Taiwan TaxiLtd And 2 Other Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have seen significant movements, with major benchmarks like the S&P 500 reaching record highs amid optimism for growth and tax reforms. As investors navigate these dynamic conditions, dividend stocks such as Taiwan Taxi Ltd can offer stability and income potential by providing regular payouts that may help enhance portfolio resilience amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.15% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Taiwan TaxiLtd (TPEX:2640)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Taiwan Taxi Co., Ltd. offers taxi services in Taiwan and has a market capitalization of NT$6.90 billion.

Operations: Taiwan Taxi Co., Ltd.'s revenue segments include Information Media Services generating NT$2.28 billion and Sales of Platform Peripherals contributing NT$967.67 million.

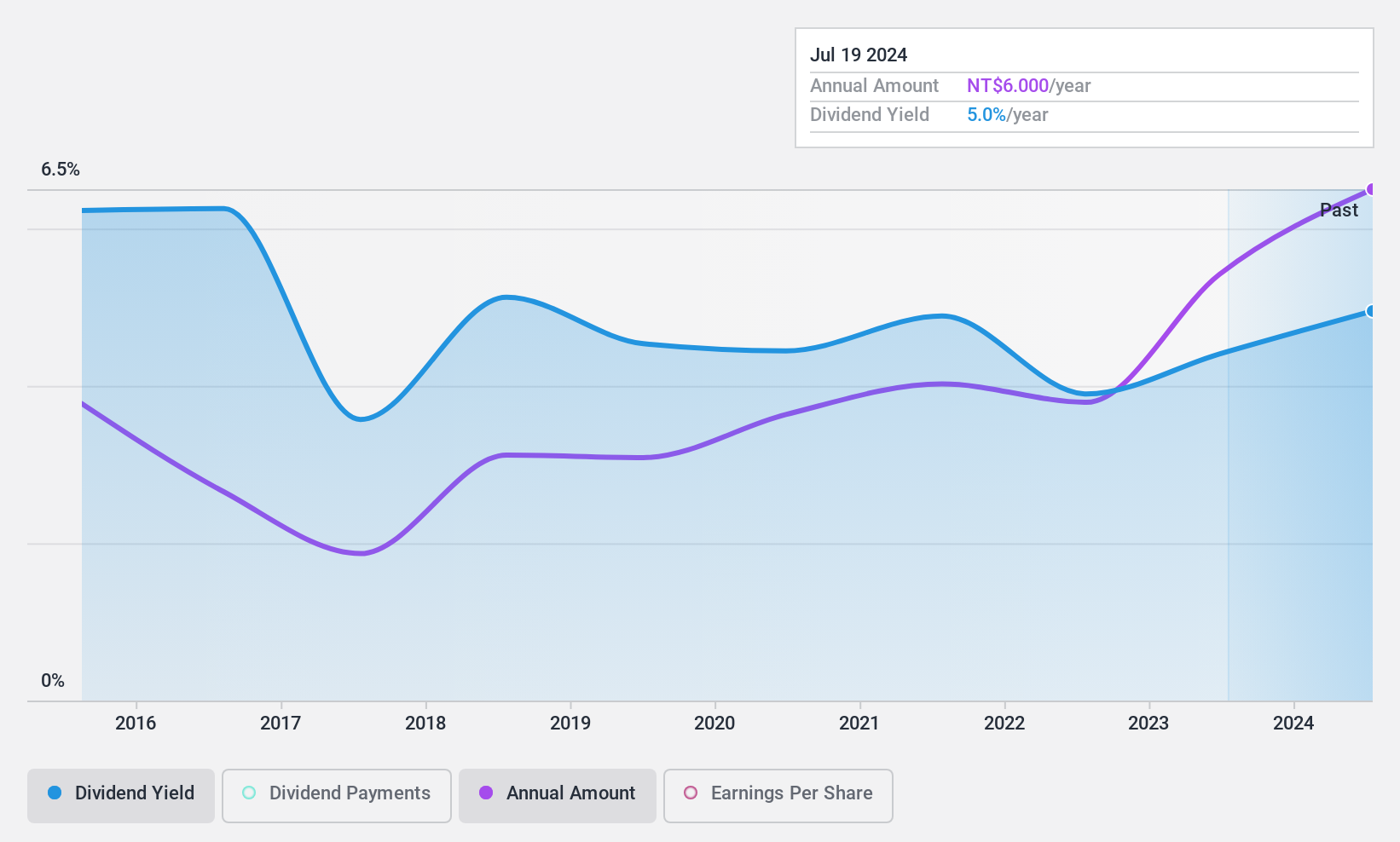

Dividend Yield: 4.9%

Taiwan Taxi Ltd. reported solid earnings growth, with net income rising to TWD 118.6 million in Q2 2024 from TWD 95.54 million a year prior, supporting its dividend payments. The company's dividend yield is among the top quartile in Taiwan's market but has been historically volatile and unreliable over the past decade despite recent increases. Dividends are covered by both earnings and cash flows, with payout ratios of 79.8% and 71.7%, respectively, indicating sustainability within current financial parameters.

- Unlock comprehensive insights into our analysis of Taiwan TaxiLtd stock in this dividend report.

- According our valuation report, there's an indication that Taiwan TaxiLtd's share price might be on the expensive side.

GlobalWafers (TPEX:6488)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GlobalWafers Co., Ltd., along with its subsidiaries, is engaged in the research, design, development, and manufacturing of semiconductor ingots and wafers both in Taiwan and internationally, with a market cap of NT$210.37 billion.

Operations: GlobalWafers Co., Ltd. generates its revenue primarily from the Semiconductor Business Group, which contributes NT$62.89 billion, and the Renewable Energy Division, which adds NT$155.17 million.

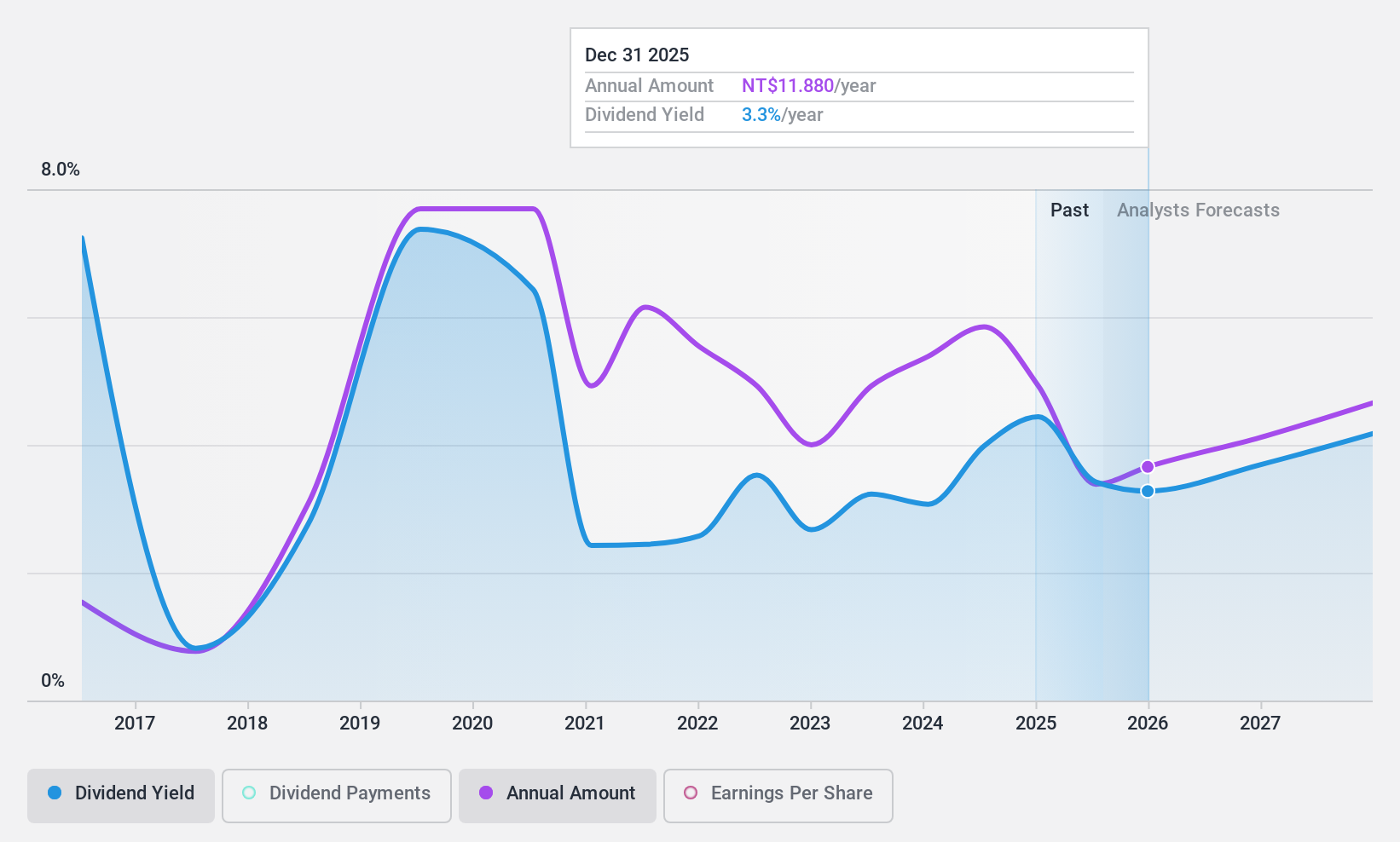

Dividend Yield: 4.5%

GlobalWafers' dividend yield is in the top 25% of Taiwan's market, but recent earnings declines raise concerns about sustainability. Despite a low payout ratio of 36.4%, dividends are not covered by free cash flow, indicating potential risk. The company has experienced shareholder dilution and volatile dividend payments over the past decade, though dividends have grown historically. Trading significantly below estimated fair value suggests potential for capital appreciation despite current financial challenges.

- Click here to discover the nuances of GlobalWafers with our detailed analytical dividend report.

- Our valuation report here indicates GlobalWafers may be undervalued.

KSKLtd (TSE:9687)

Simply Wall St Dividend Rating: ★★★★★★

Overview: KSK Co., Ltd. operates in the LSI, software, hardware, customer service, and data entry sectors with a market cap of ¥18.09 billion.

Operations: KSK Co., Ltd.'s revenue segments include the IT Solution Business at ¥5.31 billion, System Core Business at ¥3.99 billion, and Network Service Business at ¥13.27 billion.

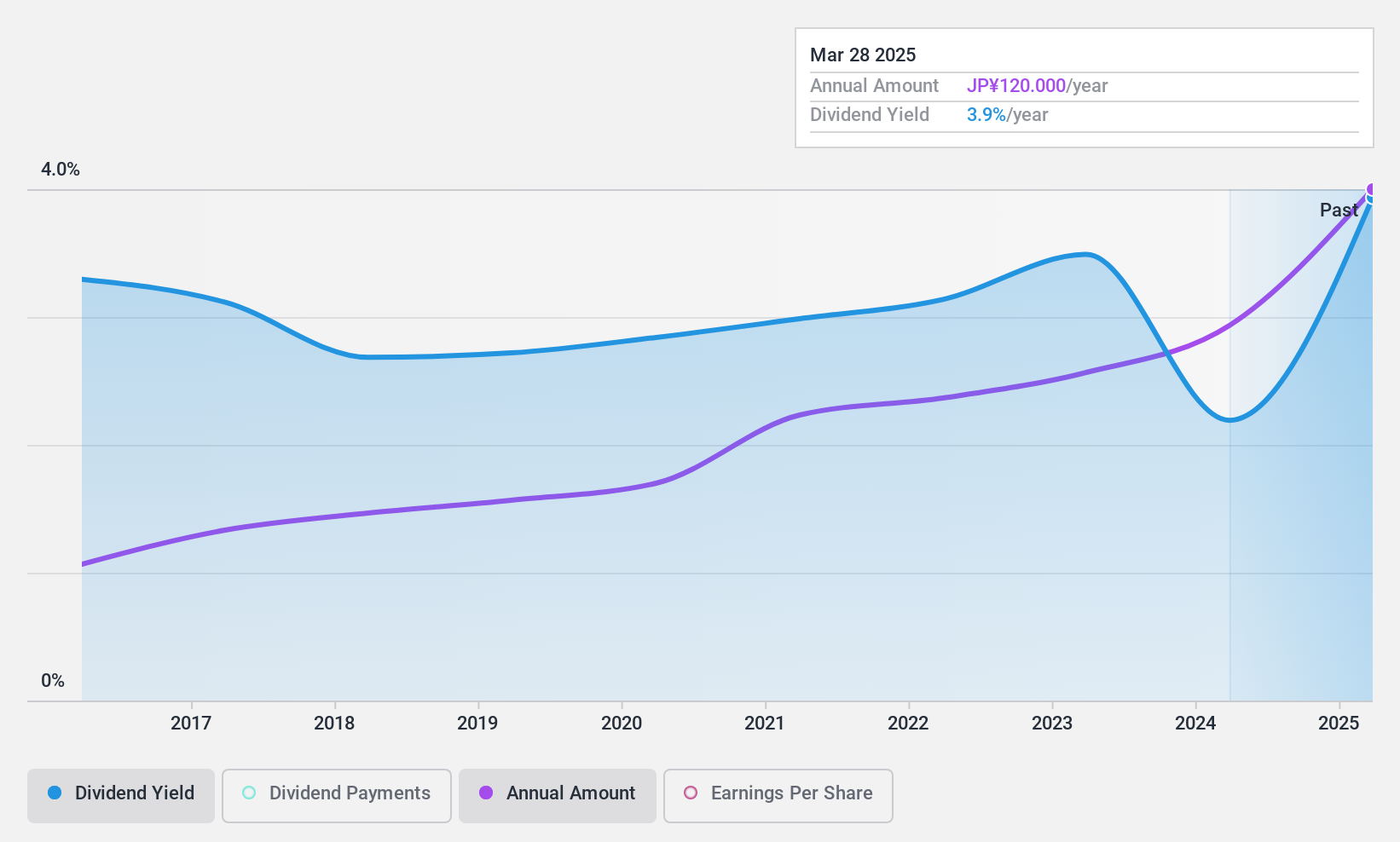

Dividend Yield: 4%

KSK Ltd. offers a compelling dividend profile with a yield of 3.97%, placing it in the top 25% of Japan's market. Dividends are well-supported by earnings, with a payout ratio of 32.7%, and cash flows, reflected in a cash payout ratio of 54.6%. Over the past decade, dividends have been stable and reliably growing, underpinned by consistent earnings growth averaging 8.5% annually over five years. The stock trades at approximately 24.9% below its estimated fair value, enhancing its attractiveness for income-focused investors.

- Get an in-depth perspective on KSKLtd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that KSKLtd is priced lower than what may be justified by its financials.

Seize The Opportunity

- Get an in-depth perspective on all 1939 Top Dividend Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KSKLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9687

KSKLtd

Engages in the LSI, software, hardware, customer service, and data entry businesses.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives