE.

Conclusion

In total, we're a bit ambivalent about FocalTech Systems' performance. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you decide to trade FocalTech Systems, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3545

FocalTech Systems

Provides human-machine interface solutions in Taiwan, Mainland China, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026