As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are keenly observing sector-specific impacts, particularly in financials and energy. Amidst these shifts, dividend stocks remain a focal point for those seeking steady income streams, especially in times of fluctuating market dynamics. A good dividend stock often combines a reliable payout history with resilience to economic changes, making it an attractive option for investors looking to weather current market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.84% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

JDM JingDaMachine (Ningbo)Ltd (SHSE:603088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JDM JingDaMachine (Ningbo) Co. Ltd specializes in the manufacturing and sale of precision stamping press, HVAC equipment, and automation equipment both in China and internationally, with a market cap of CN¥3.62 billion.

Operations: The company's revenue primarily comes from its Metal Forming Machine Tool Manufacturing segment, which generated CN¥783.71 million.

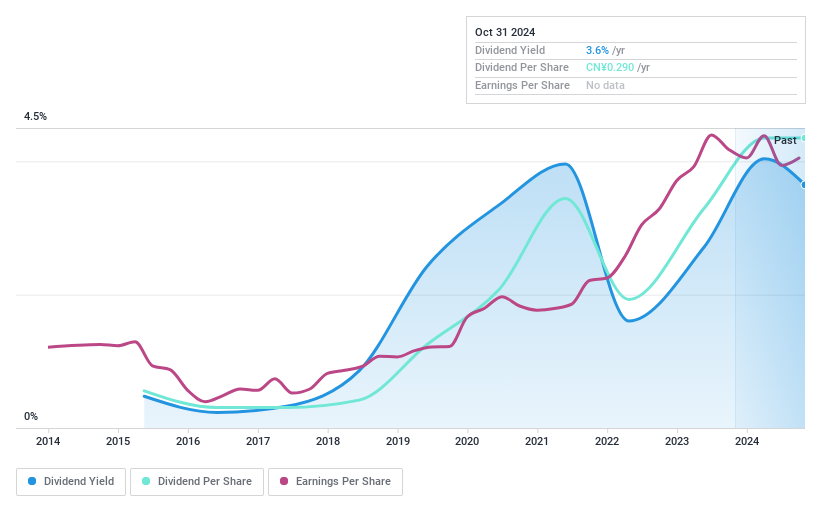

Dividend Yield: 3.5%

JDM JingDaMachine (Ningbo) Ltd's recent earnings report shows modest growth, with net income rising to CNY 118.69 million. However, its dividend yield of 3.51% is not well covered by free cash flows, with a high cash payout ratio of 97%. Although the dividend is in the top tier for the Chinese market and has increased over the past decade, it remains volatile and unreliable due to inconsistent historical payments.

- Navigate through the intricacies of JDM JingDaMachine (Ningbo)Ltd with our comprehensive dividend report here.

- Our valuation report here indicates JDM JingDaMachine (Ningbo)Ltd may be undervalued.

Golden Long Teng Development (TPEX:3188)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Golden Long Teng Development Co., Ltd. focuses on the development, sale, and lease of residential and commercial buildings with a market cap of NT$5.14 billion.

Operations: Golden Long Teng Development Co., Ltd. generates revenue through its activities in developing, selling, and leasing residential and commercial properties.

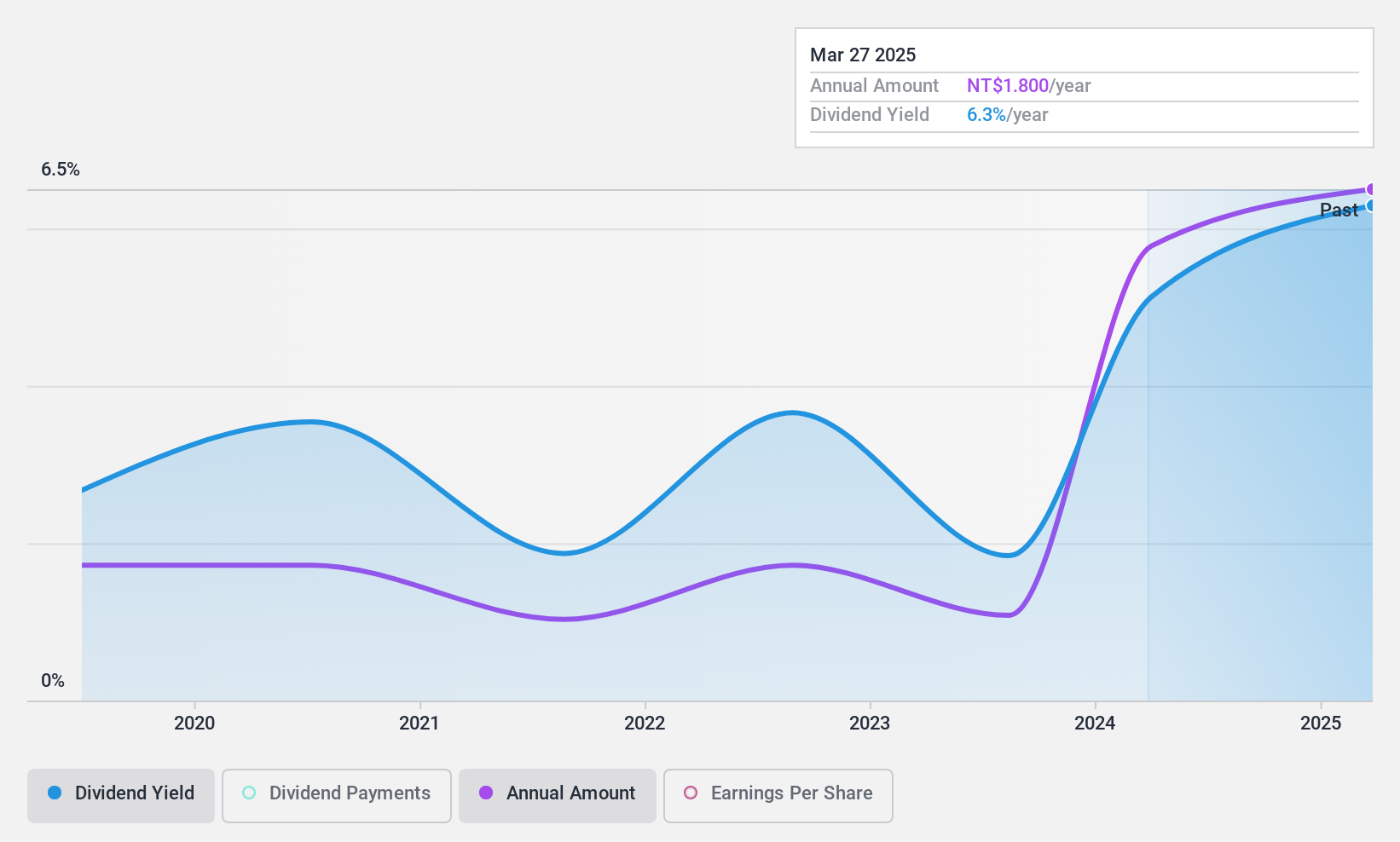

Dividend Yield: 5.8%

Golden Long Teng Development's recent earnings report reveals significant growth, with net income rising to TWD 137.79 million for Q3. The company offers a dividend yield in the top 25% of the TW market, though its six-year dividend history is marked by volatility and unreliability. Despite this, dividends are well-covered by earnings (41.5% payout ratio) and cash flows (69% cash payout ratio). The stock trades significantly below estimated fair value, indicating potential upside for investors seeking undervalued dividend stocks.

- Get an in-depth perspective on Golden Long Teng Development's performance by reading our dividend report here.

- The analysis detailed in our Golden Long Teng Development valuation report hints at an deflated share price compared to its estimated value.

Univacco Technology (TPEX:3303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Univacco Technology Inc. operates in the stamping foil industry under the UNIVACCO brand, serving both Taiwan and international markets, with a market cap of NT$5.85 billion.

Operations: Univacco Technology Inc.'s revenue segments are not detailed in the provided text.

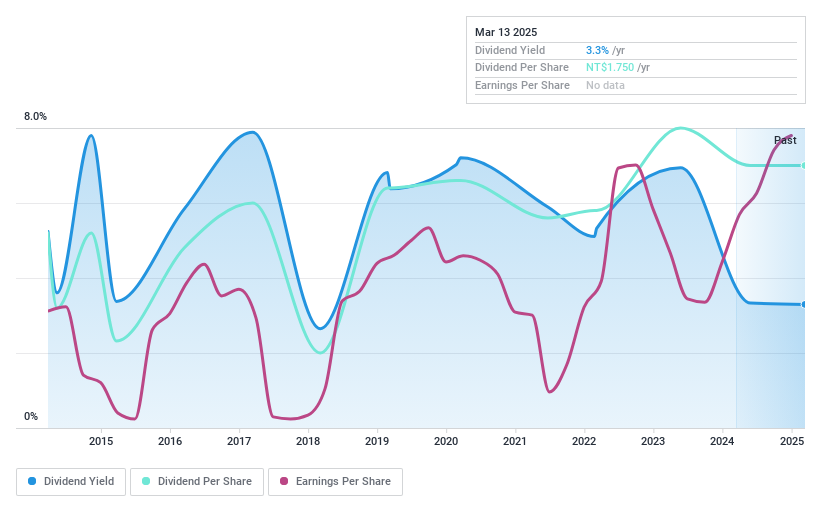

Dividend Yield: 2.9%

Univacco Technology's recent earnings report shows substantial growth, with net income for Q3 increasing to TWD 127.96 million. Despite a volatile dividend history over the past decade, dividends are well-covered by both earnings and cash flows, with payout ratios around 47%. The stock trades at a discount to its estimated fair value, but the dividend yield is lower than the top quartile in Taiwan's market. Shareholders experienced dilution in the past year.

- Click to explore a detailed breakdown of our findings in Univacco Technology's dividend report.

- Our valuation report unveils the possibility Univacco Technology's shares may be trading at a discount.

Summing It All Up

- Get an in-depth perspective on all 1970 Top Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3303

Univacco Technology

Operates in the stamping foil industry under the UNIVACCO brand in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.