- Japan

- /

- Retail Distributors

- /

- TSE:8117

Asian Dividend Stocks To Watch In December 2025

Reviewed by Simply Wall St

As we approach December 2025, Asian markets are capturing global attention, with technology and AI-related stocks in Japan and China rebounding amidst optimism for growth despite recent economic slowdowns. In this dynamic environment, dividend stocks can offer stability and income potential, making them appealing options for investors seeking to navigate the current market landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.38% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.85% | ★★★★★★ |

| NCD (TSE:4783) | 4.37% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.12% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.76% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.78% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.51% | ★★★★★★ |

Click here to see the full list of 1030 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Toenec (TSE:1946)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toenec Corporation is involved in the construction and enhancement of social infrastructure across energy, environment, and information technology sectors in Japan, with a market cap of approximately ¥184.27 billion.

Operations: Toenec Corporation generates revenue primarily from its Equipment Installation Business (excluding Energy Business) at ¥251.65 billion and its Energy Business at ¥12.47 billion.

Dividend Yield: 3.3%

Toenec's recent dividend policy revision targets a 40% payout ratio, up from 30%, indicating a stronger commitment to shareholder returns. The interim dividend increased to ¥28 per share, with a year-end forecast of ¥37 per share. Despite past volatility in dividends, current payouts are well-covered by earnings and cash flow, maintaining ratios of 35.6% and 44.7%, respectively. However, its dividend yield remains below the top tier in Japan's market at 3.27%.

- Get an in-depth perspective on Toenec's performance by reading our dividend report here.

- According our valuation report, there's an indication that Toenec's share price might be on the cheaper side.

Central Automotive Products (TSE:8117)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central Automotive Products Ltd. is involved in the development, import and export, and sale of automotive parts and related services, with a market cap of ¥104.34 billion.

Operations: Central Automotive Products Ltd. generates revenue through its diverse operations in the automotive sector, including the development, import and export, and sale of automotive parts and related services.

Dividend Yield: 3%

Central Automotive Products Ltd.'s dividend yield of 3.02% is lower than Japan's top quartile, yet remains reliable and stable over the past decade. The company's recent stock split adjusted dividends to ¥26 per share for the half-year, with payments well-covered by earnings (18.2% payout ratio) and cash flow (44.9% cash payout ratio). Despite a decrease from ¥68 per share pre-split, dividends are sustainable with anticipated earnings growth and good relative value compared to peers.

- Delve into the full analysis dividend report here for a deeper understanding of Central Automotive Products.

- Upon reviewing our latest valuation report, Central Automotive Products' share price might be too pessimistic.

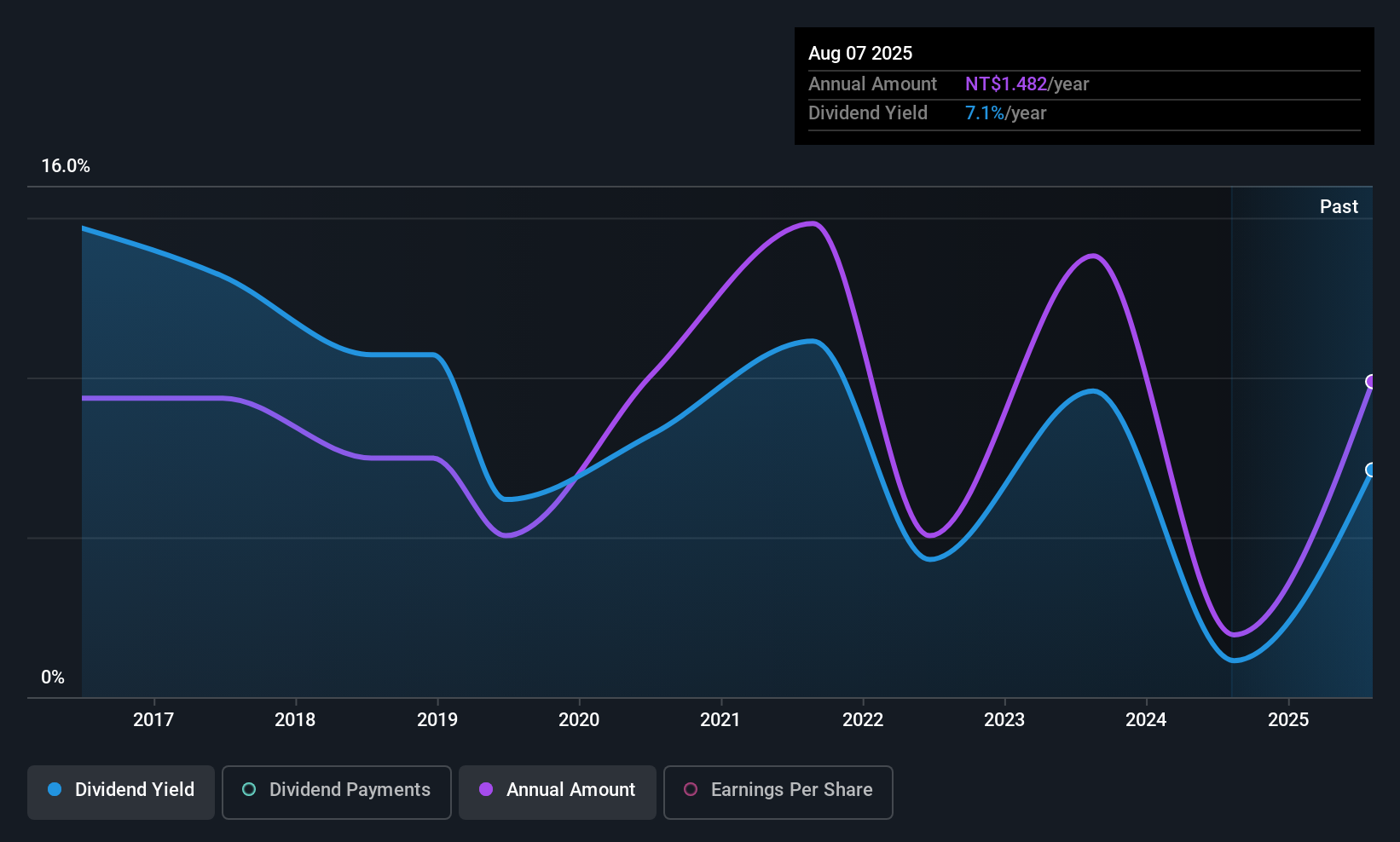

Fu Hua Innovation (TWSE:3056)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fu Hua Innovation Co., Ltd. is involved in the development and construction of real estate properties in Taiwan, with a market cap of NT$9.37 billion.

Operations: Fu Hua Innovation Co., Ltd. generates revenue primarily through its activities in real estate development and construction within Taiwan.

Dividend Yield: 7.6%

Fu Hua Innovation's dividend yield of 7.6% ranks in the top 25% of Taiwan's market, but its history shows volatility over the past decade. Despite this, dividends are well-covered by earnings and cash flows with payout ratios at 25.2% and 7.5%, respectively, indicating sustainability. The company became profitable this year with significant revenue growth reported for Q3 2025, yet its stock trades significantly below estimated fair value, suggesting potential undervaluation.

- Navigate through the intricacies of Fu Hua Innovation with our comprehensive dividend report here.

- Our valuation report unveils the possibility Fu Hua Innovation's shares may be trading at a discount.

Seize The Opportunity

- Explore the 1030 names from our Top Asian Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8117

Central Automotive Products

Engages in the development, import and export, and sale of automotive parts and related services.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026