- Taiwan

- /

- Real Estate

- /

- TWSE:5534

Did You Participate In Any Of Chong Hong Construction's (TPE:5534) Fantastic 178% Return ?

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can do a lot better than that by buying good quality businesses for attractive prices. For example, the Chong Hong Construction Co., Ltd. (TPE:5534) share price is 93% higher than it was five years ago, which is more than the market average. In stark contrast, the stock price has actually fallen 1.9% in the last year.

View our latest analysis for Chong Hong Construction

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

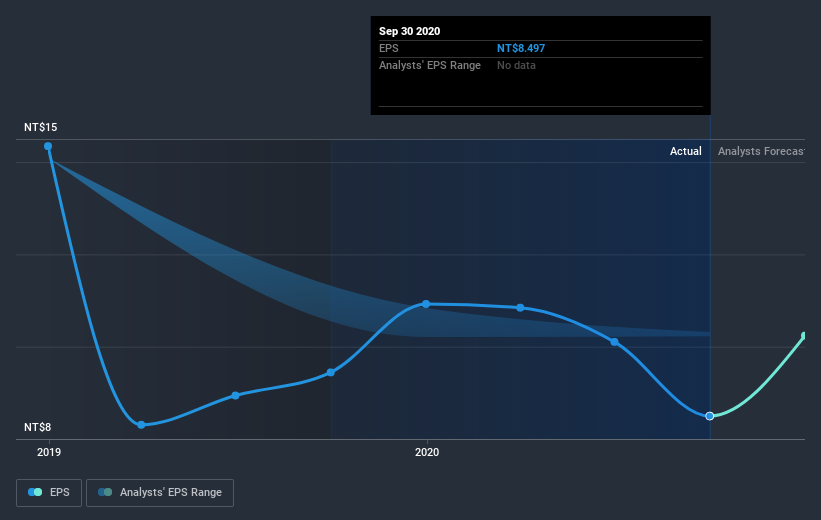

During five years of share price growth, Chong Hong Construction achieved compound earnings per share (EPS) growth of 5.1% per year. This EPS growth is lower than the 14% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Chong Hong Construction's key metrics by checking this interactive graph of Chong Hong Construction's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Chong Hong Construction the TSR over the last 5 years was 178%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Chong Hong Construction provided a TSR of 5.4% over the last twelve months. But that was short of the market average. On the bright side, the longer term returns (running at about 23% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Chong Hong Construction better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Chong Hong Construction you should be aware of, and 2 of them make us uncomfortable.

But note: Chong Hong Construction may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Chong Hong Construction, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5534

Chong Hong Construction

Engages in the construction, sale, and leasing of residential and commercial buildings in Taiwan.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives