- Taiwan

- /

- Semiconductors

- /

- TPEX:3122

Companies Like Megawin Technology (GTSM:3122) Are In A Position To Invest In Growth

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Megawin Technology (GTSM:3122) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Megawin Technology

When Might Megawin Technology Run Out Of Money?

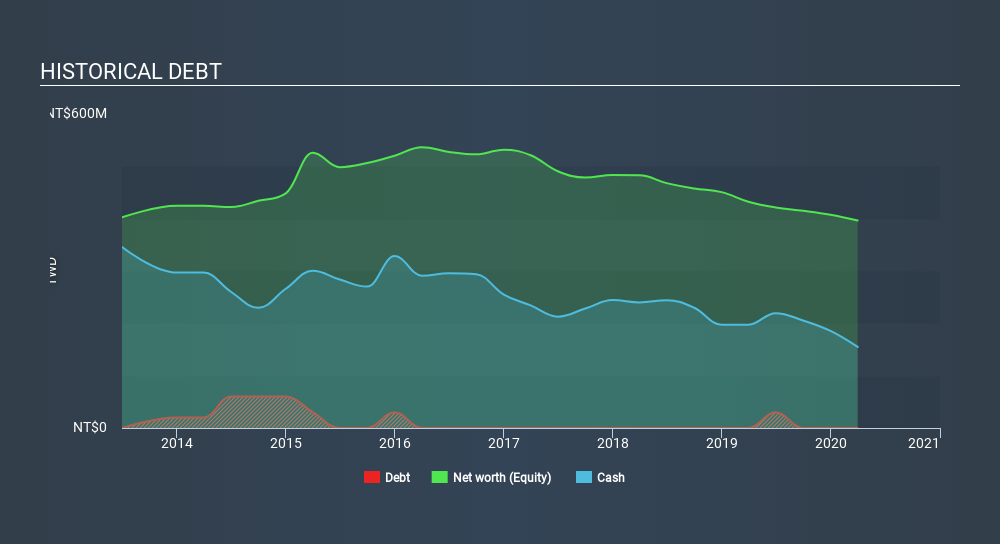

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Megawin Technology last reported its balance sheet in March 2020, it had zero debt and cash worth NT$155m. In the last year, its cash burn was NT$37m. So it had a cash runway of about 4.2 years from March 2020. There's no doubt that this is a reassuringly long runway. You can see how its cash balance has changed over time in the image below.

How Well Is Megawin Technology Growing?

At first glance it's a bit worrying to see that Megawin Technology actually boosted its cash burn by 12%, year on year. The revenue growth of 8.0% gives a ray of hope, at the very least. Considering both these factors, we're not particularly excited by its growth profile. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how Megawin Technology is building its business over time.

How Hard Would It Be For Megawin Technology To Raise More Cash For Growth?

There's no doubt Megawin Technology seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash to fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Megawin Technology has a market capitalisation of NT$425m and burnt through NT$37m last year, which is 8.7% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About Megawin Technology's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Megawin Technology is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Megawin Technology (of which 1 is potentially serious!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TPEX:3122

Megawin Technology

Engages in the design and sale of ICs in Taiwan and internationally.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives