- Taiwan

- /

- Semiconductors

- /

- TPEX:3372

We're Not Very Worried About Taiwan IC Packaging's (GTSM:3372) Cash Burn Rate

Just because a business does not make any money, does not mean that the stock will go down. By way of example, Taiwan IC Packaging (GTSM:3372) has seen its share price rise 175% over the last year, delighting many shareholders. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given its strong share price performance, we think it's worthwhile for Taiwan IC Packaging shareholders to consider whether its cash burn is concerning. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Taiwan IC Packaging

When Might Taiwan IC Packaging Run Out Of Money?

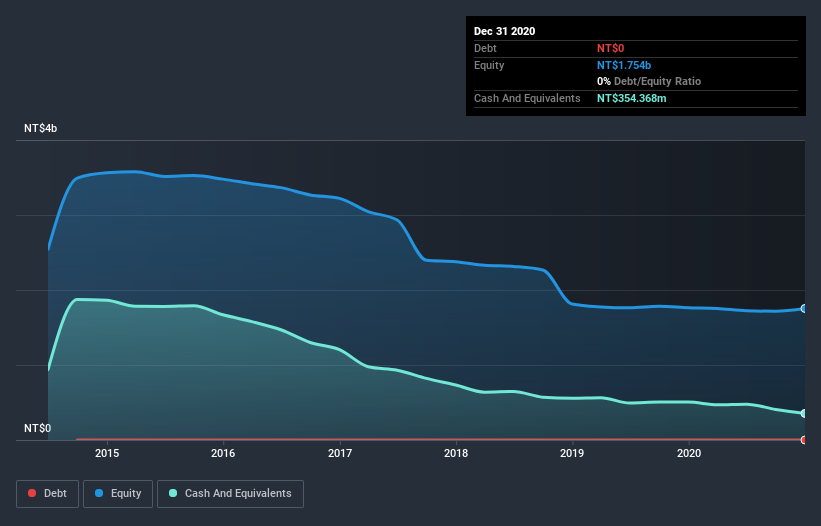

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In December 2020, Taiwan IC Packaging had NT$354m in cash, and was debt-free. Importantly, its cash burn was NT$149m over the trailing twelve months. So it had a cash runway of about 2.4 years from December 2020. Arguably, that's a prudent and sensible length of runway to have. You can see how its cash balance has changed over time in the image below.

How Well Is Taiwan IC Packaging Growing?

One thing for shareholders to keep front in mind is that Taiwan IC Packaging increased its cash burn by 200% in the last twelve months. That does give us pause, and we can't take much solace in the operating revenue growth of 2.4% in the same time frame. Considering these two factors together makes us nervous about the direction the company seems to be heading. In reality, this article only makes a short study of the company's growth data. You can take a look at how Taiwan IC Packaging has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For Taiwan IC Packaging To Raise More Cash For Growth?

Even though it seems like Taiwan IC Packaging is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of NT$3.8b, Taiwan IC Packaging's NT$149m in cash burn equates to about 3.9% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About Taiwan IC Packaging's Cash Burn?

On this analysis of Taiwan IC Packaging's cash burn, we think its cash burn relative to its market cap was reassuring, while its increasing cash burn has us a bit worried. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. An in-depth examination of risks revealed 1 warning sign for Taiwan IC Packaging that readers should think about before committing capital to this stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading Taiwan IC Packaging or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Taiwan IC Packaging, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taiwan IC Packaging might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3372

Taiwan IC Packaging

Develops optical and ultrathin IC package technologies.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives