- Taiwan

- /

- Electrical

- /

- TWSE:1608

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets experience a surge, with U.S. stock indexes nearing record highs and European indices reaching fresh peaks, investors are paying close attention to inflation trends and interest rate expectations. In this dynamic environment, dividend stocks can offer a compelling opportunity for those seeking steady income streams amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

Click here to see the full list of 1974 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

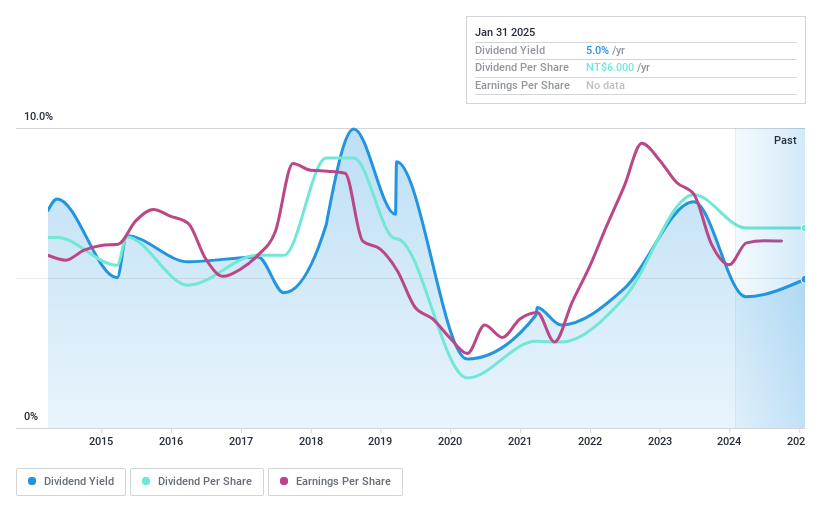

Feedback Technology (TPEX:8091)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Feedback Technology Corp. manufactures and sells components for the semiconductor, LCD, LED, medical, and aerospace industries in Taiwan with a market cap of NT$6.70 billion.

Operations: Feedback Technology Corp. generates revenue primarily from its Semiconductor segment, contributing NT$1.89 billion, and the Optoelectronic segment, adding NT$86.55 million.

Dividend Yield: 4.7%

Feedback Technology offers a dividend yield of 4.72%, placing it in the top 25% of dividend payers in the TW market. However, its dividends have been volatile over the past decade, experiencing significant annual drops. The payout ratio stands at 87.5%, indicating coverage by earnings, but with a cash payout ratio of 166.8%, dividends are not well covered by free cash flows, raising sustainability concerns despite recent earnings growth of 5.9%.

- Click here to discover the nuances of Feedback Technology with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Feedback Technology's share price might be too optimistic.

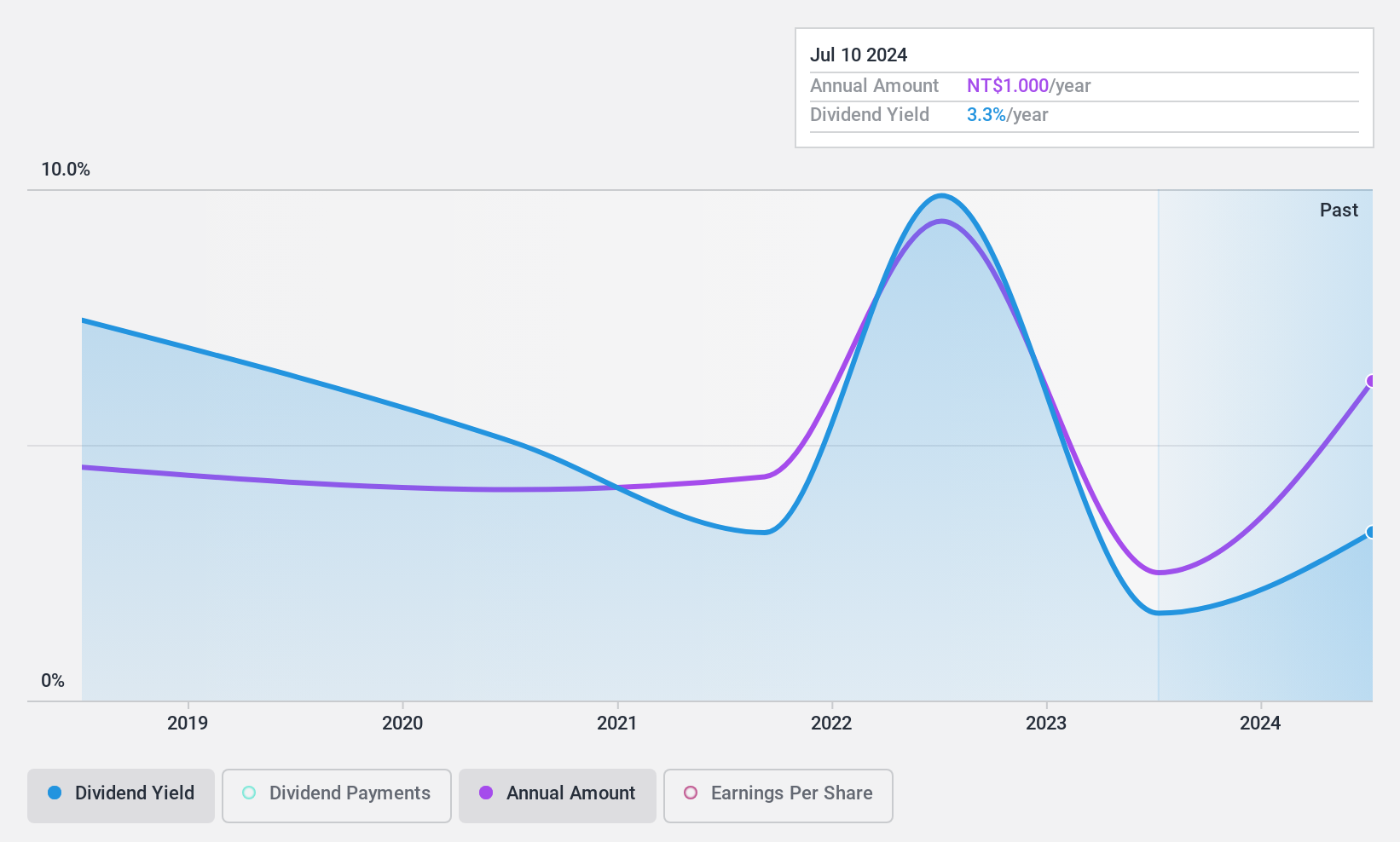

Hua Eng Wire & Cable (TWSE:1608)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hua Eng Wire & Cable Co., Ltd. operates in Taiwan, focusing on the processing, manufacture, construction, and sale of wire, cable, and copper products with a market cap of NT$11.60 billion.

Operations: Hua Eng Wire & Cable Co., Ltd.'s revenue is derived from three main segments: Cable (NT$4.90 billion), Wire Materials (NT$3.19 billion), and Copper Products (NT$3.06 billion).

Dividend Yield: 3.7%

Hua Eng Wire & Cable's dividend yield of 3.66% is below the top 25% of TW market payers, yet its dividends are well-covered by earnings and cash flows with payout ratios of 47.8% and 39.7%, respectively. Despite a history of volatility, dividends have grown over the past decade. The stock trades significantly below estimated fair value, but recent earnings growth is influenced by large one-off items, impacting overall financial quality perceptions.

- Click to explore a detailed breakdown of our findings in Hua Eng Wire & Cable's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Hua Eng Wire & Cable shares in the market.

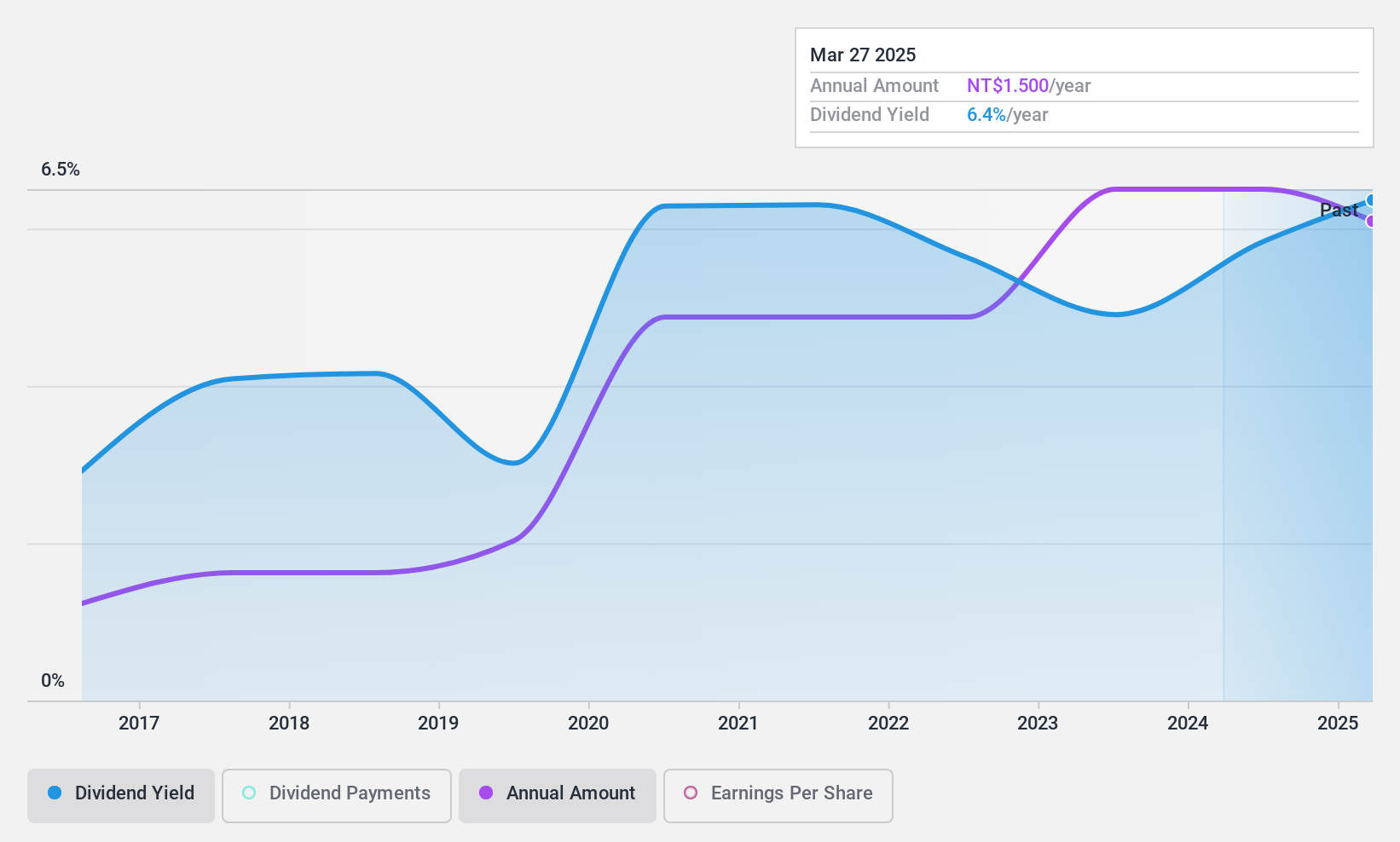

Emerging Display Technologies (TWSE:3038)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Emerging Display Technologies Corp. specializes in the production and sale of capacitive touch panels and liquid crystal displays (LCD) across Taiwan, Europe, the United States, and other international markets, with a market cap of NT$4.20 billion.

Operations: Emerging Display Technologies Corp.'s revenue is derived from its operations in the Americas (NT$1.31 billion), Taiwan (NT$3.66 billion), and Mainland District (NT$433.08 million).

Dividend Yield: 5.7%

Emerging Display Technologies offers a dividend yield of 5.66%, placing it in the top 25% of Taiwan's market. The company's dividends have been stable and growing over the past decade, supported by earnings and cash flows with payout ratios of 69.8% and 62%, respectively. Trading at a discount to its estimated fair value, future earnings are expected to decline significantly, which could impact long-term dividend sustainability.

- Get an in-depth perspective on Emerging Display Technologies' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Emerging Display Technologies' share price might be too pessimistic.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1971 more companies for you to explore.Click here to unveil our expertly curated list of 1974 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Eng Wire & Cable might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1608

Hua Eng Wire & Cable

Engages in the processing, manufacture, construction, and sale of wire, cable, and copper products in Taiwan.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives