- Taiwan

- /

- Retail Distributors

- /

- TWSE:1439

Is Chuwa Wool Industry Co., (Taiwan) Ltd.'s (TPE:1439) Recent Price Movement Underpinned By Its Weak Fundamentals?

Chuwa Wool Industry (Taiwan) (TPE:1439) has had a rough month with its share price down 1.6%. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. In this article, we decided to focus on Chuwa Wool Industry (Taiwan)'s ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Chuwa Wool Industry (Taiwan)

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Chuwa Wool Industry (Taiwan) is:

1.8% = NT$40m ÷ NT$2.3b (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.02 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Chuwa Wool Industry (Taiwan)'s Earnings Growth And 1.8% ROE

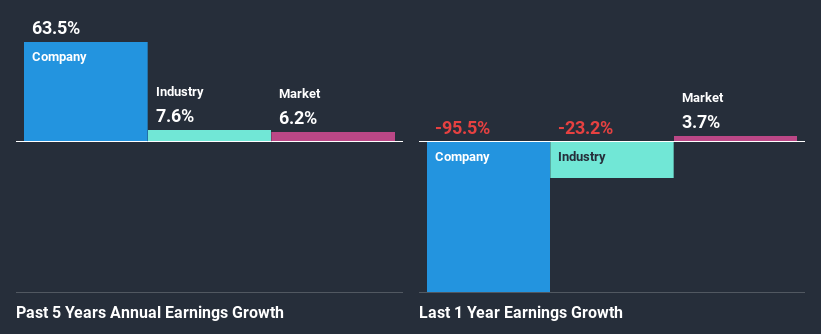

As you can see, Chuwa Wool Industry (Taiwan)'s ROE looks pretty weak. Even compared to the average industry ROE of 7.8%, the company's ROE is quite dismal. However, we we're pleasantly surprised to see that Chuwa Wool Industry (Taiwan) grew its net income at a significant rate of 64% in the last five years. We reckon that there could be other factors at play here. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared Chuwa Wool Industry (Taiwan)'s net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 7.6%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Chuwa Wool Industry (Taiwan) fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Chuwa Wool Industry (Taiwan) Using Its Retained Earnings Effectively?

The really high three-year median payout ratio of 211% for Chuwa Wool Industry (Taiwan) suggests that the company is paying its shareholders more than what it is earning. However, this hasn't hampered its ability to grow as we saw earlier. Having said that, the high payout ratio is definitely risky and something to keep an eye on. Our risks dashboard should have the 4 risks we have identified for Chuwa Wool Industry (Taiwan).

Moreover, Chuwa Wool Industry (Taiwan) is determined to keep sharing its profits with shareholders which we infer from its long history of nine years of paying a dividend.

Summary

On the whole, we feel that the performance shown by Chuwa Wool Industry (Taiwan) can be open to many interpretations. While the company has posted impressive earnings growth, its poor ROE and low earnings retention makes us doubtful if that growth could continue, if by any chance the business is faced with any sort of risk. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Chuwa Wool Industry (Taiwan)'s past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade Chuwa Wool Industry (Taiwan), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1439

Ascent Development

Sells wool tops, carbonized wool, scoured wool, shrink-resistant wool tops products in Taiwan.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives