There are a few key trends to look for if we want to identify the next multi-bagger. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So on that note, Asia Tech Image (GTSM:4974) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Asia Tech Image, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = NT$473m ÷ (NT$3.5b - NT$982m) (Based on the trailing twelve months to September 2020).

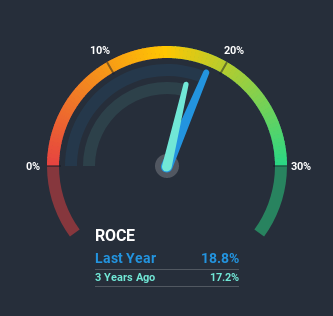

Thus, Asia Tech Image has an ROCE of 19%. In absolute terms, that's a satisfactory return, but compared to the Semiconductor industry average of 10% it's much better.

View our latest analysis for Asia Tech Image

Historical performance is a great place to start when researching a stock so above you can see the gauge for Asia Tech Image's ROCE against it's prior returns. If you'd like to look at how Asia Tech Image has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Asia Tech Image Tell Us?

Asia Tech Image is showing promise given that its ROCE is trending up and to the right. More specifically, while the company has kept capital employed relatively flat over the last five years, the ROCE has climbed 34% in that same time. So it's likely that the business is now reaping the full benefits of its past investments, since the capital employed hasn't changed considerably. On that front, things are looking good so it's worth exploring what management has said about growth plans going forward.

In Conclusion...

In summary, we're delighted to see that Asia Tech Image has been able to increase efficiencies and earn higher rates of return on the same amount of capital. Since the stock has returned a staggering 101% to shareholders over the last five years, it looks like investors are recognizing these changes. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation on our platform that is definitely worth checking out.

While Asia Tech Image isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade Asia Tech Image, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:4974

Asia Tech Image

Designs, develops, and manufactures contact image sensor module (CIS) products in Taiwan, China, and Myanmar.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.