As global markets continue to grapple with inflationary pressures and fluctuating interest rates, U.S. stock indexes are nearing record highs, with growth stocks leading the charge. In this environment, companies with high insider ownership can be appealing as they often signal confidence from those closest to the business's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 38.5% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Let's dive into some prime choices out of the screener.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★★☆

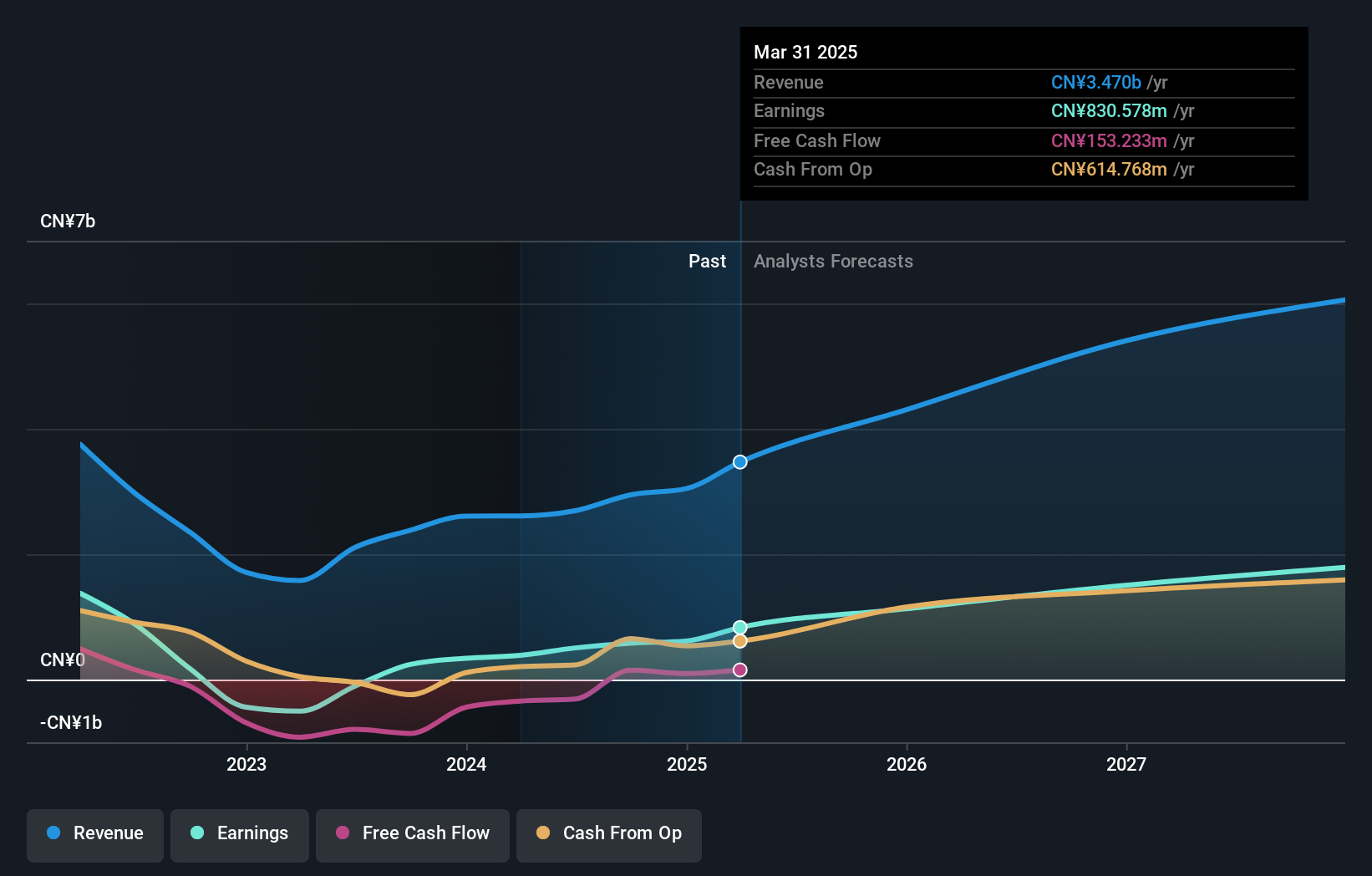

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog APIs and injections in China, with a market cap of CN¥26.52 billion.

Operations: The company generates revenue of CN¥2.95 billion from the development, production, and sales of insulin and related products.

Insider Ownership: 36.6%

Revenue Growth Forecast: 27.7% p.a.

Gan & Lee Pharmaceuticals demonstrates strong growth potential with earnings forecasted to grow 43.8% annually, outpacing the Chinese market. Despite a recent index removal and a completed share buyback of 396,900 shares for CNY 15.13 million, insider ownership remains significant, supporting investor confidence. However, the company's return on equity is expected to be low at 10.9%, and its dividend yield of 1.1% is not well covered by free cash flows.

- Take a closer look at Gan & Lee Pharmaceuticals' potential here in our earnings growth report.

- Our valuation report here indicates Gan & Lee Pharmaceuticals may be overvalued.

Sinofibers TechnologyLtd (SZSE:300777)

Simply Wall St Growth Rating: ★★★★★☆

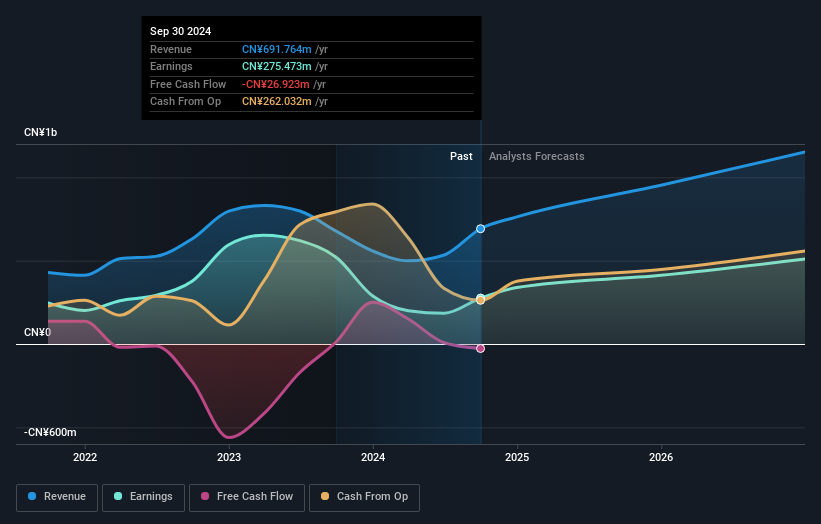

Overview: Sinofibers Technology Co., Ltd. focuses on the research, development, production, and sales of high-performance carbon fibers and fabrics, with a market cap of CN¥12.75 billion.

Operations: Sinofibers Technology Co., Ltd. generates revenue through its involvement in the research, development, production, and sales of advanced carbon fibers and fabrics.

Insider Ownership: 10.6%

Revenue Growth Forecast: 22.6% p.a.

Sinofibers Technology is poised for growth, with revenue expected to increase 22.6% annually, surpassing the Chinese market's average. Recent board changes and amendments to the company's articles of association may enhance governance. The company completed a share buyback worth CNY 30 million, signaling confidence in its valuation. However, profit margins have decreased significantly from last year, and return on equity is projected to be low at 9.6%, which could impact long-term performance.

- Unlock comprehensive insights into our analysis of Sinofibers TechnologyLtd stock in this growth report.

- The valuation report we've compiled suggests that Sinofibers TechnologyLtd's current price could be inflated.

Gudeng Precision Industrial (TPEX:3680)

Simply Wall St Growth Rating: ★★★★★★

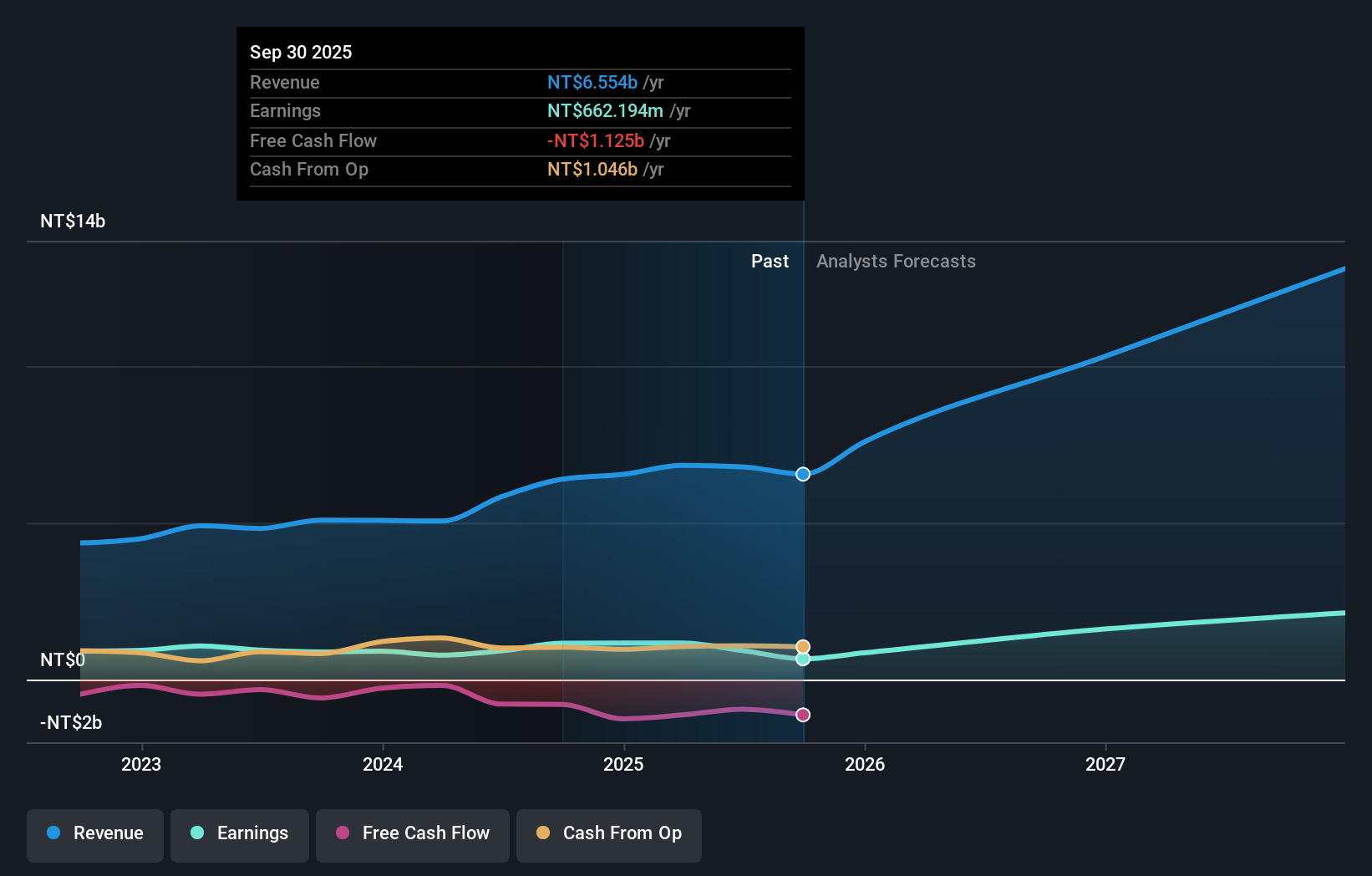

Overview: Gudeng Precision Industrial Co., Ltd. offers technology services globally and has a market cap of NT$42.27 billion.

Operations: The company's revenue is primarily derived from semiconductor manufacturing, contributing NT$5.01 billion, and semiconductor equipment manufacturing, which adds NT$1.20 billion.

Insider Ownership: 30.8%

Revenue Growth Forecast: 26.8% p.a.

Gudeng Precision Industrial is set for robust growth, with revenue and earnings forecast to expand at 26.8% and 33% annually, outpacing the Taiwan market. The company recently announced a capital injection of TWD 280 million to establish JiaChen Venture Capital Co., Ltd. While insider activity remains unchanged over the past three months, Gudeng's high return on equity projection of 20.6% in three years underscores its potential for sustained performance.

- Navigate through the intricacies of Gudeng Precision Industrial with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Gudeng Precision Industrial's share price might be too optimistic.

Next Steps

- Embark on your investment journey to our 1460 Fast Growing Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603087

Gan & Lee Pharmaceuticals

A biopharmaceutical company, engages in the research, development, production, and sale of insulin analog active pharmaceutical ingredients (APIs) and injections in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives