As global markets navigate a complex landscape marked by interest rate cuts from the ECB and SNB, alongside expectations for a U.S. Fed rate cut, investors are keenly observing how these shifts impact various indices and sectors. Amidst this backdrop of mixed market performance and economic indicators, dividend stocks continue to attract attention for their potential to provide stable income streams. In such an environment, reliable dividend stocks can offer a measure of consistency through regular payouts, making them appealing options for those seeking steady returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

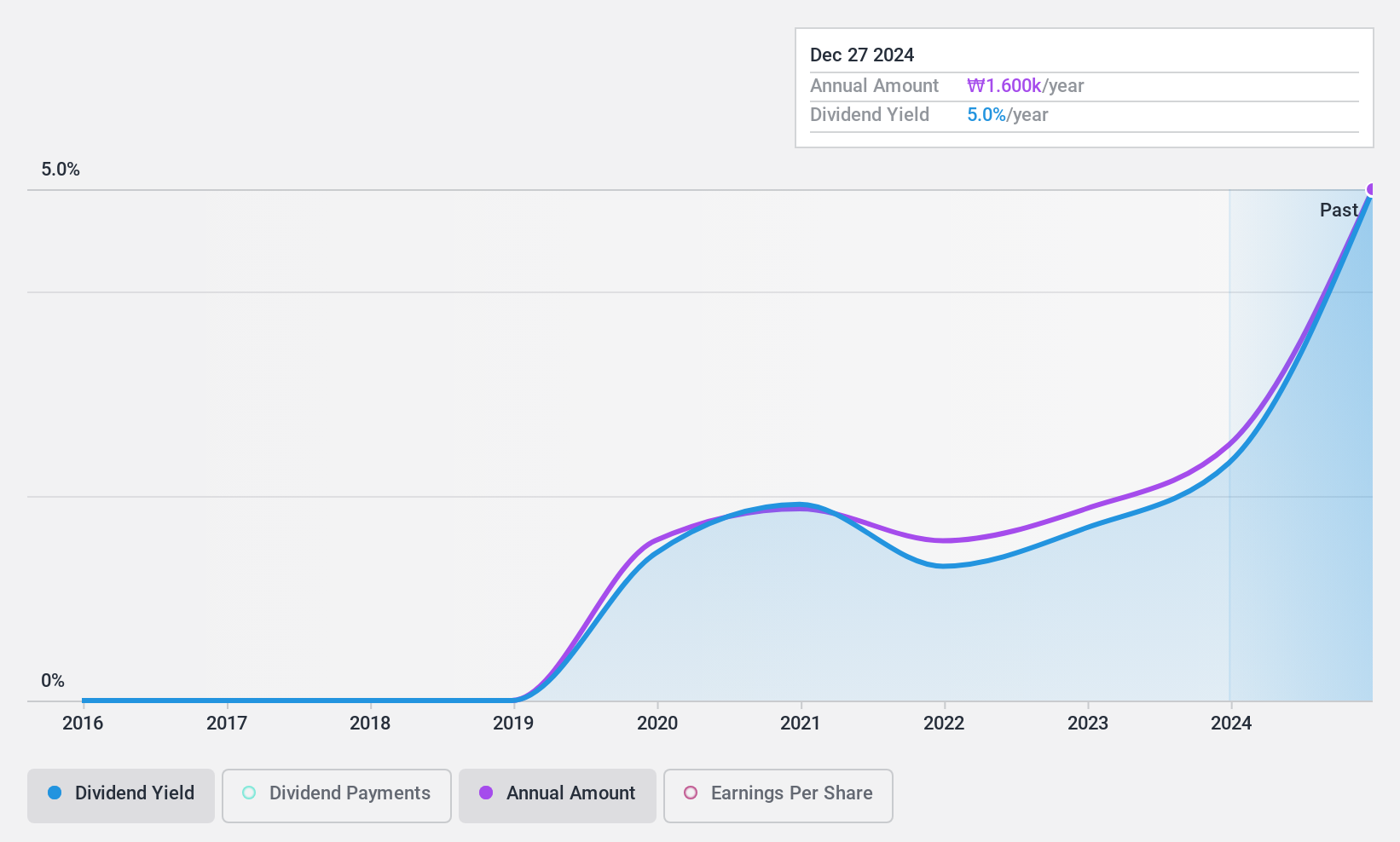

Multicampus (KOSDAQ:A067280)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multicampus Corporation focuses on education activities for the HRD system primarily in South Korea and has a market cap of approximately ₩177.80 billion.

Operations: The company's revenue is primarily derived from its Educational Business segment, which generated ₩354.04 billion.

Dividend Yield: 5.4%

Multicampus offers a compelling dividend profile with a payout ratio of 30.1%, indicating dividends are well covered by earnings. The cash payout ratio is also low at 20.4%, suggesting strong coverage by cash flows. Although the company has only paid dividends for five years, payments have been reliable and growing, placing its yield in the top tier of the KR market at 5.35%. Recent earnings growth supports continued dividend sustainability despite short-term revenue fluctuations.

- Click to explore a detailed breakdown of our findings in Multicampus' dividend report.

- Our valuation report here indicates Multicampus may be undervalued.

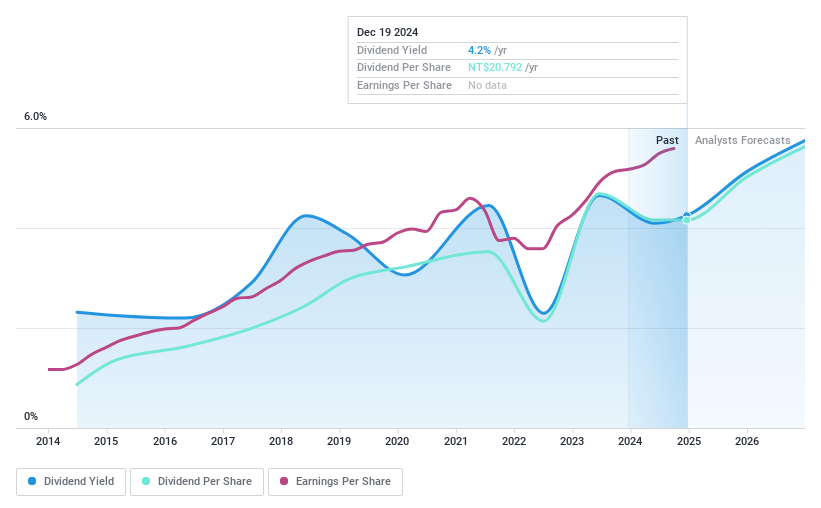

POYA International (TPEX:5904)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: POYA International Co., Ltd. operates a chain of retail stores in Taiwan and has a market cap of NT$50.99 billion.

Operations: POYA International Co., Ltd.'s revenue is primarily derived from its General Merchandise Retail Sales Department, which generated NT$23.26 billion.

Dividend Yield: 4.2%

POYA International's dividend prospects are mixed, with a payout ratio of 79.7% and a cash payout ratio of 55.4%, indicating dividends are covered by earnings and cash flows. However, dividend payments have been volatile over the past decade, despite recent growth in payments. The dividend yield is slightly below the top tier in Taiwan at 4.25%. Earnings have shown consistent growth, with Q3 net income rising to TWD 762.98 million from TWD 712.93 million year-on-year, supporting future payouts.

- Dive into the specifics of POYA International here with our thorough dividend report.

- According our valuation report, there's an indication that POYA International's share price might be on the cheaper side.

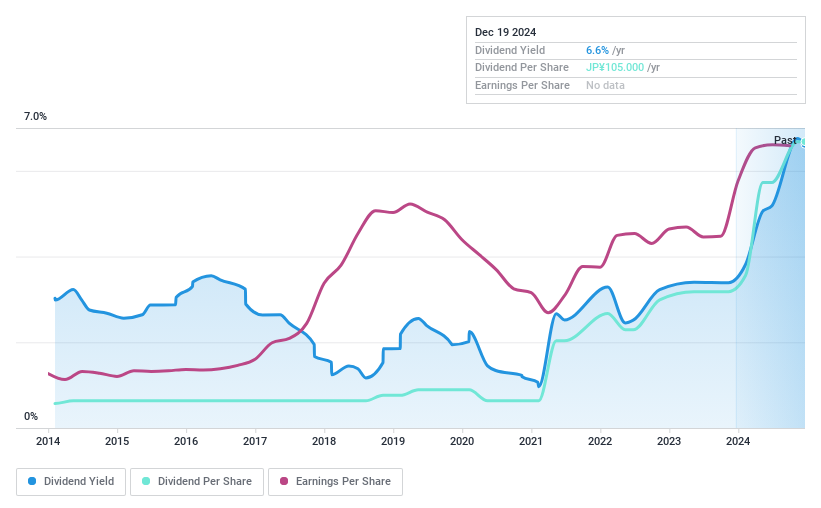

Yotai Refractories (TSE:5357)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yotai Refractories Co., Ltd. manufactures and sells refractories and new ceramics, along with related engineering services in Japan, with a market cap of ¥29.10 billion.

Operations: Yotai Refractories Co., Ltd.'s revenue is primarily derived from its Refractory segment, contributing ¥24.43 billion, and its Engineering segment, which adds ¥5.03 billion.

Dividend Yield: 6.6%

Yotai Refractories' dividend yield is high at 6.64%, placing it in the top 25% of Japanese dividend payers, but payments have been volatile over the past decade and not well covered by free cash flow, despite a reasonable payout ratio of 50.7%. Recent earnings growth of 40.5% may support dividends, yet large one-off items affect financial results. A recent share buyback aims to enhance shareholder returns amid lowered earnings guidance for FY2025.

- Click here to discover the nuances of Yotai Refractories with our detailed analytical dividend report.

- The analysis detailed in our Yotai Refractories valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Click here to access our complete index of 1967 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade POYA International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5904

Very undervalued with outstanding track record and pays a dividend.

Market Insights

Community Narratives