- Taiwan

- /

- Semiconductors

- /

- TPEX:3580

Should You Buy UVAT Technology Co., Ltd. (GTSM:3580) For Its Dividend?

Is UVAT Technology Co., Ltd. (GTSM:3580) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

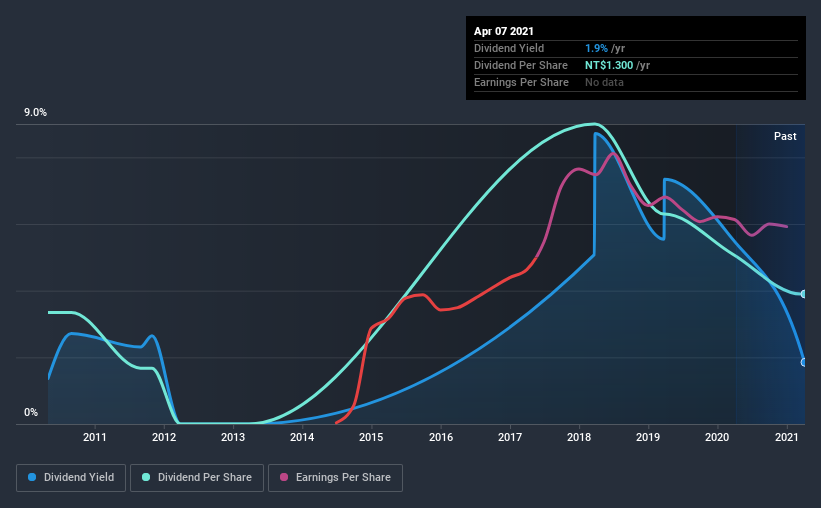

A 1.9% yield is nothing to get excited about, but investors probably think the long payment history suggests UVAT Technology has some staying power. Some simple analysis can reduce the risk of holding UVAT Technology for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on UVAT Technology!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 70% of UVAT Technology's profits were paid out as dividends in the last 12 months. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. UVAT Technology paid out 92% of its free cash last year. Cash flows can be lumpy, but this dividend was not well covered by cash flow. While UVAT Technology's dividends were covered by the company's reported profits, free cash flow is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were UVAT Technology to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

While the above analysis focuses on dividends relative to a company's earnings, we do note UVAT Technology's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on UVAT Technology every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of UVAT Technology's dividend payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was NT$1.1 in 2011, compared to NT$1.3 last year. This works out to be a compound annual growth rate (CAGR) of approximately 1.5% a year over that time. The dividends haven't grown at precisely 1.5% every year, but this is a useful way to average out the historical rate of growth.

Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's good to see UVAT Technology has been growing its earnings per share at 35% a year over the past five years. Earnings per share are sharply up, but we wonder if paying out more than half its earnings (leaving less for reinvestment) is an implicit signal that UVAT Technology's growth will be slower in the future.

Conclusion

To summarise, shareholders should always check that UVAT Technology's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we think UVAT Technology has an acceptable payout ratio, although its dividend was not well covered by cashflow. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. In sum, we find it hard to get excited about UVAT Technology from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for UVAT Technology that you should be aware of before investing.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading UVAT Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3580

UVAT Technology

Engages in the design and development of physical vapor deposition equipment and coating machines in Taiwan and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives