- Taiwan

- /

- Semiconductors

- /

- TPEX:3666

Announcing: Optivision Technology (GTSM:3666) Stock Soared An Exciting 381% In The Last Year

Optivision Technology, Inc. (GTSM:3666) shareholders might be concerned after seeing the share price drop 25% in the last quarter. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In that time, shareholders have had the pleasure of a 381% boost to the share price. Arguably, the recent fall is to be expected after such a strong rise. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

View our latest analysis for Optivision Technology

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Optivision Technology grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We think that the revenue growth of 34% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

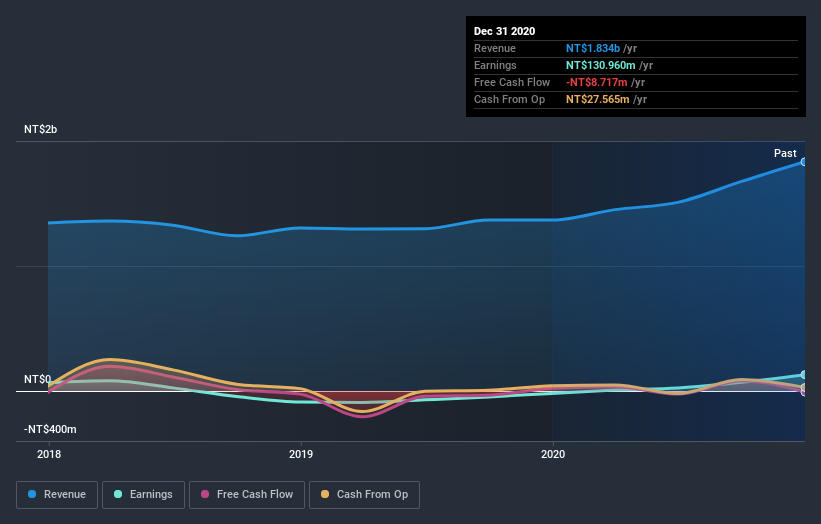

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Optivision Technology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Optivision Technology shareholders have received a total shareholder return of 381% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 17% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Optivision Technology (1 is concerning!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Optivision Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3666

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026