- Taiwan

- /

- Semiconductors

- /

- TPEX:5443

Exploring Hidden Potential In Undiscovered Gems With 3 Small Cap Opportunities

Reviewed by Simply Wall St

As global markets navigate an exceptionally busy period marked by mixed earnings reports and fluctuating economic indicators, small-cap stocks have demonstrated relative resilience compared to their larger counterparts. In this context of market volatility and cautious investor sentiment, identifying stocks with strong fundamentals and growth potential can uncover hidden opportunities in the small-cap sector.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Techno Smart | NA | 6.07% | -0.57% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Compañía Electro Metalúrgica | 72.83% | 12.17% | 19.18% | ★★★★☆☆ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hangzhou Heatwell Electric Heating Technology (SHSE:603075)

Simply Wall St Value Rating: ★★★★★☆

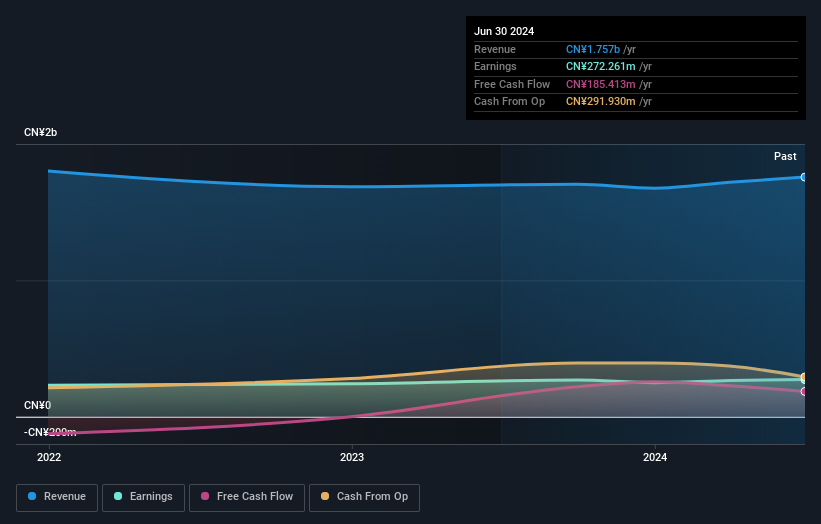

Overview: Hangzhou Heatwell Electric Heating Technology Co., Ltd. is a company engaged in the development and manufacturing of electric heating products, with a market cap of approximately CN¥7.86 billion.

Operations: Hangzhou Heatwell Electric Heating Technology generates revenue primarily from the sale of electric heating products. The company's financial performance is highlighted by a notable gross profit margin trend, reflecting its efficiency in managing production costs relative to sales.

Hangzhou Heatwell Electric Heating Technology, a promising player in its field, reported sales of CNY 1.41 billion for the first nine months of 2024, up from CNY 1.27 billion the previous year. Net income rose to CNY 228.77 million compared to last year's CNY 194.89 million, with earnings per share at CNY 0.57 from continuing operations. The company enjoys high-quality past earnings and a price-to-earnings ratio of 28.9x, below the CN market average of 34.4x—indicating potential value for investors seeking growth beyond industry standards with manageable debt levels and positive free cash flow dynamics.

Silvery Dragon Prestressed MaterialsLTD Tianjin (SHSE:603969)

Simply Wall St Value Rating: ★★★★☆☆

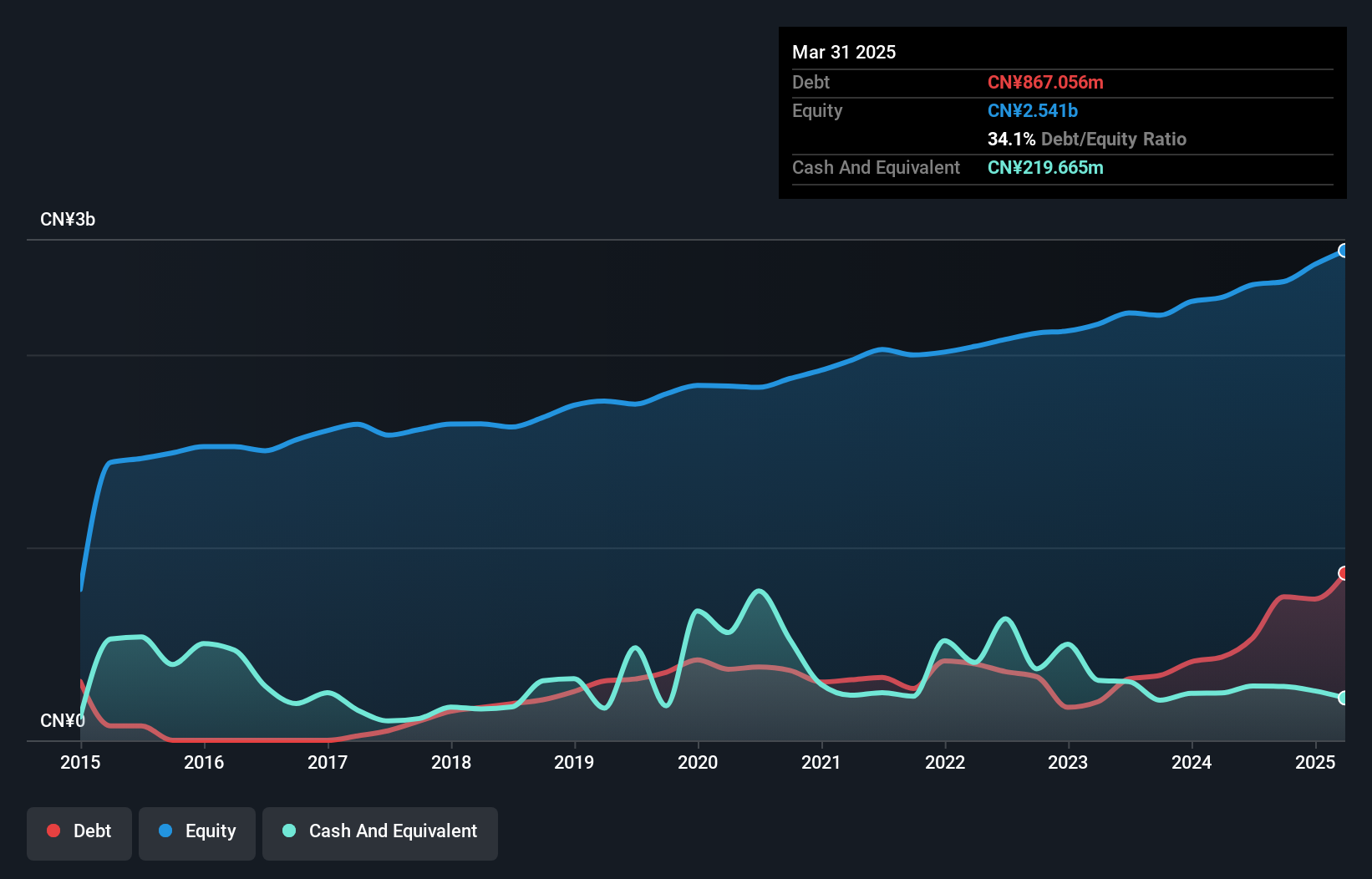

Overview: Silvery Dragon Prestressed Materials Co., LTD Tianjin is engaged in the manufacturing and sale of prestressed steel products in China, with a market capitalization of CN¥5.01 billion.

Operations: Silvery Dragon generates revenue primarily from its Metal Processors and Fabrication segment, with reported sales of CN¥2.93 billion. The company's financial performance is reflected in its net profit margin trends, which provide insight into profitability levels over time.

Silvery Dragon, a smaller player in the materials industry, has shown resilience with its earnings growth of 76.4% over the past year, outpacing the broader Metals and Mining sector's -2.3%. The company's interest payments are comfortably covered by EBIT at 30.1x, indicating robust financial health. With a net debt to equity ratio of 19.5%, it maintains satisfactory leverage levels despite an increase from 19.6% to 31.3% over five years. Recent earnings for nine months ending September show sales rising to CNY 2,202 million from CNY 2,018 million last year and net income climbing to CNY 169 million from CNY 118 million previously.

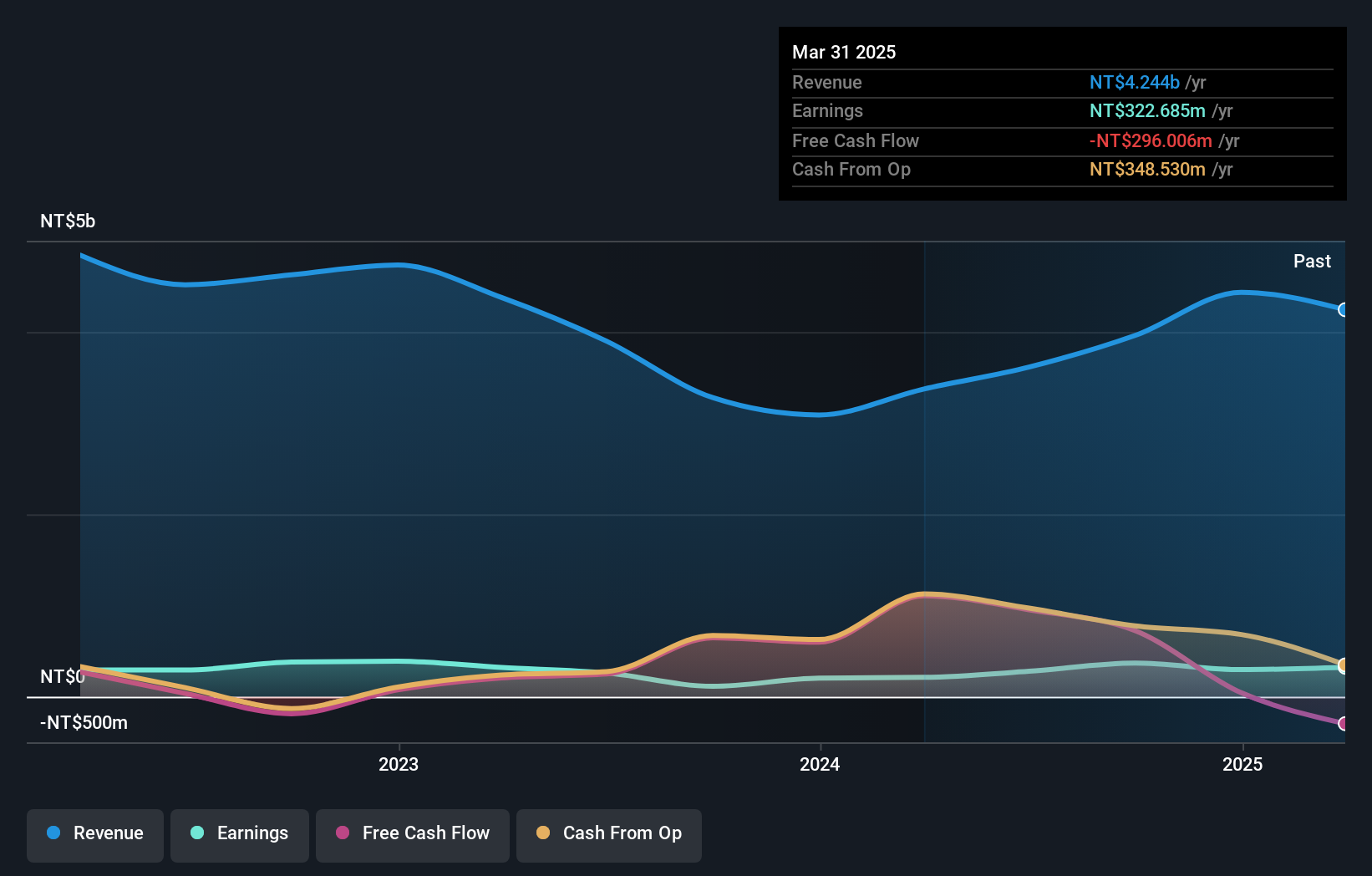

Gallant Precision Machining (TPEX:5443)

Simply Wall St Value Rating: ★★★★★★

Overview: Gallant Precision Machining Co., Ltd. specializes in the R&D, production, and sale of flat panel display testing, semiconductor assembly, and intelligent automation equipment across Taiwan, China, and international markets with a market cap of NT$20.84 billion.

Operations: Gallant Precision Machining generates revenue primarily from Gallant Micro. Machining Co., Ltd. (NT$2.07 billion) and Gallant Precision Machining Co., Ltd. (NT$1.68 billion), with smaller contributions from GRC Corporation and Apex-I International Co., Ltd. The company's net profit margin is an important metric to consider when evaluating its financial performance over time, reflecting the efficiency of its operations relative to total revenue generated across its segments.

Gallant Precision Machining, a nimble player in its field, has shown promising growth with earnings rising by 7.2% over the past year, outpacing the broader semiconductor industry’s marginal increase of 0.01%. The company reported second-quarter sales of TWD 898 million and net income of TWD 109 million, marking a notable improvement from last year's figures. Despite recent share price volatility, Gallant trades at a significant discount to its estimated fair value. With a reduced debt-to-equity ratio from 51.8% to 30.9% over five years and satisfactory interest coverage, it appears financially robust for future endeavors like their recent property acquisition for operational expansion in Hsinchu County valued at TWD 6.6 billion.

- Unlock comprehensive insights into our analysis of Gallant Precision Machining stock in this health report.

Gain insights into Gallant Precision Machining's past trends and performance with our Past report.

Where To Now?

- Access the full spectrum of 4726 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5443

Gallant Precision Machining

Engages in the research and development, production, manufacture, and sale of flat panel display testing, semiconductor assembly, and intelligent automation equipment in Taiwan, China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives