- Taiwan

- /

- Real Estate

- /

- TWSE:2524

We Think King's Town Construction's (TPE:2524) Solid Earnings Are Understated

The market seemed underwhelmed by last week's earnings announcement from King's Town Construction Co., Ltd. (TPE:2524) despite the healthy numbers. We did some digging, and we think that investors are missing some encouraging factors in the underlying numbers.

Check out our latest analysis for King's Town Construction

Examining Cashflow Against King's Town Construction's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

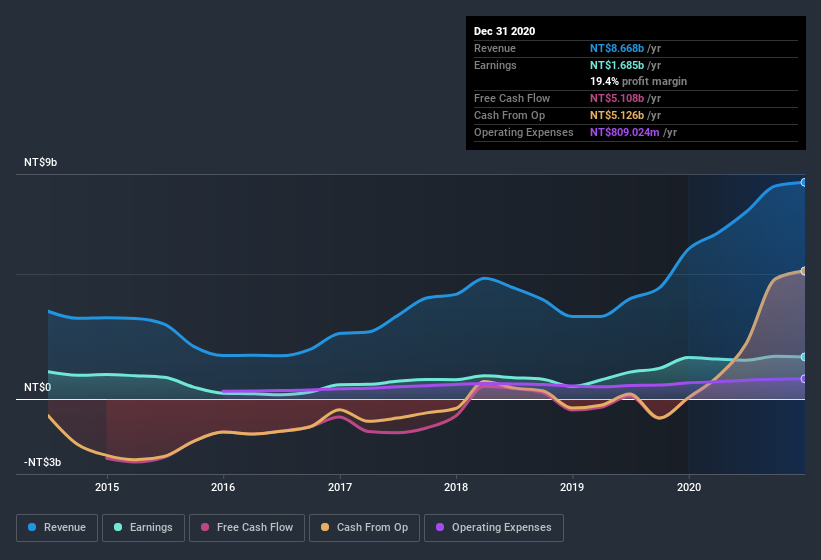

King's Town Construction has an accrual ratio of -0.11 for the year to December 2020. That indicates that its free cash flow was a fair bit more than its statutory profit. To wit, it produced free cash flow of NT$5.1b during the period, dwarfing its reported profit of NT$1.68b. King's Town Construction's free cash flow improved over the last year, which is generally good to see. However, as we will discuss below, we can see that the company's accrual ratio has been impacted by its tax situation.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of King's Town Construction.

An Unusual Tax Situation

Moving on from the accrual ratio, we note that King's Town Construction profited from a tax benefit which contributed NT$248m to profit. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On King's Town Construction's Profit Performance

In conclusion, King's Town Construction has strong cashflow relative to earnings, which indicates good quality earnings, but the tax benefit means its profit wasn't as sustainable as we'd like to see. Based on these factors, it's hard to tell if King's Town Construction's profits are a reasonable reflection of its underlying profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. You'd be interested to know, that we found 1 warning sign for King's Town Construction and you'll want to know about it.

Our examination of King's Town Construction has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade King's Town Construction, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if King's Town Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2524

King's Town Construction

Engages in the residential and building development in Taiwan.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives