- Taiwan

- /

- Semiconductors

- /

- TPEX:3234

If You Had Bought TrueLight's (GTSM:3234) Shares Five Years Ago You Would Be Down 67%

While not a mind-blowing move, it is good to see that the TrueLight Corporation (GTSM:3234) share price has gained 12% in the last three months. But that doesn't change the fact that the returns over the last half decade have been disappointing. The share price has failed to impress anyone , down a sizable 67% during that time. Some might say the recent bounce is to be expected after such a bad drop. But it could be that the fall was overdone.

Check out our latest analysis for TrueLight

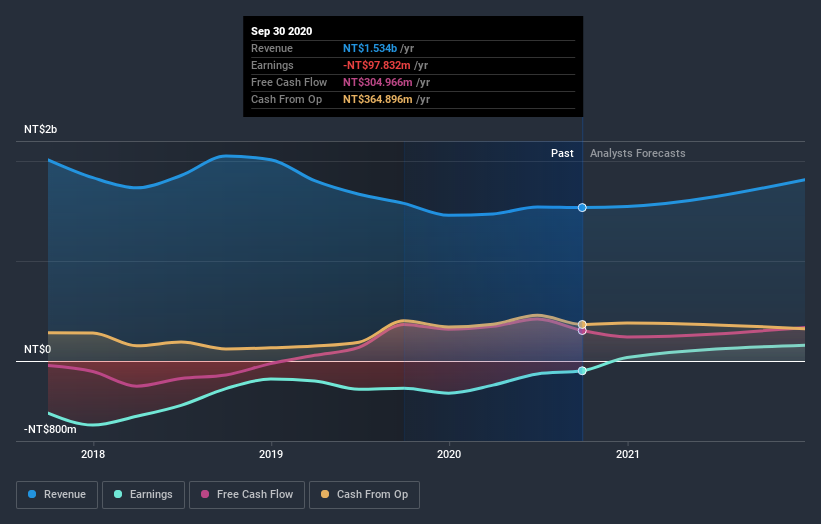

TrueLight isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade TrueLight reduced its trailing twelve month revenue by 28% for each year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 11% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at TrueLight's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between TrueLight's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. TrueLight's TSR of was a loss of 62% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

TrueLight shareholders gained a total return of 16% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 10% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand TrueLight better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for TrueLight you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade TrueLight, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TrueLight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3234

TrueLight

Designs, develops, and supplies optical components in China, Taiwan, rest of Asia, the United States, and Europe.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives