- Taiwan

- /

- Semiconductors

- /

- TPEX:4974

Would Asia Tech Image Inc. (GTSM:4974) Be Valuable To Income Investors?

Today we'll take a closer look at Asia Tech Image Inc. (GTSM:4974) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

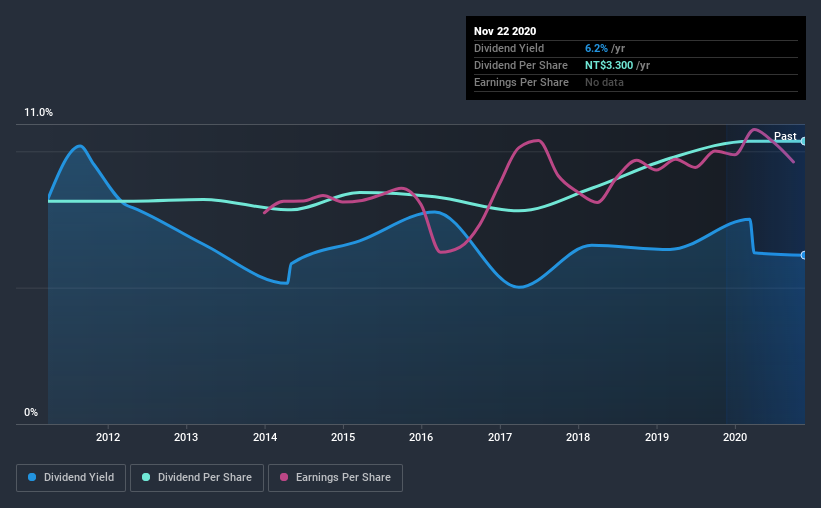

With Asia Tech Image yielding 6.2% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. It would not be a surprise to discover that many investors buy it for the dividends. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 69% of Asia Tech Image's profits were paid out as dividends in the last 12 months. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Asia Tech Image paid out a conservative 48% of its free cash flow as dividends last year. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

While the above analysis focuses on dividends relative to a company's earnings, we do note Asia Tech Image's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on Asia Tech Image every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Asia Tech Image has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past 10-year period, the first annual payment was NT$2.6 in 2010, compared to NT$3.3 last year. This works out to be a compound annual growth rate (CAGR) of approximately 2.4% a year over that time.

Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think is seriously impressive.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Asia Tech Image has grown its earnings per share at 3.4% per annum over the past five years. Growth of 3.4% is relatively anaemic growth, which we wonder about. If the company is struggling to grow, perhaps that's why it elects to pay out more than half of its earnings to shareholders.

Conclusion

To summarise, shareholders should always check that Asia Tech Image's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Asia Tech Image's payout ratios are within a normal range for the average corporation, and we like that its cashflow was stronger than reported profits. Second, earnings growth has been mediocre, but at least the dividends have been relatively stable. Overall we think Asia Tech Image is an interesting dividend stock, although it could be better.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Are management backing themselves to deliver performance? Check their shareholdings in Asia Tech Image in our latest insider ownership analysis.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade Asia Tech Image, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:4974

Asia Tech Image

Designs, develops, and manufactures contact image sensor module (CIS) products in Taiwan, China, and Myanmar.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.