- Taiwan

- /

- Real Estate

- /

- TWSE:1442

Did You Participate In Any Of Advancetek EnterpriseLtd's (TPE:1442) Respectable 68% Return?

It hasn't been the best quarter for Advancetek Enterprise Co.,Ltd. (TPE:1442) shareholders, since the share price has fallen 13% in that time. But at least the stock is up over the last five years. Unfortunately its return of 23% is below the market return of 138%.

View our latest analysis for Advancetek EnterpriseLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Advancetek EnterpriseLtd's earnings per share are down 42% per year, despite strong share price performance over five years.

Since the EPS are down strongly, it seems highly unlikely market participants are looking at EPS to value the company. Given that EPS is down, but the share price is up, it seems clear the market is focussed on other aspects of the business, at the moment.

We note that the dividend has not increased, so that doesn't seem to explain the increase, either. And the -28% compound annual revenue reduction might be interpreted as a sign that Advancetek EnterpriseLtd's best days are behind it. So it's not clear to us why the share price is up - a closer inspection of the stock might yield clues.

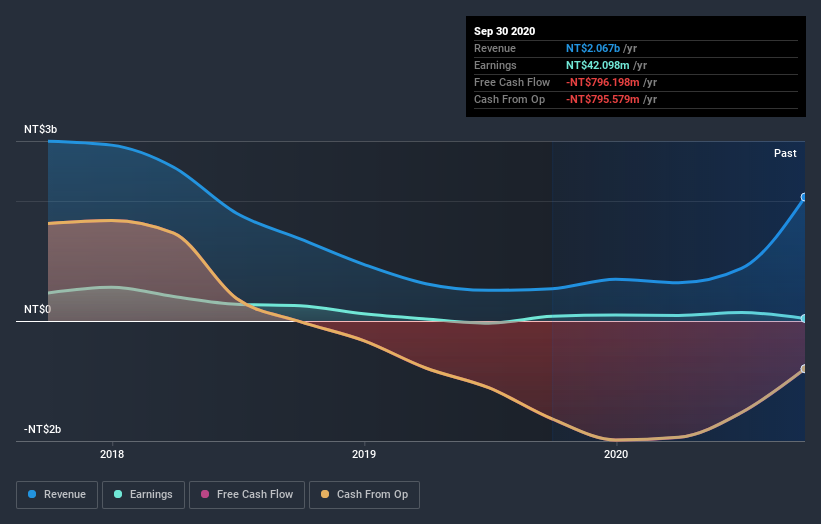

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Advancetek EnterpriseLtd stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Advancetek EnterpriseLtd, it has a TSR of 68% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 33% in the last year, Advancetek EnterpriseLtd shareholders lost 9.8% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 11% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with Advancetek EnterpriseLtd (including 2 which are a bit unpleasant) .

We will like Advancetek EnterpriseLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Advancetek EnterpriseLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1442

Advancetek EnterpriseLtd

Advancetek Enterprise Co.,Ltd. entrusts construction companies to build national residential buildings and commercial buildings for leasing and sale in Taiwan.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026