- Turkey

- /

- Consumer Finance

- /

- IBSE:KTLEV

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate the influence of rising U.S. Treasury yields and tepid economic growth, investors are increasingly seeking stability in dividend stocks, which can provide a reliable income stream amidst market volatility. In this environment, identifying strong dividend stocks involves looking for companies with consistent earnings and robust cash flows that can sustain their payouts despite broader economic challenges.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.20% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.00% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Southside Bancshares (NasdaqGS:SBSI) | 4.51% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.03% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.92% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2040 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

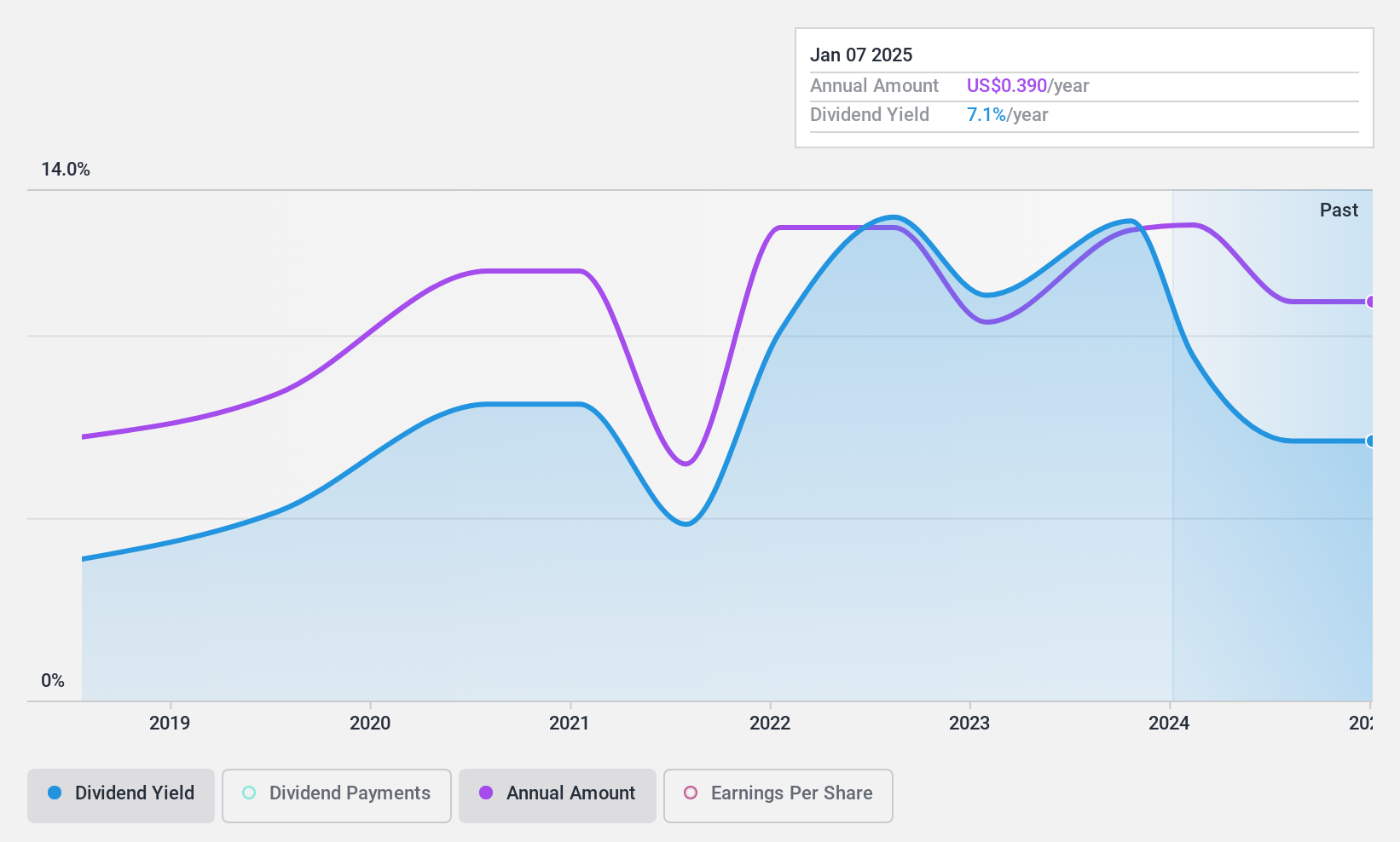

Orascom Construction (DIFX:OC)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Orascom Construction PLC operates as an engineering and construction contractor focusing on infrastructure, industrial, and high-end commercial projects across the United States, the Middle East, Africa, and Central Asia with a market cap of $672.49 million.

Operations: The company's revenue is primarily derived from its operations in the USA, contributing $1.69 billion, and the MENA region, contributing $1.59 billion.

Dividend Yield: 5.8%

Orascom Construction's dividend payments, though well-covered by earnings (payout ratio of 34.3%) and cash flows (cash payout ratio of 8.2%), have been volatile over the past seven years, making them unreliable for consistent income. Despite trading at a good value relative to peers and having a low cash payout ratio, its dividend yield of 5.82% is below the top quartile in the AE market. Recent earnings showed declining sales and net income, potentially impacting future dividends.

- Get an in-depth perspective on Orascom Construction's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Orascom Construction's current price could be quite moderate.

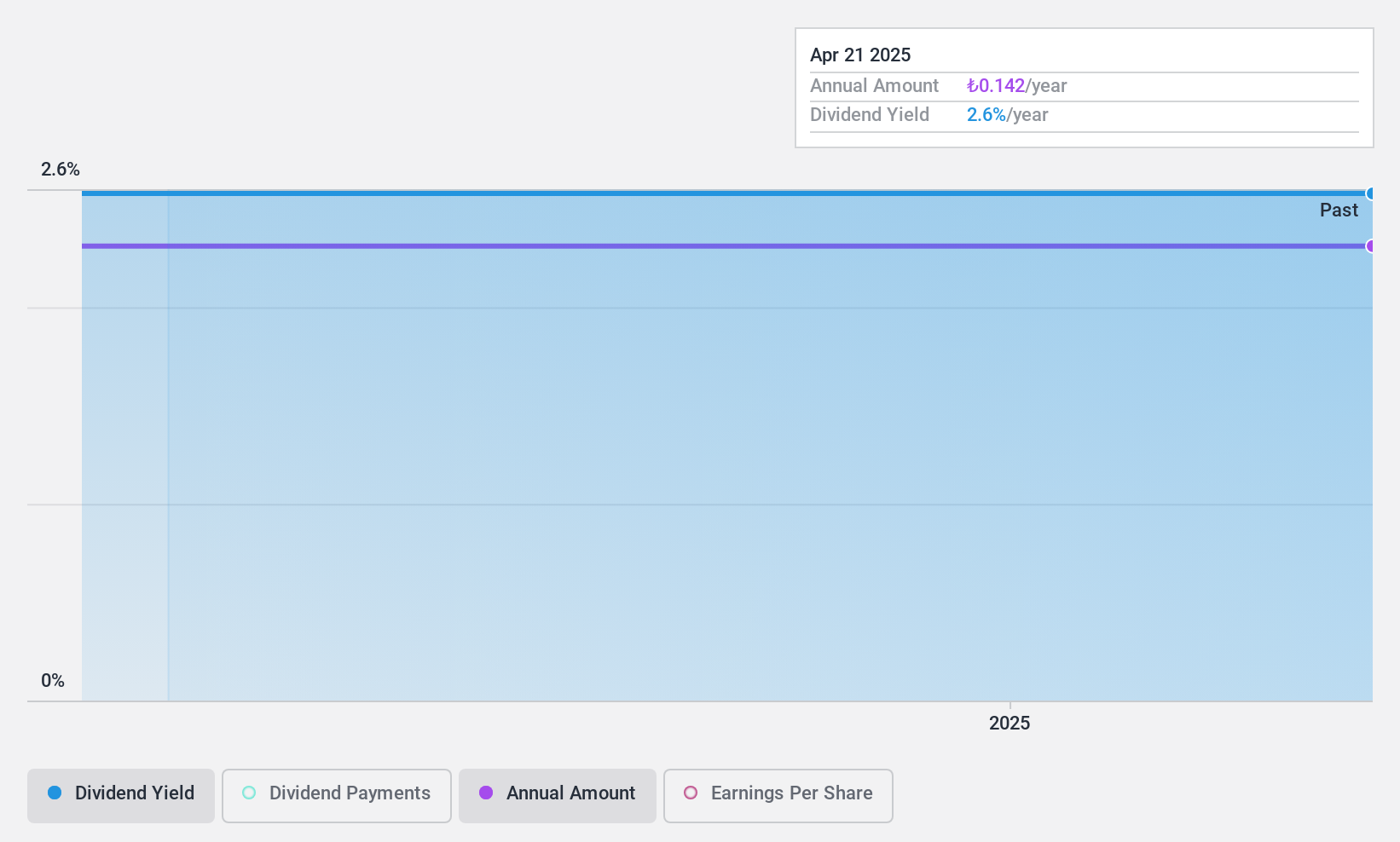

Katilimevim Tasarruf Finansman Anonim Sirketi (IBSE:KTLEV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Katilimevim Tasarruf Finansman Anonim Sirketi offers savings finance for purchasing houses and cars in Turkey, with a market cap of TRY10.26 billion.

Operations: Katilimevim Tasarruf Finansman Anonim Sirketi generates revenue of TRY2.47 billion from its financial services focused on consumer savings finance.

Dividend Yield: 2.9%

Katilimevim Tasarruf Finansman Anonim Sirketi offers a compelling dividend profile with its low payout ratio of 21.5%, indicating dividends are well covered by earnings and cash flows (cash payout ratio of 18.1%). Despite a recent start to dividend payments, which makes it too early to assess stability or growth, the company's dividend yield of 3.13% ranks in the top quartile for the TR market. However, its share price has been highly volatile recently.

- Navigate through the intricacies of Katilimevim Tasarruf Finansman Anonim Sirketi with our comprehensive dividend report here.

- Our valuation report unveils the possibility Katilimevim Tasarruf Finansman Anonim Sirketi's shares may be trading at a premium.

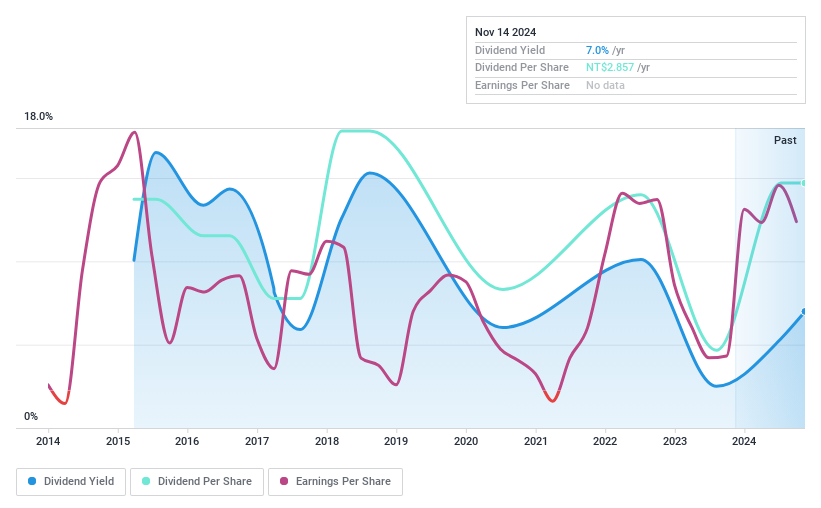

Da-Li DevelopmentLtd (TWSE:6177)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Da-Li Development Co., Ltd., along with its subsidiaries, engages in the construction business in Taiwan and the United States, with a market capitalization of NT$19.41 billion.

Operations: Da-Li Development Co., Ltd.'s revenue is primarily derived from its Construction Segment, which generated NT$4.27 billion, and its Construction Department, which contributed NT$17.37 billion.

Dividend Yield: 6.3%

Da-Li Development Ltd. shows a mixed dividend profile with strong coverage by earnings (payout ratio of 52.2%) and cash flows (cash payout ratio of 13.7%), but an unstable dividend history over the past decade. The company's recent earnings surge, with net income rising to TWD 346.92 million in Q2 2024, supports its top-tier dividend yield of 6.31% in Taiwan's market, despite high debt levels and share price volatility.

- Take a closer look at Da-Li DevelopmentLtd's potential here in our dividend report.

- Upon reviewing our latest valuation report, Da-Li DevelopmentLtd's share price might be too pessimistic.

Turning Ideas Into Actions

- Discover the full array of 2040 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Katilimevim Tasarruf Finansman Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KTLEV

Katilimevim Tasarruf Finansman Anonim Sirketi

Provides savings finance to buy houses and cars in Turkey.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives