Unearthing None And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rising inflation and cautious monetary policies, small-cap stocks have struggled to keep pace with their larger counterparts, as evidenced by the Russell 2000 Index trailing behind the S&P 500. In such an environment, identifying promising small-cap companies with strong growth potential requires a keen eye for those that can capitalize on market opportunities and demonstrate resilience amid economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shiyue Daotian Group (SEHK:9676)

Simply Wall St Value Rating: ★★★★★☆

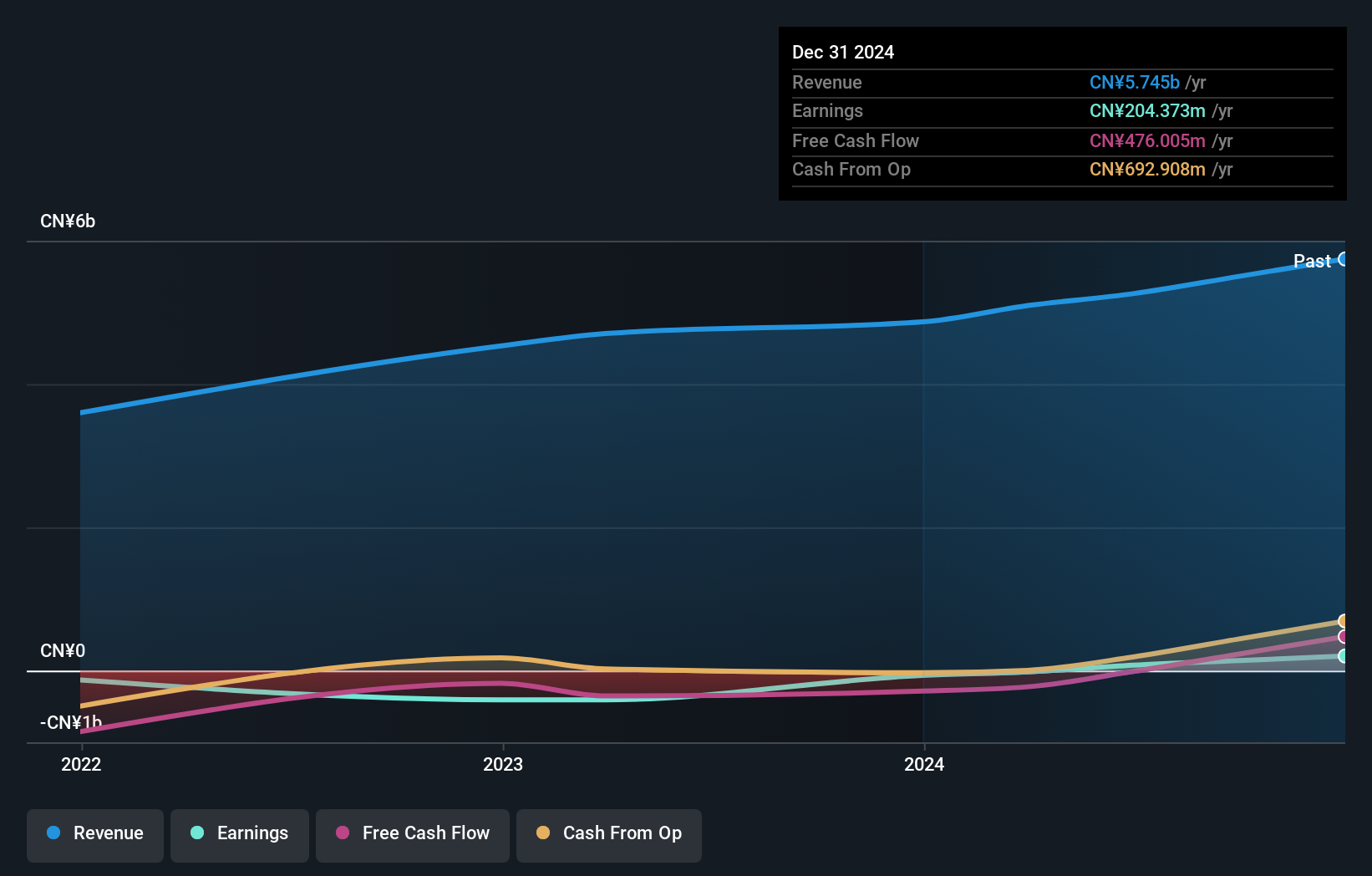

Overview: Shiyue Daotian Group Co., Ltd. is a company that manufactures and sells pantry staple foods in the People's Republic of China, with a market capitalization of approximately HK$6.26 billion.

Operations: The company's primary revenue stream comes from rice products, generating CN¥3.80 billion, followed by whole grain, bean and other products at CN¥1.04 billion. Dried food and other products contribute CN¥422.83 million to the total revenue.

Shiyue Daotian Group, a smaller player in the food sector, has recently turned profitable, outpacing the industry's -3.3% earnings growth. The company boasts high-quality earnings and holds more cash than its total debt, indicating financial stability. Interest payments are comfortably covered by EBIT at 16.3 times, suggesting strong operational performance. Despite not being free cash flow positive yet, with levered free cash flow at US$-12.72 million as of June 2024 and significant capital expenditures of US$203.78 million during the same period, Shiyue Daotian's robust cash position provides a cushion for future growth opportunities.

- Click here and access our complete health analysis report to understand the dynamics of Shiyue Daotian Group.

Evaluate Shiyue Daotian Group's historical performance by accessing our past performance report.

Keystone Microtech (TPEX:6683)

Simply Wall St Value Rating: ★★★★★★

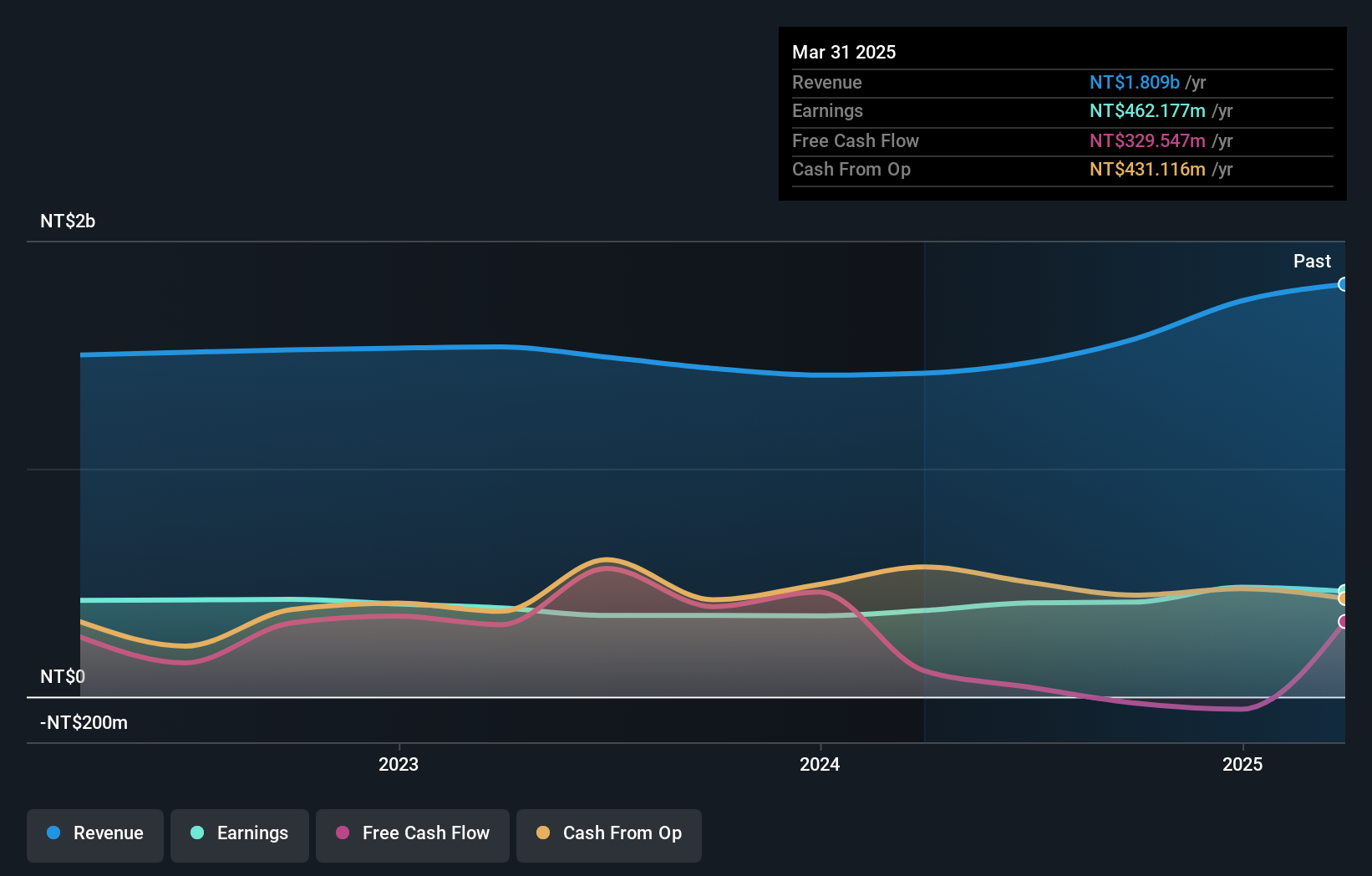

Overview: Keystone Microtech Corporation operates in the semiconductor industry in Taiwan and internationally, with a market capitalization of NT$12.60 billion.

Operations: Keystone Microtech generates revenue primarily through the manufacture and sale of various test carriers for semiconductor wafer testing, amounting to NT$1.57 billion. The company's market capitalization stands at NT$12.60 billion.

Keystone Microtech, with its nimble market position, showcases impressive earnings growth of 16.4% over the past year, outpacing the Semiconductor industry's average of 5.9%. The company operates debt-free for five years, eliminating concerns about interest payments and highlighting financial prudence. Despite a volatile share price recently, Keystone's high level of non-cash earnings suggests robust underlying performance. Its Price-To-Earnings ratio stands at 30.4x, slightly undercutting the industry average of 30.6x, indicating potential value relative to peers in its sector. This combination of factors paints a compelling picture for those seeking promising opportunities in this space.

- Navigate through the intricacies of Keystone Microtech with our comprehensive health report here.

Examine Keystone Microtech's past performance report to understand how it has performed in the past.

Dainichiseika Color & Chemicals Mfg (TSE:4116)

Simply Wall St Value Rating: ★★★★★★

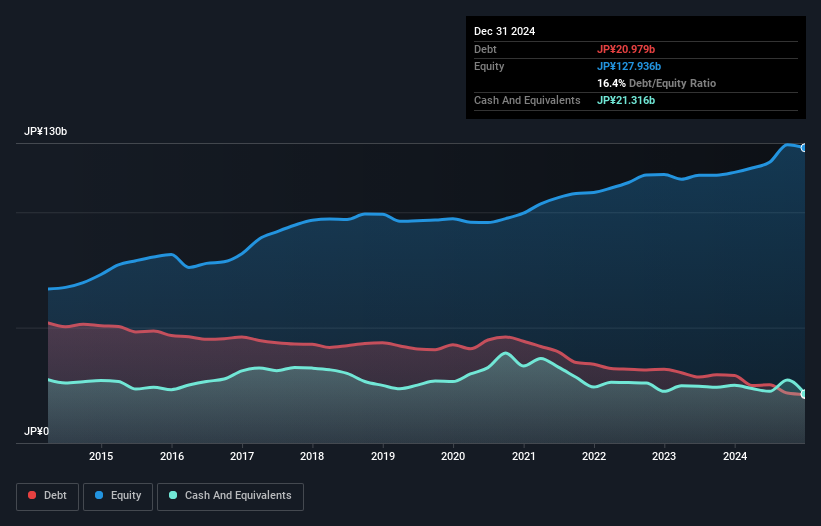

Overview: Dainichiseika Color & Chemicals Mfg. Co., Ltd., with a market cap of ¥53.54 billion, specializes in the production and distribution of pigments, colorants, and related chemical products.

Operations: Dainichiseika generates revenue primarily from its pigments and colorants segments. The company has a market cap of ¥53.54 billion, reflecting its scale in the chemical products industry.

Dainichiseika Color & Chemicals Mfg. has shown impressive earnings growth of 204% over the past year, outpacing the broader chemicals industry growth of 17%. This performance was bolstered by a significant one-off gain of ¥6.6 billion, suggesting some unusual factors at play in its recent results. The company’s debt-to-equity ratio improved significantly from 44% to 16% over five years, indicating effective debt management. Recently, they revised their dividend forecast to ¥75 per share for fiscal year-end March 2025, up from ¥51 previously anticipated, reflecting confidence in their financial health and future prospects despite prior guidance adjustments.

- Dive into the specifics of Dainichiseika Color & Chemicals Mfg here with our thorough health report.

Key Takeaways

- Click through to start exploring the rest of the 4722 Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9676

Shiyue Daotian Group

Manufactures and sells pantry staple food in the People's Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)