- Taiwan

- /

- Semiconductors

- /

- TWSE:3006

With EPS Growth And More, Elite Semiconductor Microelectronics Tech (TPE:3006) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Elite Semiconductor Microelectronics Tech (TPE:3006). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Elite Semiconductor Microelectronics Tech

How Quickly Is Elite Semiconductor Microelectronics Tech Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years Elite Semiconductor Microelectronics Tech grew its EPS by 7.4% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

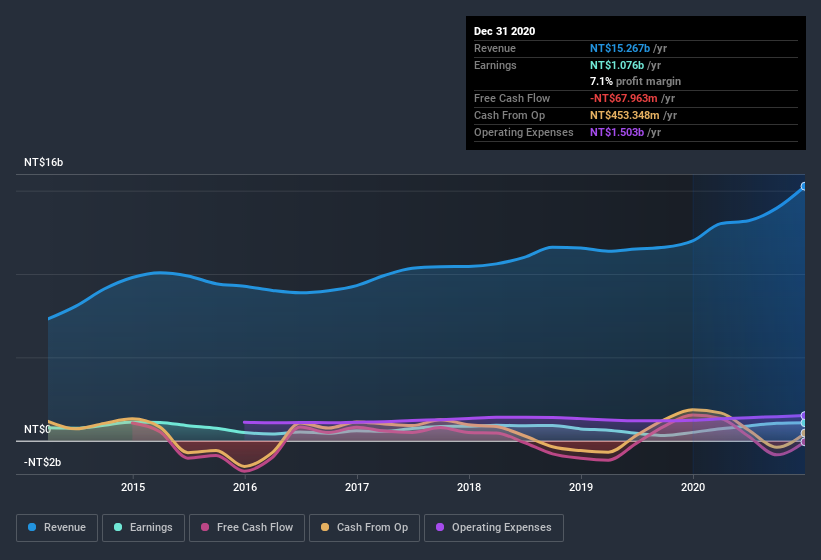

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Elite Semiconductor Microelectronics Tech is growing revenues, and EBIT margins improved by 2.7 percentage points to 7.5%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Elite Semiconductor Microelectronics Tech's balance sheet strength, before getting too excited.

Are Elite Semiconductor Microelectronics Tech Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Elite Semiconductor Microelectronics Tech shares worth a considerable sum. Given insiders own a small fortune of shares, currently valued at NT$1.7b, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between NT$11b and NT$45b, like Elite Semiconductor Microelectronics Tech, the median CEO pay is around NT$15m.

The CEO of Elite Semiconductor Microelectronics Tech only received NT$6.0m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Elite Semiconductor Microelectronics Tech Worth Keeping An Eye On?

One positive for Elite Semiconductor Microelectronics Tech is that it is growing EPS. That's nice to see. Earnings growth might be the main game for Elite Semiconductor Microelectronics Tech, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. We don't want to rain on the parade too much, but we did also find 2 warning signs for Elite Semiconductor Microelectronics Tech (1 is a bit unpleasant!) that you need to be mindful of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Elite Semiconductor Microelectronics Tech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elite Semiconductor Microelectronics Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3006

Elite Semiconductor Microelectronics Technology

Elite Semiconductor Microelectronics Technology Inc.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion