- Taiwan

- /

- Communications

- /

- TPEX:3152

Exploring Undiscovered Gems in Asia December 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of interest rate adjustments and economic uncertainties, the Asian market presents unique opportunities, particularly in the small-cap sector. With recent shifts in monetary policy and evolving economic indicators, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to uncover undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Double Elephant Micro Fibre MaterialLtd | 5.49% | 13.38% | 64.10% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 32.67% | 9.30% | 4.58% | ★★★★★★ |

| Thai Steel Cable | NA | 3.35% | 17.89% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 11.87% | 8.96% | -3.28% | ★★★★★★ |

| Nextronics Engineering | 20.23% | 11.39% | 24.54% | ★★★★★★ |

| Wholetech System Hitech | 14.93% | 13.36% | 18.63% | ★★★★★☆ |

| House of Investments | 18.23% | 14.46% | 47.47% | ★★★★★☆ |

| Li Ming Development Construction | 183.36% | 8.59% | 19.98% | ★★★★☆☆ |

| Chinyang Holdings | 31.98% | 7.57% | -15.85% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 51.85% | 20.80% | -5.94% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Advanced Ceramic X (TPEX:3152)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Ceramic X Corporation specializes in designing, manufacturing, and selling RF front-end devices and modules for wireless communication applications across Taiwan, China, the United States, and other international markets with a market capitalization of NT$98 billion.

Operations: Advanced Ceramic X generates revenue from the high-frequency integration of components and modules, amounting to NT$1.54 billion.

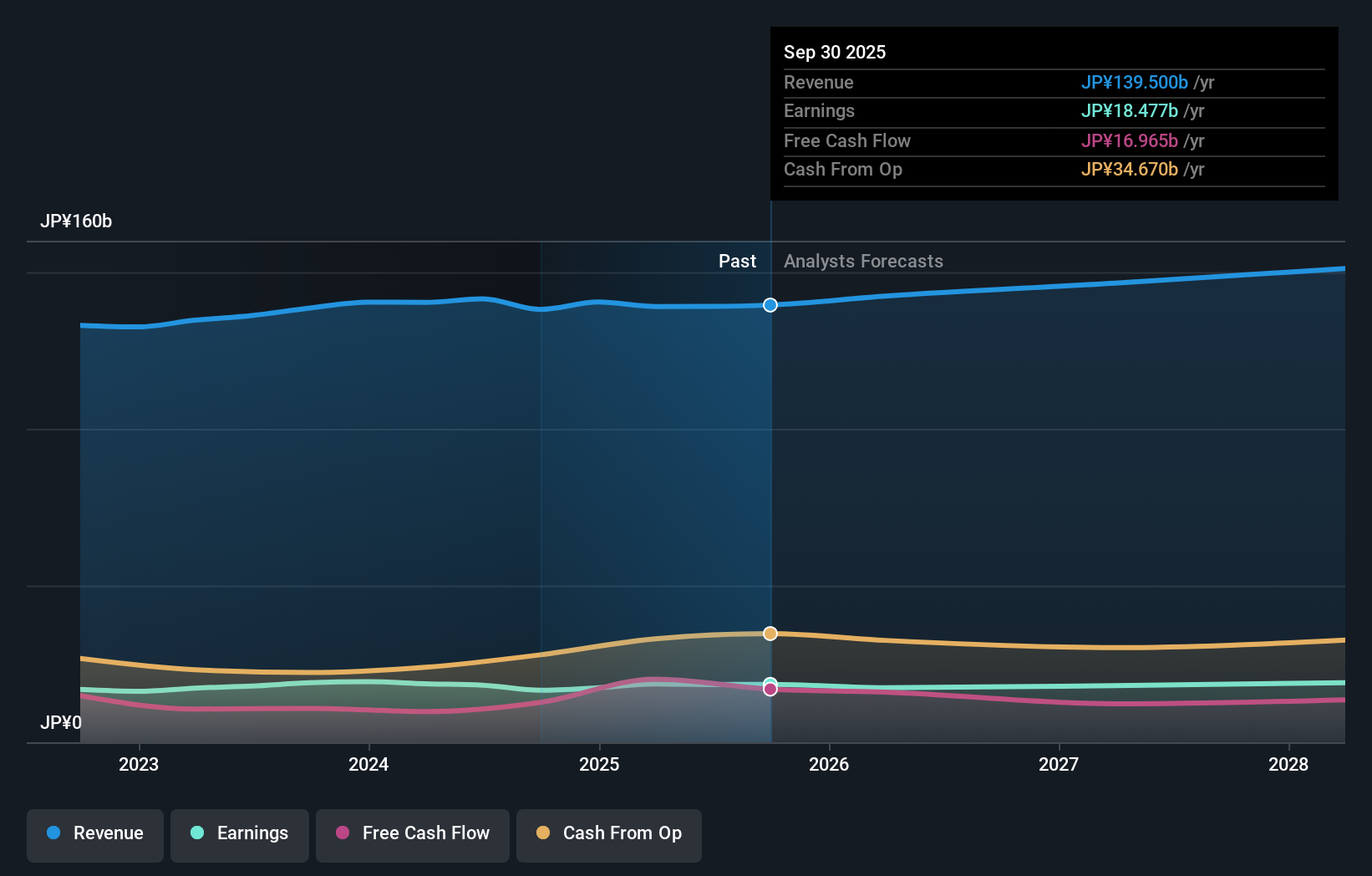

Advanced Ceramic X, a smaller player in the industry, has shown an impressive earnings growth of 67.6% over the past year, outpacing the broader Communications sector's 8.8%. The company operates debt-free, eliminating concerns over interest payments and showcasing strong financial health with positive free cash flow. Recent figures reveal a net income of NT$77.66 million for Q3 2025, down from NT$98.81 million in the previous year; however, nine-month results show an increase to NT$567.45 million from NT$319.7 million last year, indicating potential resilience despite quarterly fluctuations.

- Dive into the specifics of Advanced Ceramic X here with our thorough health report.

Assess Advanced Ceramic X's past performance with our detailed historical performance reports.

Brillian Network & Automation Integrated System (TPEX:6788)

Simply Wall St Value Rating: ★★★★★★

Overview: Brillian Network & Automation Integrated System Co. (TPEX:6788) specializes in providing integrated network and automation solutions, with a market capitalization of NT$11.27 billion.

Operations: Brillian Network & Automation Integrated System Co. generates revenue primarily through its subsidiary, Brillian Network & Automation Integrated System Co. Ltd., contributing NT$1.73 billion, and Kunshan Xinwulian Electronic Communication Co., Ltd., adding NT$744.52 million to the total revenue stream.

Brillian Network & Automation Integrated System, a promising player in the semiconductor space, has shown impressive earnings growth of 58.9% over the past year, outpacing the industry's 2.5%. Trading at 27.1% below its estimated fair value suggests potential for upside. The company is debt-free and boasts high-quality earnings, enhancing its financial stability. Recent results highlight robust net income of TWD 164 million for Q3 2025 compared to TWD 138 million last year, with basic EPS rising to TWD 4.25 from TWD 3.94. Its free cash flow remains positive at US$692 million as of September this year, reflecting strong operational efficiency.

Fukuda Denshi (TSE:6960)

Simply Wall St Value Rating: ★★★★★★

Overview: Fukuda Denshi Co., Ltd. is a company that manufactures and sells medical instruments both in Japan and internationally, with a market capitalization of ¥199.31 billion.

Operations: Fukuda Denshi generates revenue primarily from Treatment Devices, contributing ¥62.79 billion, followed by Consumables at ¥39.83 billion. Biometrics Equipment and Biological Information Monitoring add ¥27.73 billion and ¥9.14 billion, respectively, to the total revenue stream.

Fukuda Denshi, a noteworthy player in the medical equipment sector, has shown robust financial health with earnings growing by 11% over the past year, outpacing industry growth of 3%. The company’s debt to equity ratio improved from 1.4 to 1 over five years, indicating better financial management. Trading at about 26% below its estimated fair value suggests it could be undervalued relative to peers. Recent announcements include a dividend increase to ¥65 per share and projected net sales of ¥137 billion for the fiscal year ending March 2026, reinforcing its commitment to shareholder returns and strong operational performance.

- Get an in-depth perspective on Fukuda Denshi's performance by reading our health report here.

Understand Fukuda Denshi's track record by examining our Past report.

Next Steps

- Click this link to deep-dive into the 2496 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3152

Advanced Ceramic X

Designs, manufactures, and sells RF front-end devices and modules for wireless communication applications in Taiwan, China, the United States, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)