- Japan

- /

- Commercial Services

- /

- TSE:7972

Discover November 2024's Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a whirlwind of economic reports and geopolitical uncertainties, investors are witnessing mixed performances across major indices. With the U.S. experiencing a busy earnings season and Europe grappling with inflationary pressures, dividend stocks continue to attract attention for their potential stability and income generation. In such volatile times, a good dividend stock typically offers consistent payouts and financial resilience, making them appealing options for those seeking steady returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.72% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.16% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.87% | ★★★★★★ |

| Innotech (TSE:9880) | 4.76% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 2002 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

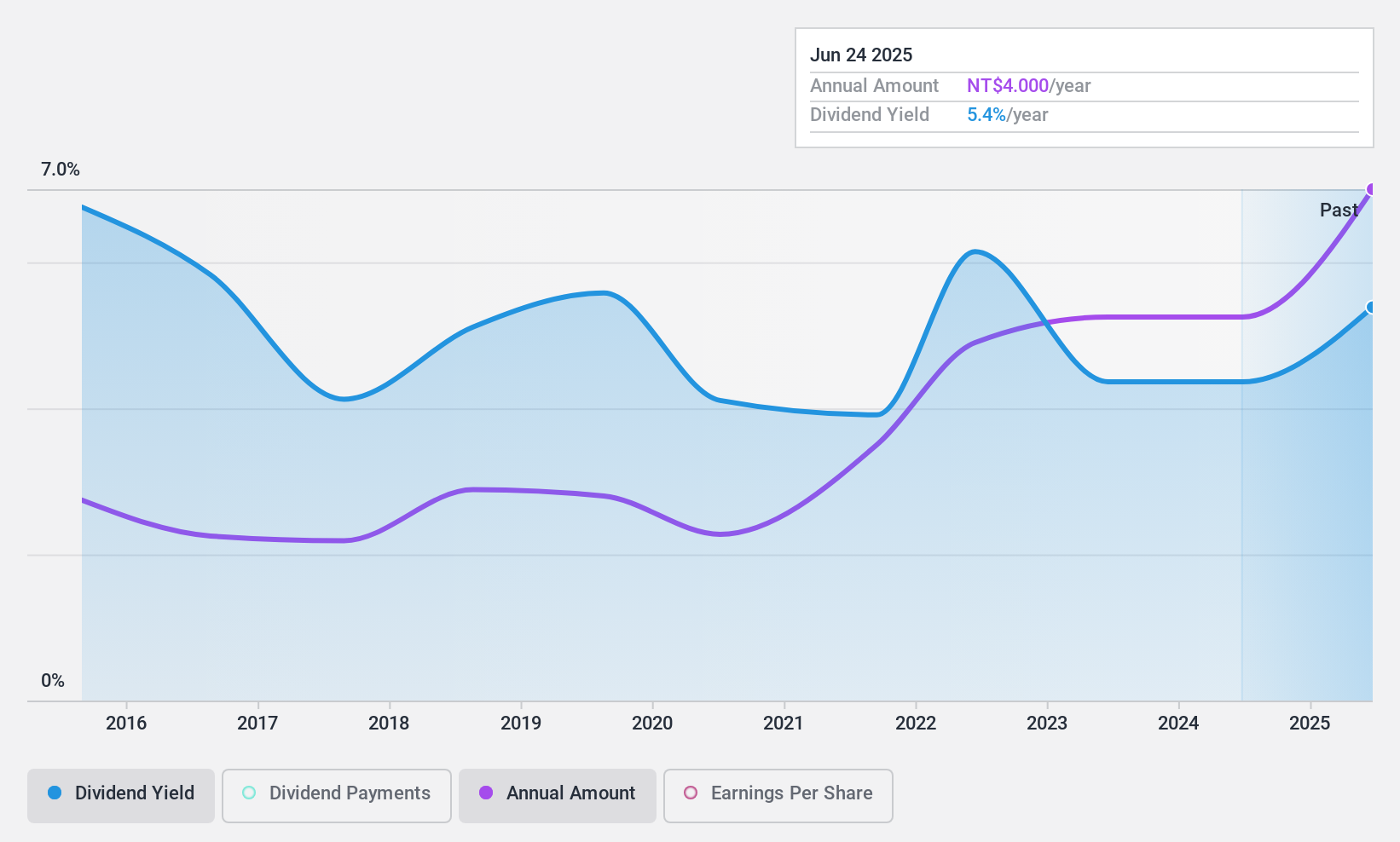

Ardentec (TPEX:3264)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ardentec Corporation offers semiconductor testing solutions for memory, logic, and mixed-signal ICs to various clients globally, with a market cap of NT$26.49 billion.

Operations: Ardentec Corporation's revenue segments include NT$8.99 billion from Ardentec Corporation, NT$710.95 million from Ardentec Singapore Pte. Ltd., and NT$3.91 billion from Quanzhi Technology (Shares) Company.

Dividend Yield: 4.3%

Ardentec's dividend yield (4.32%) is slightly below the top 25% in Taiwan, and its payout ratio of 46.5% indicates dividends are well-covered by earnings. However, the dividend history has been volatile over the past decade despite some growth. The company's cash payout ratio is reasonable at 54%, suggesting adequate cash flow coverage. Recent financials show a decline in net income and sales for Q2 2024 compared to last year, potentially impacting future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Ardentec.

- In light of our recent valuation report, it seems possible that Ardentec is trading beyond its estimated value.

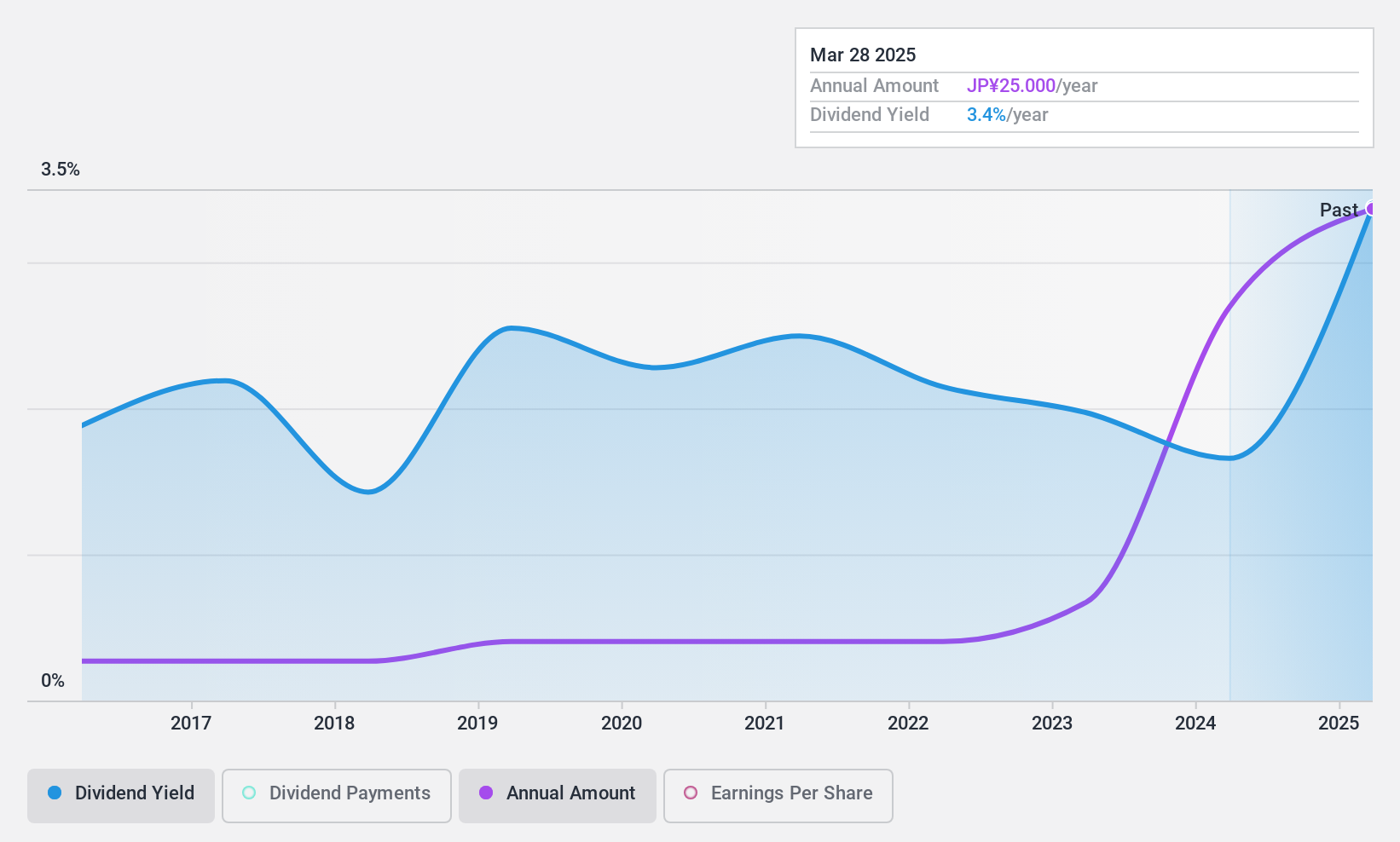

Sumiseki HoldingsInc (TSE:1514)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumiseki Holdings Inc. is engaged in importing, purchasing, and selling coal in Japan with a market cap of ¥47.27 billion.

Operations: Sumiseki Holdings Inc. generates its revenue primarily through the import, purchase, and sale of coal in Japan.

Dividend Yield: 3.9%

Sumiseki Holdings Inc.'s dividend payments are well-supported by earnings, with a payout ratio of 70.2%, and cash flows, reflected in a low cash payout ratio of 11.5%. Although dividends have been stable and increased over time, the company has only paid them for nine years. Trading significantly below its estimated fair value, Sumiseki offers an attractive yield (3.93%), ranking in the top 25% among Japanese dividend payers despite recent share price volatility.

- Click to explore a detailed breakdown of our findings in Sumiseki HoldingsInc's dividend report.

- Our comprehensive valuation report raises the possibility that Sumiseki HoldingsInc is priced higher than what may be justified by its financials.

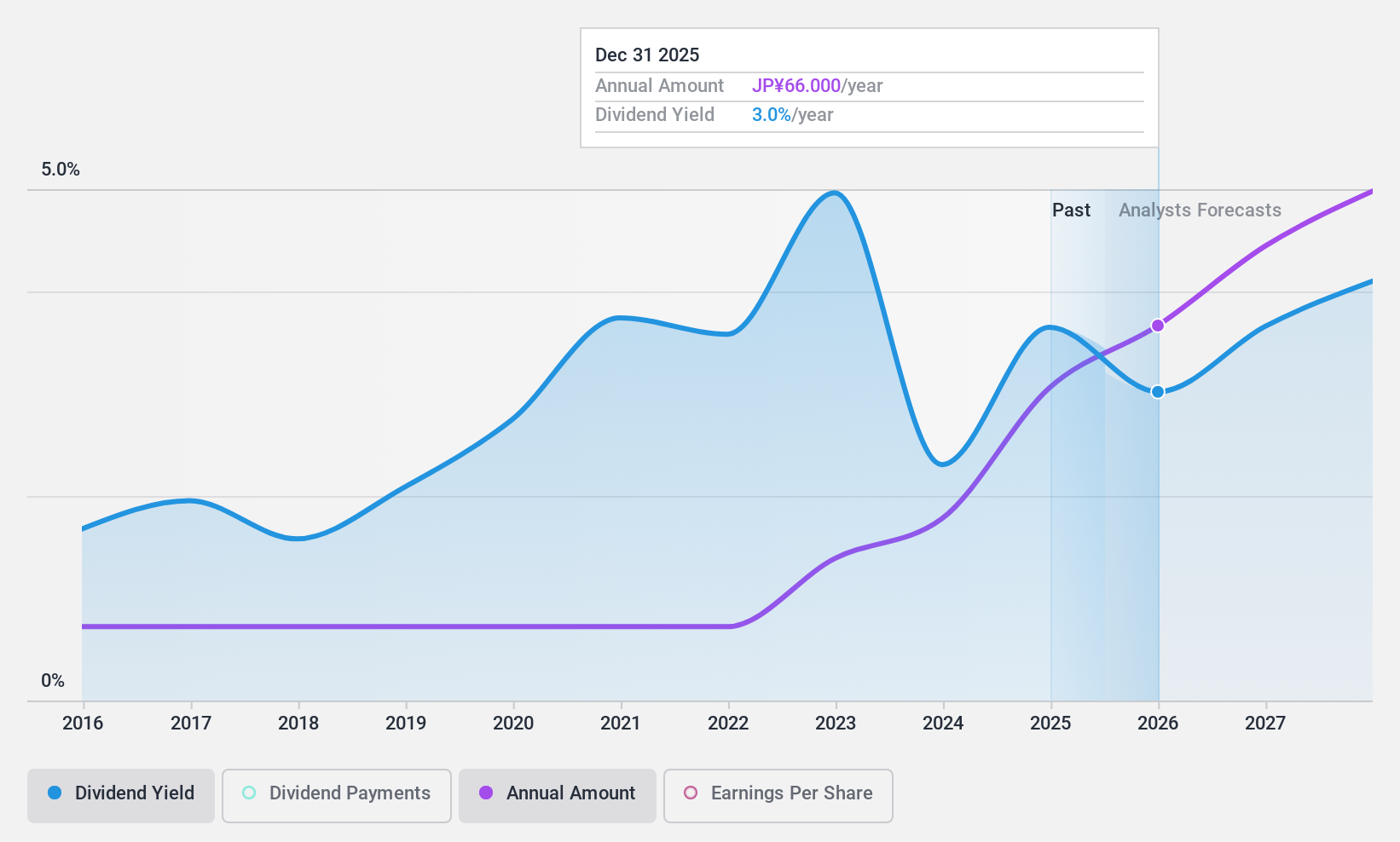

Itoki (TSE:7972)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Itoki Corporation manufactures and sells office and equipment-related products and services both in Japan and internationally, with a market cap of ¥71.84 billion.

Operations: Itoki Corporation's revenue is primarily derived from its Workplace Business, which contributes ¥99.54 billion, and its Equipment and Public Works-Related Business, which adds ¥36.27 billion.

Dividend Yield: 3.5%

Itoki's dividend payments are not covered by free cash flows, raising sustainability concerns despite a low payout ratio of 31.4%. The dividend yield of 3.5% is below the top quartile in Japan, and earnings have been forecasted to grow significantly at 17.37% annually. Although dividends have increased and remained stable over the past decade, recent shareholder dilution could impact future payouts. The stock trades at a favorable price-to-earnings ratio compared to peers.

- Navigate through the intricacies of Itoki with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Itoki's share price might be too pessimistic.

Turning Ideas Into Actions

- Reveal the 2002 hidden gems among our Top Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7972

Itoki

Engages in manufacturing and sale of office furniture in Japan and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives