- Taiwan

- /

- Semiconductors

- /

- TPEX:6548

Undiscovered Gems With Strong Potential To Explore February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and shifting trade policies, major U.S. stock indexes approach record highs, while small-cap stocks lag behind their larger counterparts. In this dynamic environment, identifying undiscovered gems requires a keen eye for companies with robust fundamentals and the ability to adapt to economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Vinacomin - Power Holding | 42.01% | -0.84% | 34.75% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Chang Wah Technology (TPEX:6548)

Simply Wall St Value Rating: ★★★★★★

Overview: Chang Wah Technology Co., Ltd. engages in the development, manufacturing, and sale of LED lead frame and molding compound materials across Taiwan, Asia, and international markets with a market capitalization of NT$33.80 billion.

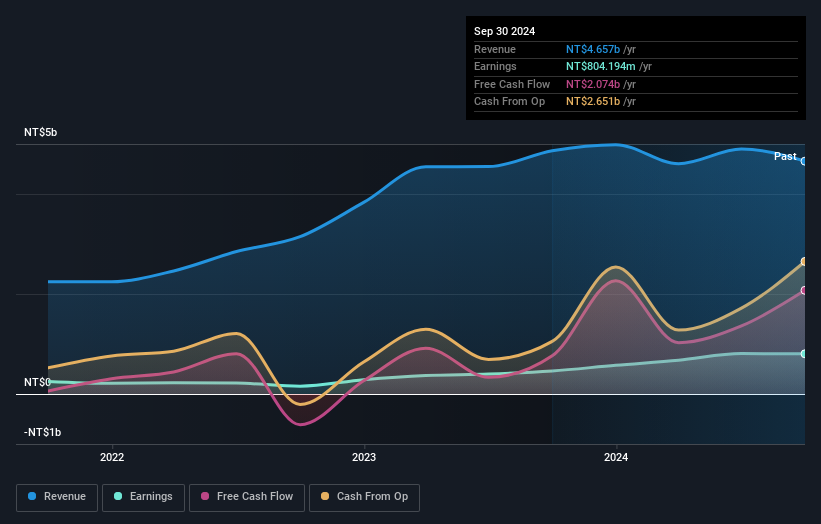

Operations: The company's primary revenue streams are derived from Chang Wah Technology, Shanghai Chang Wah, and MSHE segments, contributing NT$6.39 billion, NT$2.58 billion, and NT$2.28 billion respectively. The net profit margin reflects the company's profitability after accounting for all expenses and taxes.

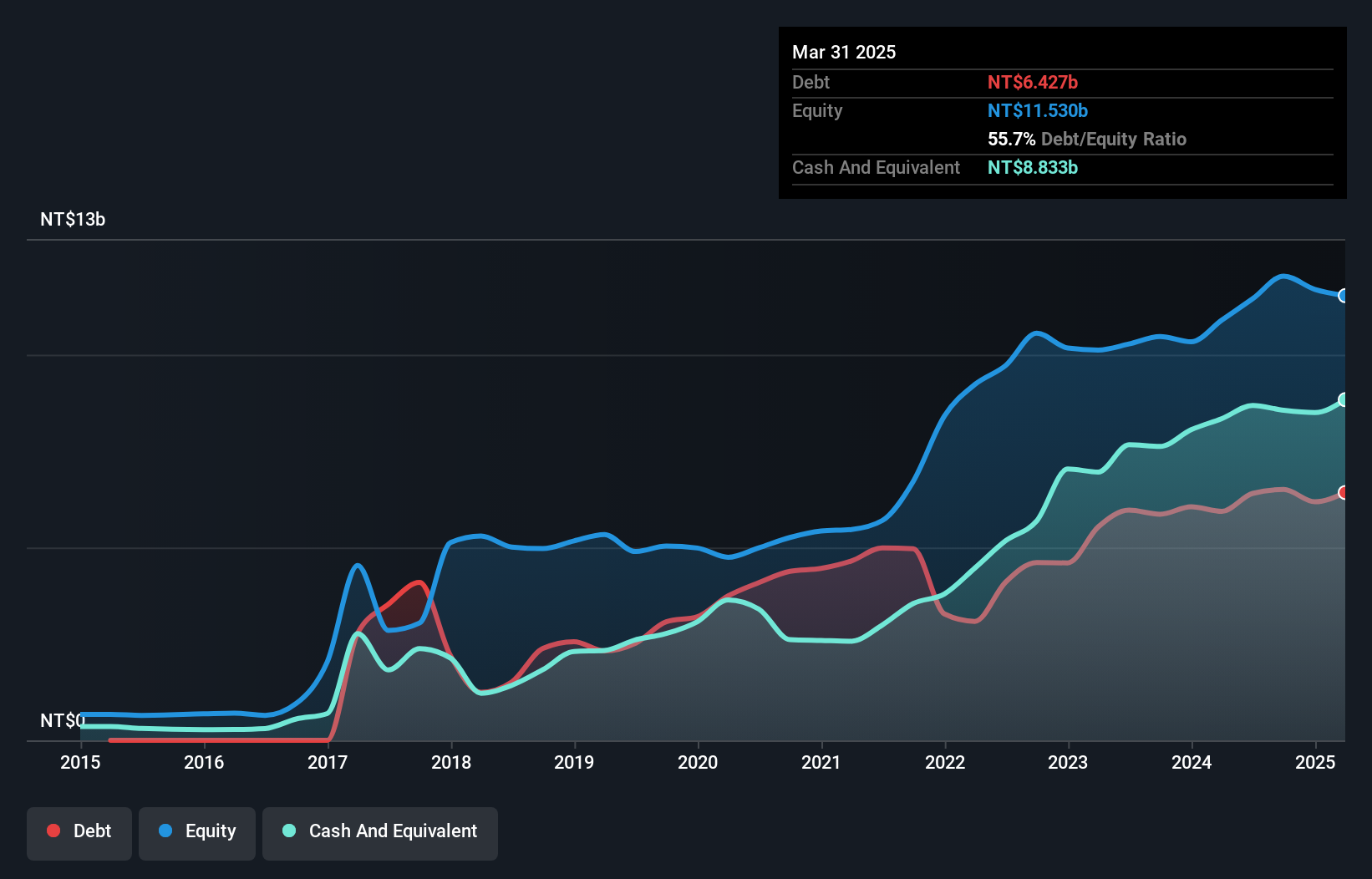

Chang Wah Technology, a smaller player in the semiconductor space, has shown resilience with high-quality earnings and a price-to-earnings ratio of 20.5x, which is favorable compared to the TW market average of 21.6x. Despite facing a negative earnings growth of -1.5% last year against an industry average growth of 5.9%, it remains profitable and boasts more cash than its total debt, indicating sound financial health. Over five years, its debt-to-equity ratio improved from 61% to 54%. Earnings are projected to grow at an annual rate of 6.78%, suggesting potential for future expansion in this competitive sector.

- Navigate through the intricacies of Chang Wah Technology with our comprehensive health report here.

Explore historical data to track Chang Wah Technology's performance over time in our Past section.

Lungteh Shipbuilding (TWSE:6753)

Simply Wall St Value Rating: ★★★★★★

Overview: Lungteh Shipbuilding Co., Ltd. is involved in the shipbuilding industry and has a market capitalization of NT$13.46 billion.

Operations: Lungteh Shipbuilding generates revenue primarily from its shipbuilding activities. The company's financial performance is reflected in its market capitalization of NT$13.46 billion.

Lungteh Shipbuilding, a compact player in the ship manufacturing sector, has shown impressive financial resilience. Over the past year, its earnings surged by 74.5%, outpacing the Machinery industry's 14.6% growth rate. The company's debt to equity ratio improved from 80.8% to 60.5% over five years, indicating better financial health and management of liabilities. With interest payments well covered by EBIT at a robust 36x coverage, Lungteh's debt seems manageable. Trading at a significant discount of 94.5% below estimated fair value suggests potential for appreciation if operational performance aligns with market expectations in upcoming reports.

- Click here and access our complete health analysis report to understand the dynamics of Lungteh Shipbuilding.

Understand Lungteh Shipbuilding's track record by examining our Past report.

Sygnity (WSE:SGN)

Simply Wall St Value Rating: ★★★★★★

Overview: Sygnity S.A. is engaged in the manufacturing and sale of IT products and services both in Poland and internationally, with a market capitalization of PLN1.53 billion.

Operations: Sygnity generates revenue primarily from its IT segment, amounting to PLN232.96 million.

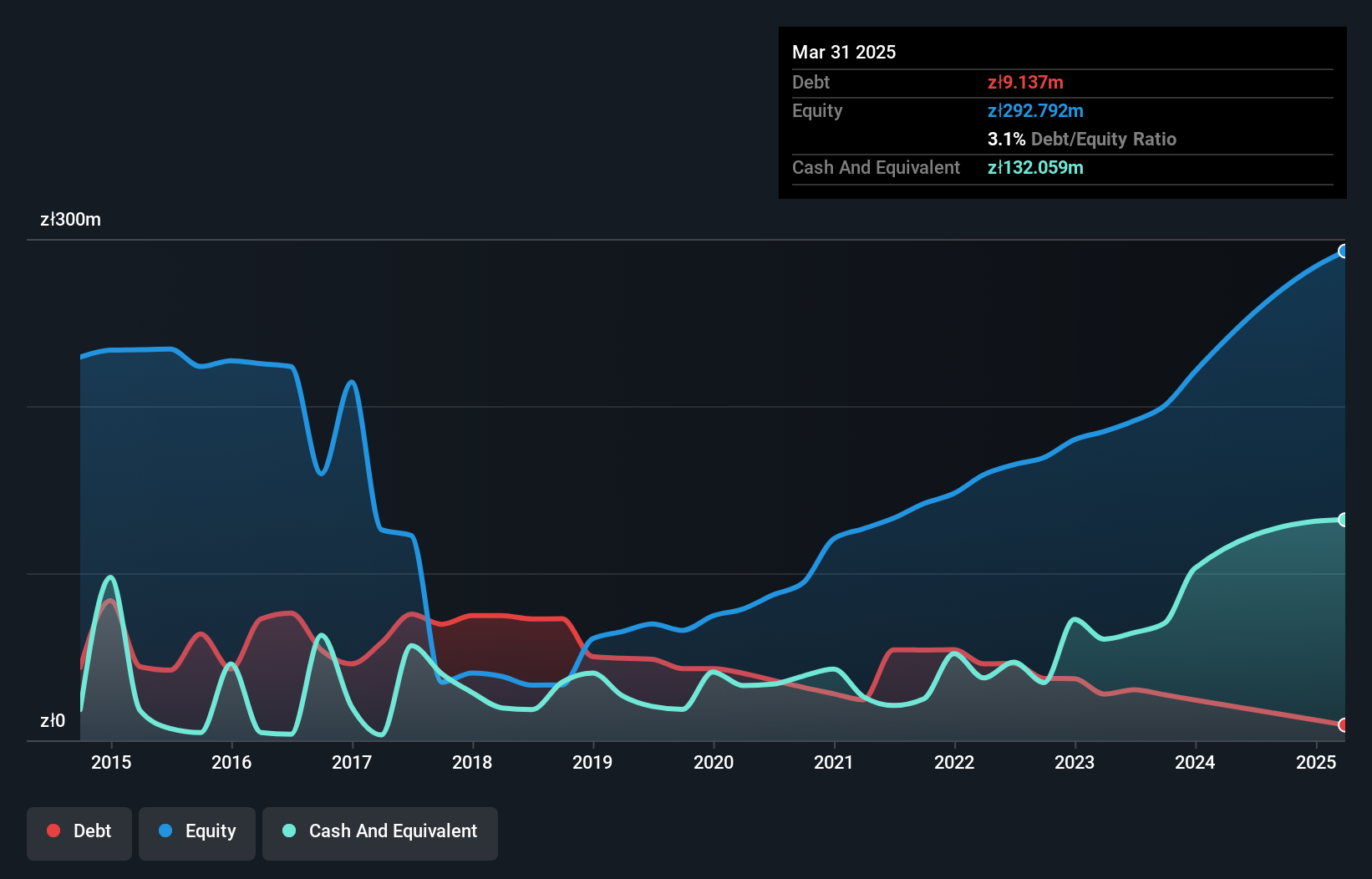

Sygnity, a nimble player in the IT sector, has demonstrated impressive financial resilience and growth. Over the past year, its earnings surged by 26.4%, significantly outpacing the industry's -25.1% performance. The company's debt-to-equity ratio has impressively dropped from 82.5% to 10.9% over five years, highlighting effective debt management strategies. Sygnity's interest payments are comfortably covered by EBIT at a robust 116 times coverage, indicating strong operational efficiency. With high-quality earnings and more cash than total debt, this company seems well-positioned for continued stability and potential growth in its niche market space.

- Get an in-depth perspective on Sygnity's performance by reading our health report here.

Gain insights into Sygnity's past trends and performance with our Past report.

Where To Now?

- Reveal the 4721 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6548

Chang Wah Technology

Develops, manufactures, and sells LED lead frame and molding compound materials in Taiwan, Asia, and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>