- China

- /

- Commercial Services

- /

- SZSE:002103

Asian Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets face volatility due to geopolitical tensions and economic uncertainties, investors are increasingly looking toward Asia for opportunities, where growth companies often demonstrate resilience. In this context, firms with high insider ownership can be particularly appealing as they may indicate strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| Schooinc (TSE:264A) | 29.6% | 68.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 22% | 40.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

Below we spotlight a couple of our favorites from our exclusive screener.

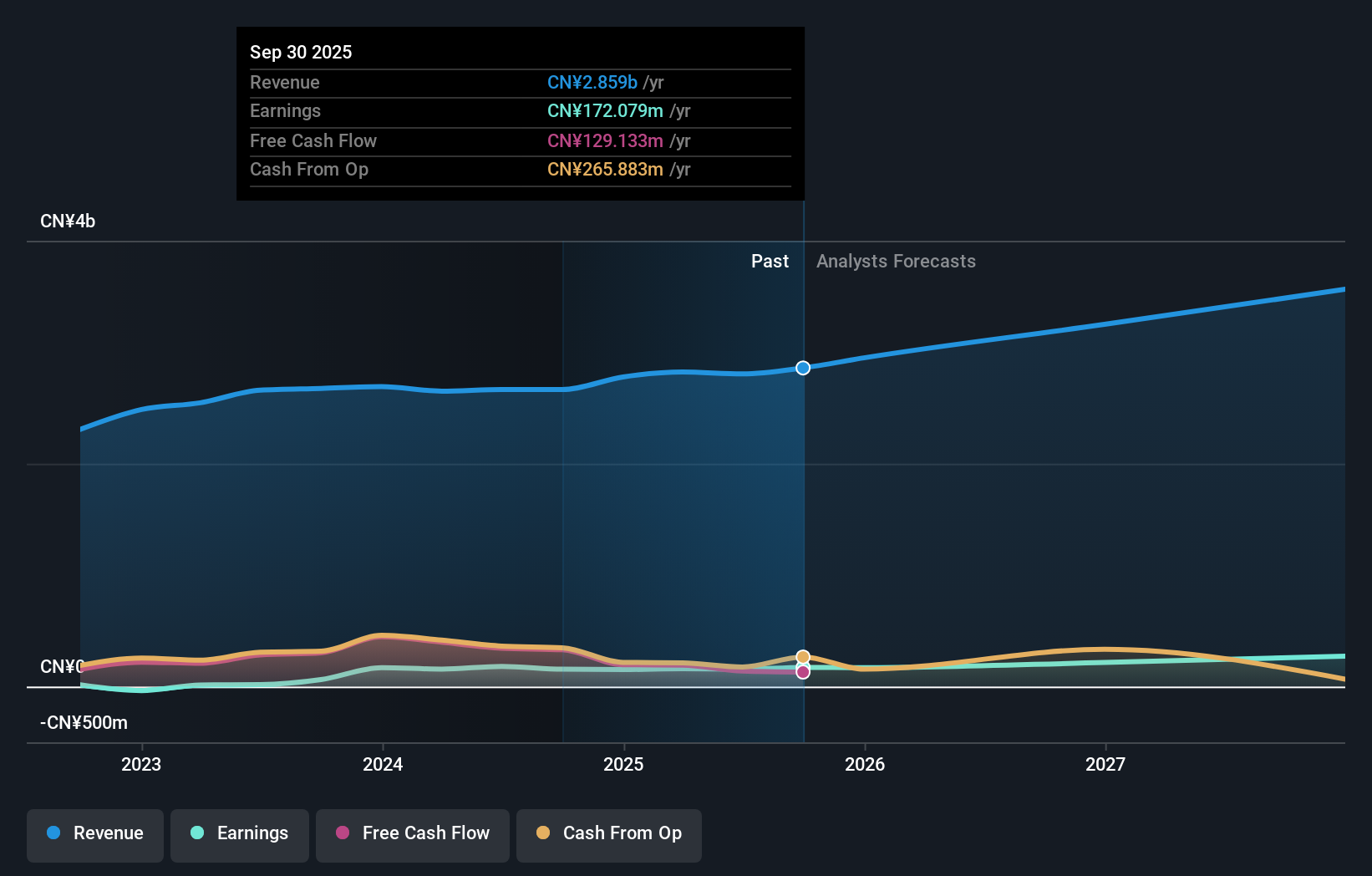

Guangbo Group Stock (SZSE:002103)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangbo Group Stock Co., Ltd. operates through its subsidiaries in the development, production, import, sale, and export of office stationery, printing paper products, and plastic products in China with a market capitalization of approximately CN¥5.51 billion.

Operations: The company generates revenue through its subsidiaries by engaging in activities related to office stationery, printing paper products, and plastic products in China.

Insider Ownership: 39%

Guangbo Group demonstrates strong growth potential with earnings forecast to grow significantly at 24.35% annually, outpacing the Chinese market's 23.3%. Despite a volatile share price recently, its P/E ratio of 34.6x remains attractive compared to the market average of 37.5x. Recent earnings reports show revenue and net income improvements, with Q1 sales rising to CNY 484.38 million from CNY 439.88 million year-on-year, indicating robust operational performance amidst insider ownership stability.

- Click here to discover the nuances of Guangbo Group Stock with our detailed analytical future growth report.

- According our valuation report, there's an indication that Guangbo Group Stock's share price might be on the expensive side.

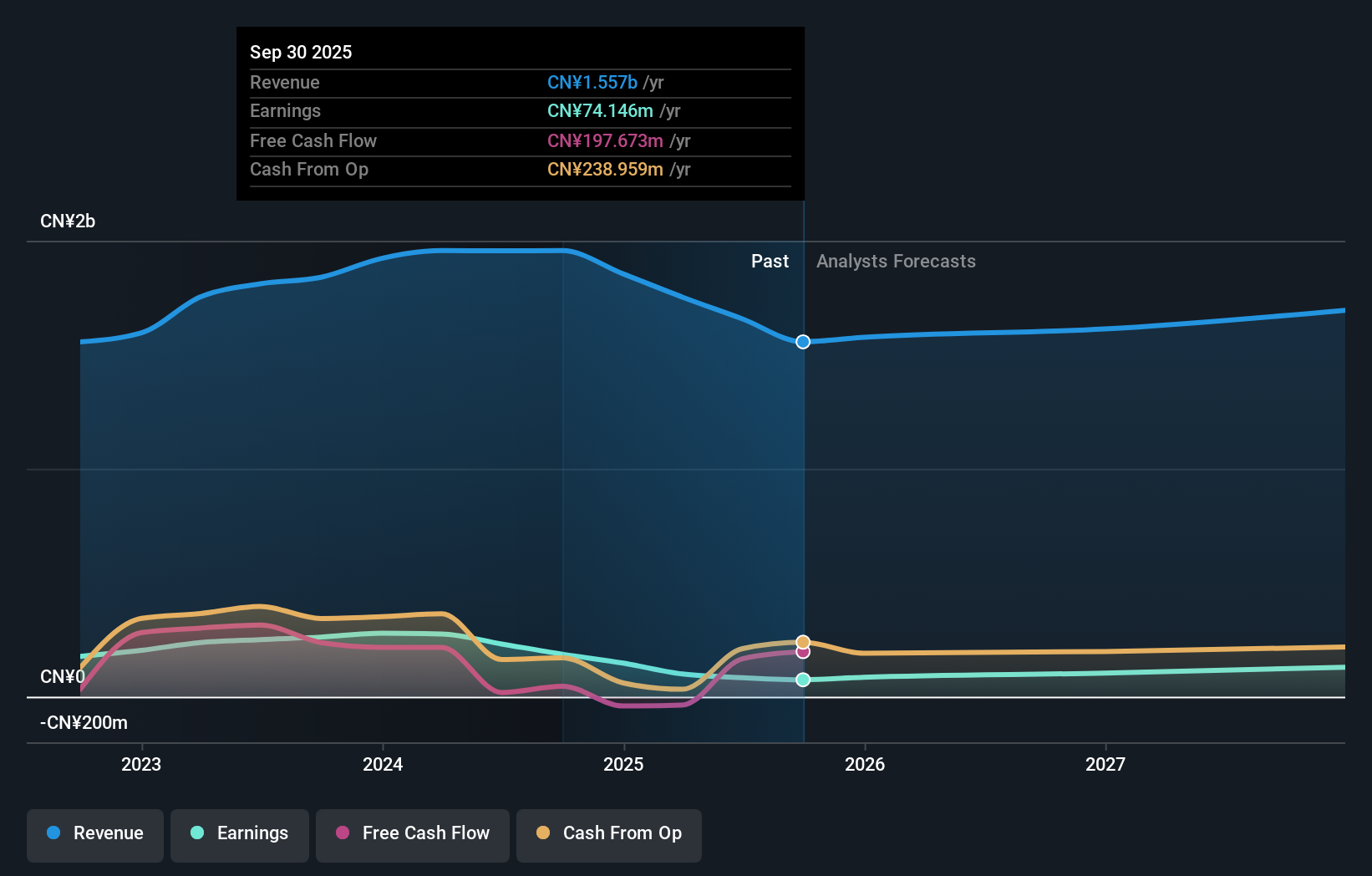

HUANLEJIA Food GroupLtd (SZSE:300997)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HUANLEJIA Food Group CO., Ltd, with a market cap of CN¥6.33 billion, is involved in the research and development, production, and sale of canned food and beverages in China.

Operations: The company's revenue primarily comes from its non-alcoholic beverages segment, which generated CN¥1.75 billion.

Insider Ownership: 17.5%

HUANLEJIA Food Group Ltd. faces challenges with declining Q1 2025 revenue and net income, yet its earnings are forecast to grow significantly at 45.8% annually, surpassing the Chinese market's growth rate. Despite a volatile share price and lower profit margins compared to last year, the company's high insider ownership could align management interests with shareholders. However, dividend sustainability is questionable due to insufficient earnings coverage, highlighting potential risks for investors focusing on income stability.

- Unlock comprehensive insights into our analysis of HUANLEJIA Food GroupLtd stock in this growth report.

- The analysis detailed in our HUANLEJIA Food GroupLtd valuation report hints at an inflated share price compared to its estimated value.

Grand Process Technology (TPEX:3131)

Simply Wall St Growth Rating: ★★★★★★

Overview: Grand Process Technology Corporation manufactures and sells semiconductor equipment in Taiwan, with a market cap of NT$35.06 billion.

Operations: Grand Process Technology Corporation's revenue segments include its manufacturing and sale of semiconductor equipment in Taiwan.

Insider Ownership: 12.5%

Grand Process Technology shows strong growth potential with a significant increase in Q1 2025 earnings, reporting sales of TWD 1.24 billion and net income of TWD 255.22 million. Earnings are forecast to grow annually by 23.47%, outpacing the Taiwan market's growth rate, while revenue is expected to rise by 25.4% per year. Despite high share price volatility, substantial insider ownership could align management interests with shareholders, supporting the company's strategic focus on expansion and profitability enhancement strategies.

- Click to explore a detailed breakdown of our findings in Grand Process Technology's earnings growth report.

- Our expertly prepared valuation report Grand Process Technology implies its share price may be too high.

Where To Now?

- Delve into our full catalog of 631 Fast Growing Asian Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002103

Guangbo Group Stock

Engages in the manufacture and sale of cultural and educational office supplies in China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives