- Taiwan

- /

- Real Estate

- /

- TWSE:2539

If EPS Growth Is Important To You, Sakura DevelopmentLtd (TWSE:2539) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Sakura DevelopmentLtd (TWSE:2539). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Sakura DevelopmentLtd

Sakura DevelopmentLtd's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Sakura DevelopmentLtd's EPS has grown 31% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

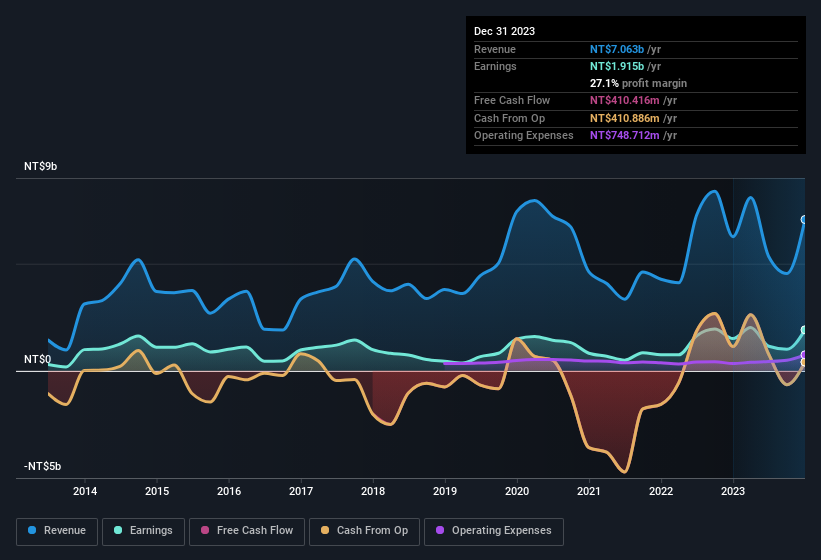

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Sakura DevelopmentLtd is growing revenues, and EBIT margins improved by 4.2 percentage points to 35%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Sakura DevelopmentLtd Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Sakura DevelopmentLtd insiders own a meaningful share of the business. Owning 44% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. NT$28b That level of investment from insiders is nothing to sneeze at.

Should You Add Sakura DevelopmentLtd To Your Watchlist?

You can't deny that Sakura DevelopmentLtd has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Sakura DevelopmentLtd's continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. We should say that we've discovered 1 warning sign for Sakura DevelopmentLtd that you should be aware of before investing here.

Although Sakura DevelopmentLtd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Taiwanese companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2539

Sakura DevelopmentLtd

Engages in the sale and lease of residential properties with focus on the Zhongzhangtou area in Taiwan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026