- Taiwan

- /

- Semiconductors

- /

- TPEX:3131

Exploring Undiscovered Gems With Potential This November 2024

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced particular pressure, with indices like the S&P MidCap 400 and Russell 2000 showing declines. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Balady Poultry (SASE:9559)

Simply Wall St Value Rating: ★★★★★☆

Overview: Balady Poultry Company is involved in the production of poultry products in the Kingdom of Saudi Arabia, with a market capitalization of SAR2.58 billion.

Operations: Balady Poultry generates revenue primarily from its food processing segment, amounting to SAR862.79 million.

Balady Poultry, a small yet dynamic player in the food industry, has shown impressive earnings growth of 48.8% over the past year, outpacing the industry average of 20.8%. The company's price-to-earnings ratio stands at 19.4x, which is favorable compared to the SA market's 24.9x, suggesting potential value for investors. With high-quality non-cash earnings and interest payments well-covered by EBIT at an impressive 604.7x coverage, Balady seems financially robust despite insufficient data on debt reduction over five years. This financial health positions it intriguingly within its sector as it navigates future opportunities.

- Click to explore a detailed breakdown of our findings in Balady Poultry's health report.

Evaluate Balady Poultry's historical performance by accessing our past performance report.

NextVision Stabilized Systems (TASE:NXSN)

Simply Wall St Value Rating: ★★★★★★

Overview: NextVision Stabilized Systems, Ltd. specializes in developing, manufacturing, and marketing stabilized day and night cameras for ground and aerial vehicles with a market capitalization of ₪3.48 billion.

Operations: NextVision Stabilized Systems generates revenue primarily from its electronic security devices segment, totaling $86.54 million.

NextVision Stabilized Systems, a nimble player in the electronics sector, has shown impressive earnings growth of 173.6% over the past year, outpacing its industry peers. The company reported significant revenue gains for Q2 2024 with sales reaching US$28.06 million from US$12.17 million the previous year and net income climbing to US$15.88 million from US$6.13 million. Trading at a substantial discount of 61% below estimated fair value, NextVision is debt-free and boasts high-quality non-cash earnings, making it an intriguing prospect despite recent share price volatility over three months and its addition to the S&P Global BMI Index in September 2024 suggests increasing recognition in broader markets.

Grand Process Technology (TPEX:3131)

Simply Wall St Value Rating: ★★★★★☆

Overview: Grand Process Technology Corporation specializes in the design, development, and servicing of metal etching and wafer cleaning equipment in Taiwan, with a market cap of NT$49.52 billion.

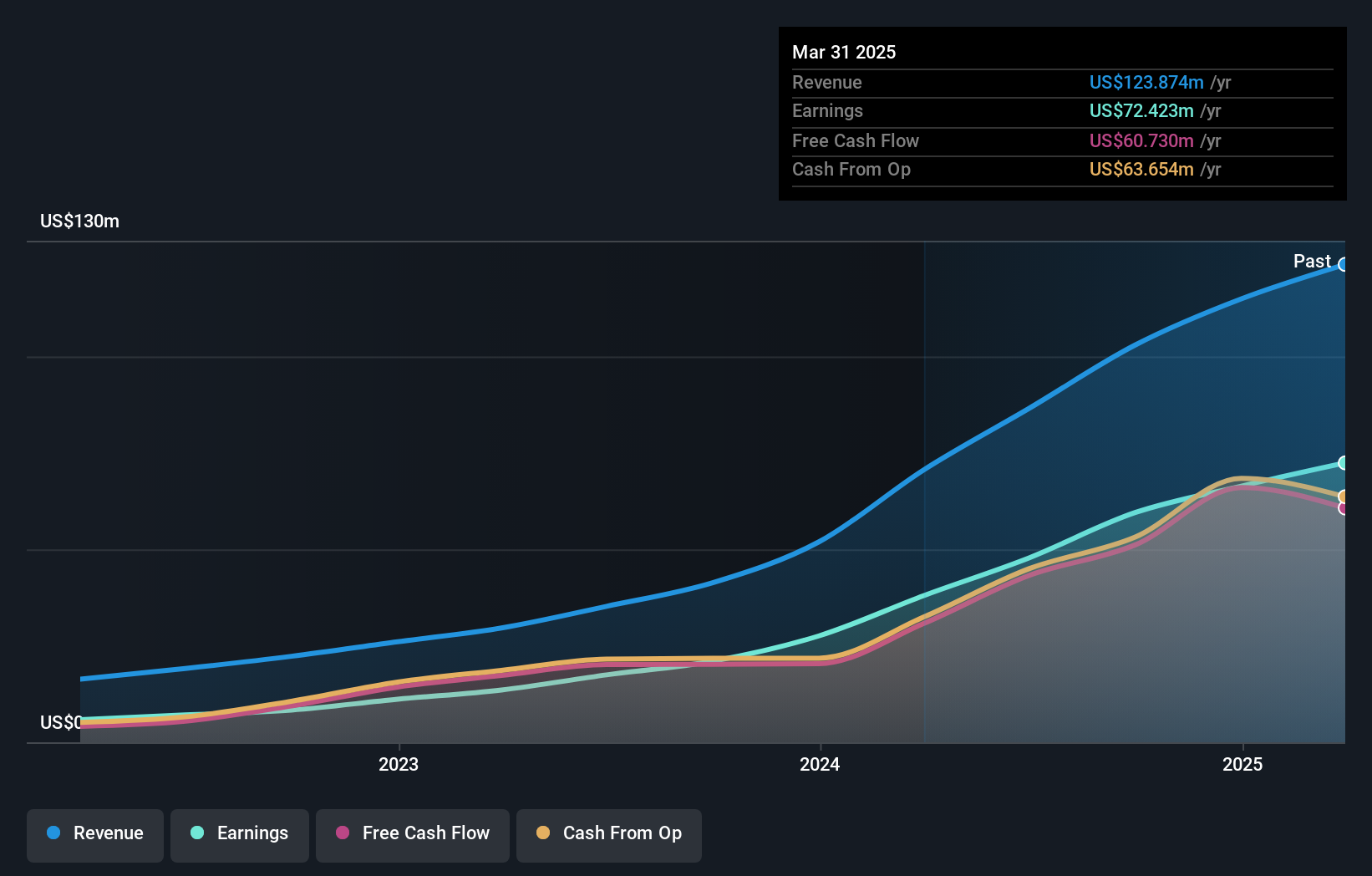

Operations: Grand Process Technology derives its revenue primarily from the Equipment Manufacturing Segment (NT$1.65 billion) and Chemical Materials Manufacturing Department (NT$1.06 billion). The company also generates income through its Equipment Sales Agent Department, contributing NT$986.37 million.

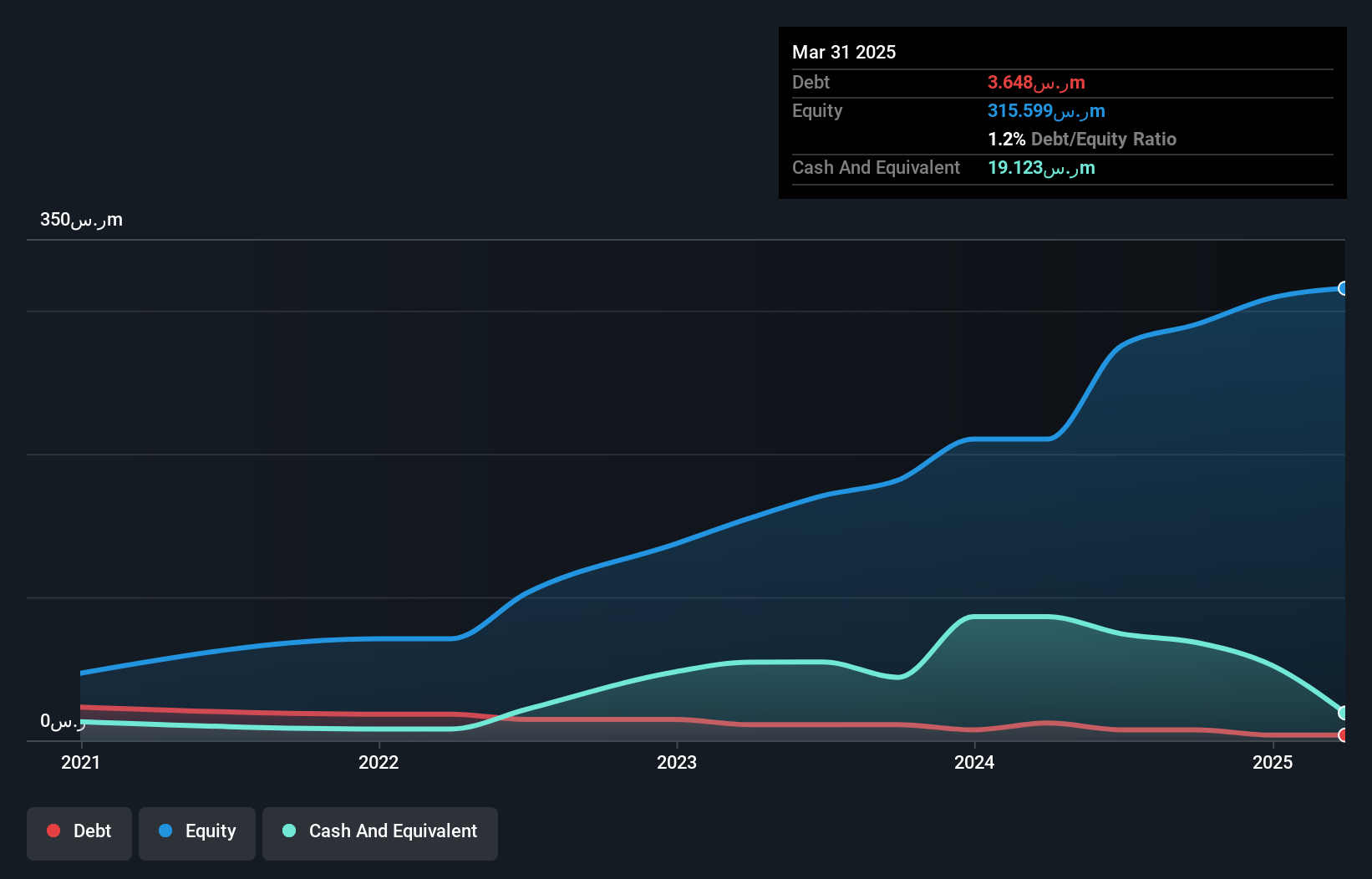

Grand Process Technology, a vibrant player in the semiconductor sector, showcases impressive financial health with earnings growth of 12% over the past year, outpacing industry peers. The company's debt to equity ratio rose from 29.3% to 38.7% in five years, yet it holds more cash than total debt, highlighting robust liquidity. Recent quarterly results report sales at TWD 961 million and net income at TWD 205 million, reflecting solid performance compared to last year’s figures of TWD 862 million and TWD 152 million respectively. Despite shareholder dilution over the past year, its high-quality earnings remain a strong point for potential investors.

- Unlock comprehensive insights into our analysis of Grand Process Technology stock in this health report.

Learn about Grand Process Technology's historical performance.

Make It Happen

- Investigate our full lineup of 4738 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3131

Grand Process Technology

Engages in manufacturing and sale of semiconductor equipment in Taiwan.

Exceptional growth potential with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives