- Taiwan

- /

- Semiconductors

- /

- TPEX:3680

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with the S&P 500 Index closing out a strong year despite recent volatility, attention is turning to small-cap stocks, which have shown resilience amid economic fluctuations. In this environment, identifying promising stocks requires a keen eye for companies that demonstrate robust fundamentals and adaptability—qualities that can position them well in both challenging and prosperous times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | 3.15% | 3.67% | 9.94% | ★★★★★★ |

| Macnica Galaxy | 52.99% | 8.23% | 18.45% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Beijing Foyou PharmaLTD | 1.88% | 7.27% | 17.56% | ★★★★★★ |

| Anapass | 7.88% | 5.06% | 41.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Zhejiang Chinastars New Materials Group | 36.20% | 2.98% | 3.98% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Xintec (TPEX:3374)

Simply Wall St Value Rating: ★★★★★★

Overview: Xintec Inc. is a wafer level chip scale packaging company with operations in Asia, the United States, and Europe, and has a market capitalization of NT$52.51 billion.

Operations: The company generates revenue primarily from its semiconductor equipment and services segment, amounting to NT$7.03 billion.

Xintec's recent performance highlights its promising position in the semiconductor industry. The company's earnings growth of 18% over the past year outpaced the industry's 6%, showcasing its competitive edge. Financially, it boasts a strong balance sheet with more cash than total debt and a reduced debt-to-equity ratio from 66% to just over 10% in five years. Recent third-quarter results show sales at TWD 2.17 billion, up from TWD 1.88 billion last year, while net income rose to TWD 561 million from TWD 514 million. With high-quality earnings and positive free cash flow, Xintec seems poised for continued growth.

- Unlock comprehensive insights into our analysis of Xintec stock in this health report.

Understand Xintec's track record by examining our Past report.

Gudeng Precision Industrial (TPEX:3680)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gudeng Precision Industrial Co., Ltd. offers technology services globally and has a market capitalization of NT$47.35 billion.

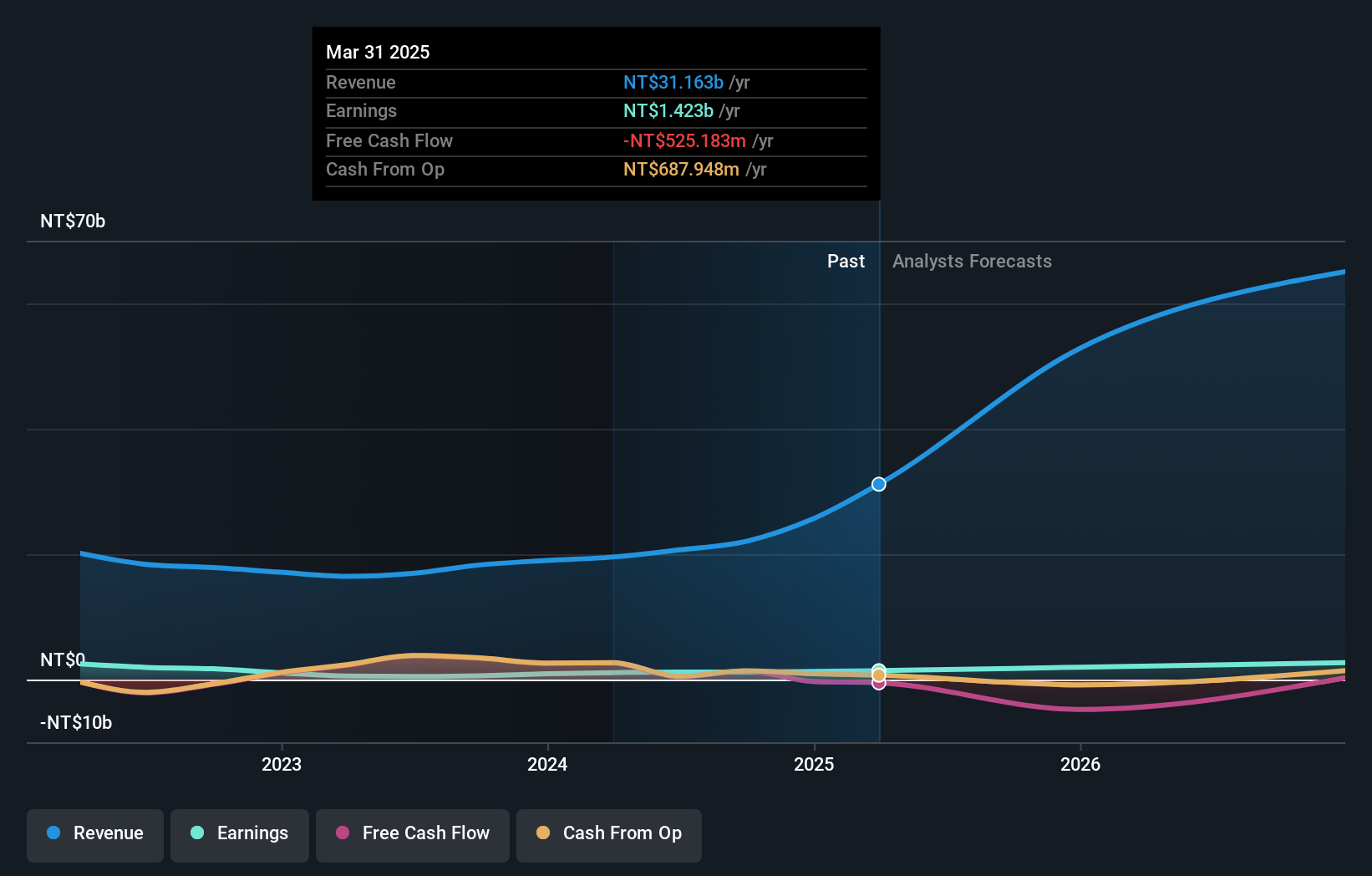

Operations: Gudeng Precision Industrial generates revenue primarily from semiconductor manufacturing and semiconductor equipment manufacturing, with NT$5.01 billion and NT$1.20 billion respectively.

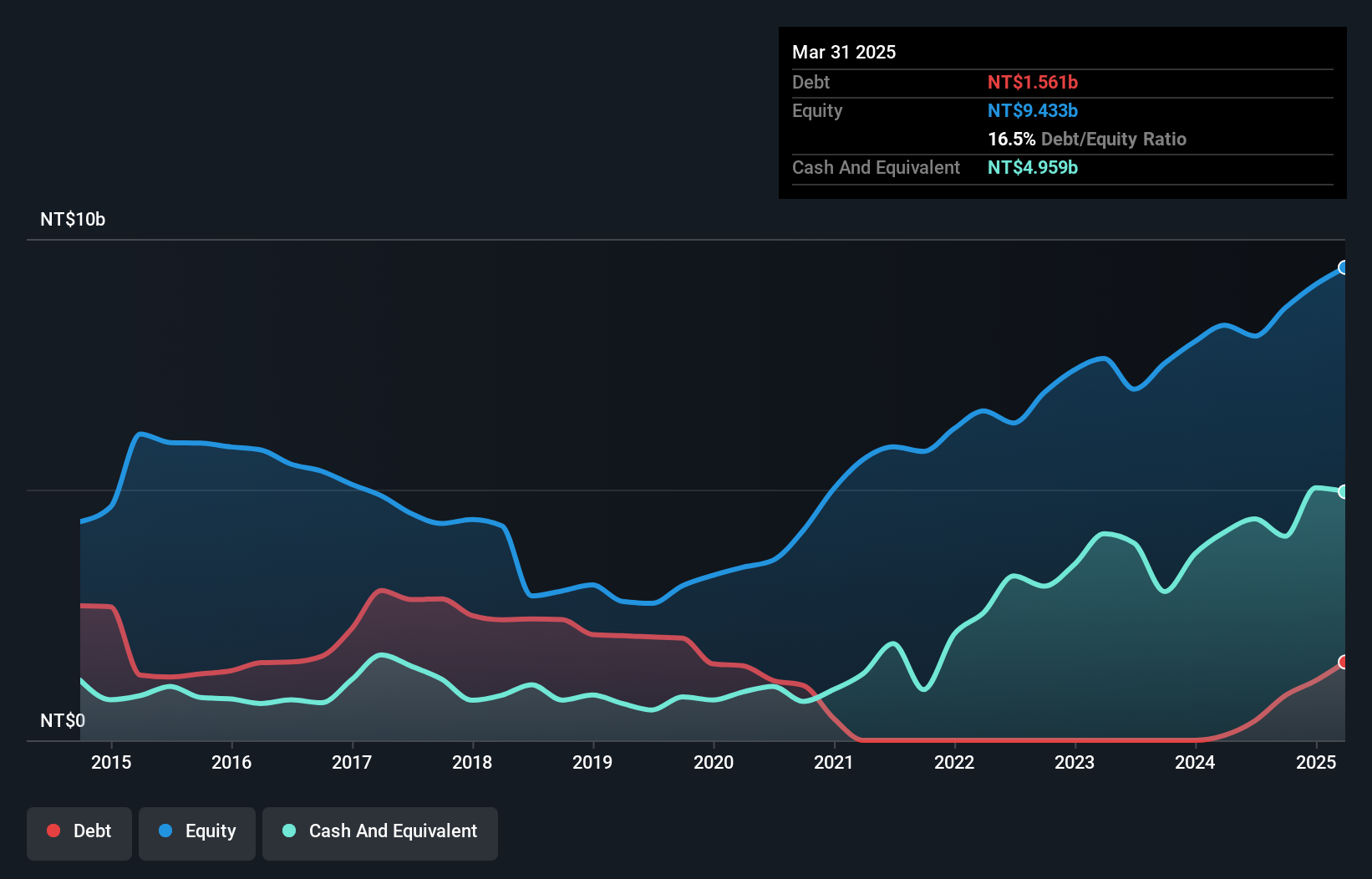

Gudeng Precision Industrial, a promising player in the semiconductor sector, has demonstrated impressive growth with earnings increasing by 31.9% over the past year, outpacing industry averages. The company's debt to equity ratio has improved significantly from 122.6% to 51.9% over five years, reflecting prudent financial management. Despite recent shareholder dilution, Gudeng remains profitable and boasts high-quality earnings with interest payments comfortably covered by EBIT at 116 times. Recent developments include a cash dividend adjustment to TWD 3.8 per share and plans for a new venture capital subsidiary with an initial capital of TWD 280 million approved by the board.

ASROCK Incorporation (TWSE:3515)

Simply Wall St Value Rating: ★★★★★★

Overview: ASROCK Incorporation is a Taiwanese company that designs, develops, and sells motherboards with a market capitalization of NT$28.61 billion.

Operations: ASROCK's primary revenue stream is from its motherboard sales, amounting to NT$22.05 billion.

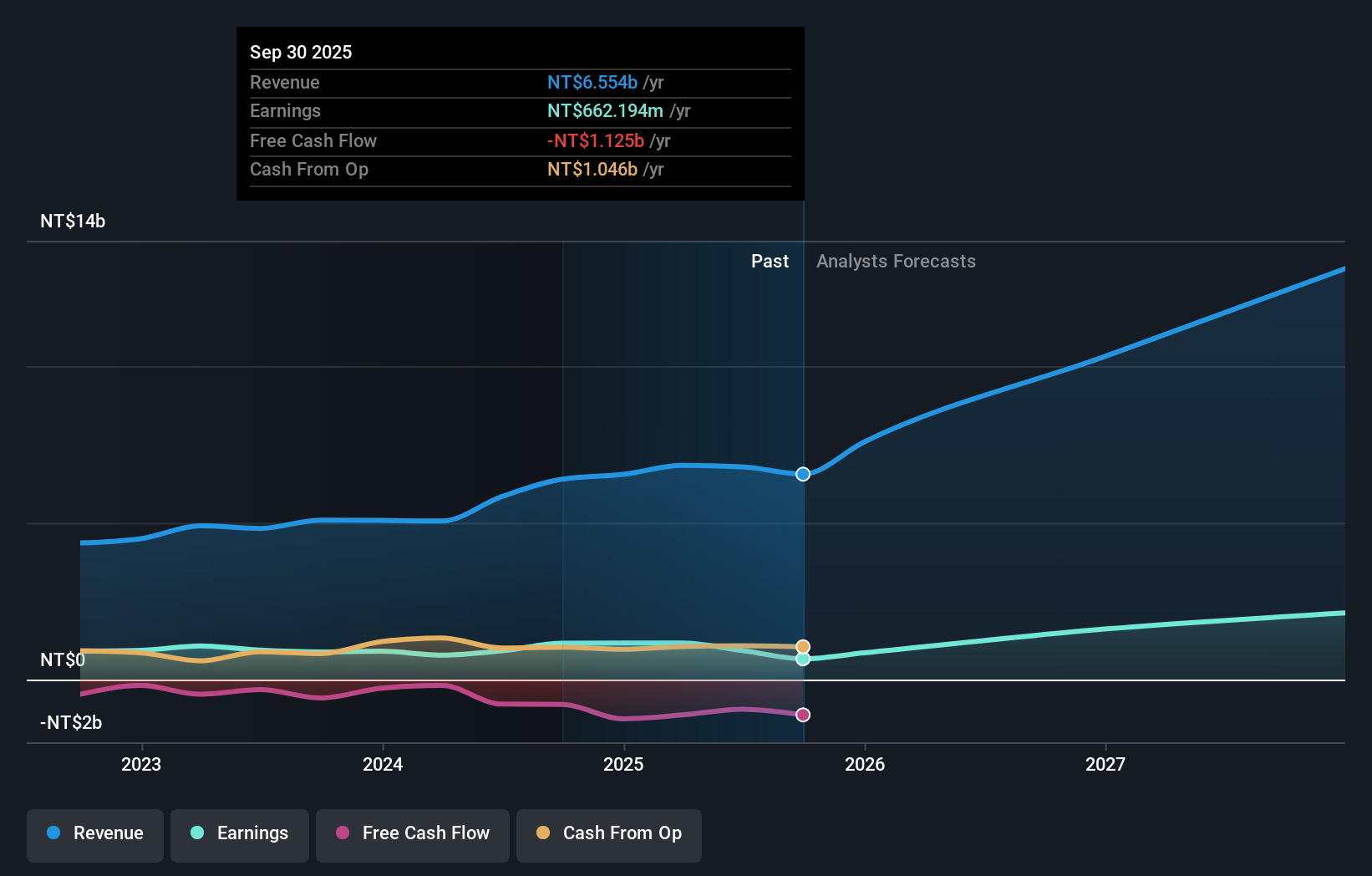

ASROCK Incorporation, a tech player with no debt, has demonstrated impressive earnings growth of 95.8% over the past year, outpacing the industry average of 12.9%. The company reported third-quarter sales of TWD 6.27 billion, up from TWD 4.90 billion the previous year, while net income slightly dipped to TWD 305 million from TWD 309 million. Despite this dip in quarterly profit, nine-month figures show net income rising to TWD 877 million compared to last year's TWD 592 million. Trading at a significant discount—67.9% below estimated fair value—ASROCK offers potential upside for investors seeking value in tech stocks.

Make It Happen

- Delve into our full catalog of 4665 Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3680

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives