- Taiwan

- /

- Real Estate

- /

- TWSE:2524

Undiscovered Gems in Asia for May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, small-cap stocks in Asia are drawing increased attention for their potential resilience and growth opportunities. In this dynamic environment, identifying promising companies requires a keen understanding of market trends, economic indicators, and the unique attributes that can drive success amidst uncertainty.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.60% | 4.56% | 15.25% | ★★★★★★ |

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Chudenko | NA | 4.67% | 10.65% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 4.34% | 5.54% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Kanro | NA | 6.67% | 37.24% | ★★★★★★ |

| Toukei Computer | NA | 5.67% | 12.77% | ★★★★★★ |

| Bank of Iwate | 119.19% | 1.75% | 7.64% | ★★★★☆☆ |

| Nippon Sharyo | 53.44% | -0.74% | -11.37% | ★★★★☆☆ |

| Kwang Dong Pharmaceutical | 44.94% | 6.47% | 3.58% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Yungshin Construction & DevelopmentLtd (TPEX:5508)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yungshin Construction & Development Co., Ltd. operates as a construction and development company with a market cap of NT$30.22 billion, focusing on residential and commercial projects.

Operations: The company's primary revenue stream is from its residential and commercial home building segment, generating NT$10.04 billion. The net profit margin exhibits a notable trend at 12.5%.

Yungshin Construction & Development Co., Ltd. has been making waves with its robust financial performance and strategic moves. The company's earnings have grown at an impressive 36.5% annually over the past five years, although recent growth of 27.7% lagged behind the broader real estate industry’s 36.5%. Despite a high net debt to equity ratio of 93.3%, its interest payments are well covered by EBIT, boasting a coverage of 4456 times. With new contracts worth TWD 194 million signed recently, Yungshin seems poised for continued activity in Taiwan's construction sector while maintaining a competitive P/E ratio of 8.7x against the market's 18.2x.

King's Town Construction (TWSE:2524)

Simply Wall St Value Rating: ★★★★☆☆

Overview: King's Town Construction Co., Ltd. focuses on residential and building development in Taiwan, with a market capitalization of approximately NT$21.20 billion.

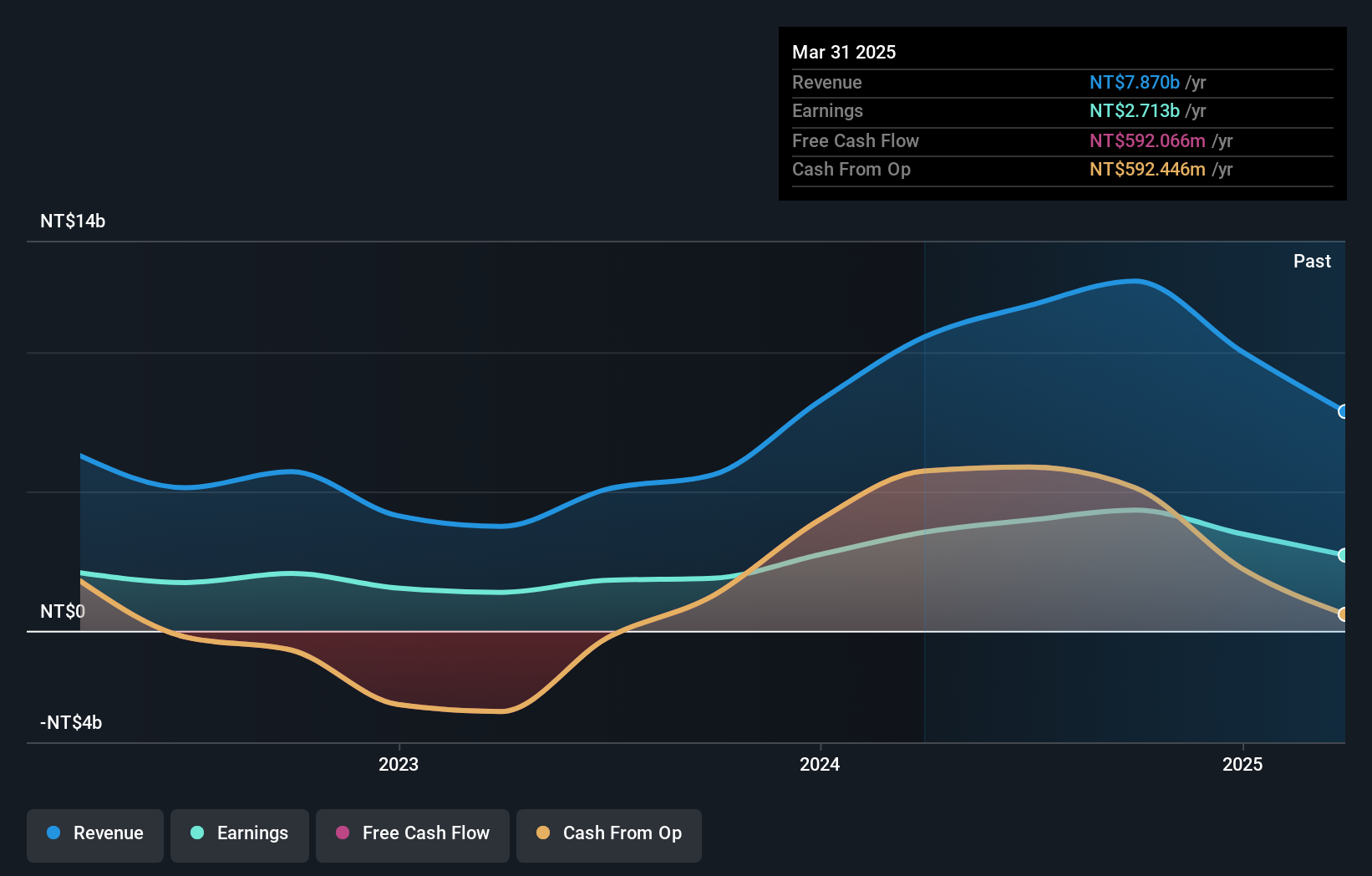

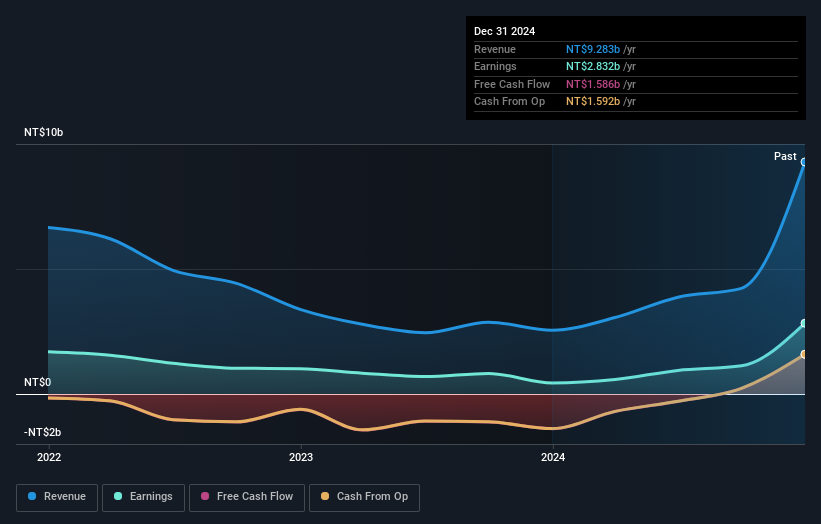

Operations: King's Town Construction generates revenue primarily from its Construction Division, which accounts for NT$9.04 billion, while its Accommodation Department contributes NT$289.99 million.

King's Town Construction showcases a remarkable turnaround with earnings surging 540.6% in the past year, outpacing the real estate industry's 36.5%. Despite a high net debt to equity ratio of 76.2%, interest payments are well covered at 10.9 times EBIT, indicating strong financial health. The company is trading at a significant discount of 77.3% below estimated fair value, presenting potential opportunities for investors. Recent strategic moves include acquiring land in Kaohsiung City for TWD 567 million and launching a share repurchase program worth TWD 16,886 million to bolster shareholder value and protect its reputation amidst market volatility.

- Take a closer look at King's Town Construction's potential here in our health report.

Understand King's Town Construction's track record by examining our Past report.

Hwang Chang General Contractor (TWSE:2543)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hwang Chang General Contractor Co., Ltd operates in the civil engineering contracting sector in Taiwan with a market capitalization of NT$37.31 billion.

Operations: The company generates revenue primarily from its Construction Engineering Division, contributing NT$11.47 billion, and a smaller portion from its Concrete Department at NT$1.74 billion. The net profit margin is not provided for analysis in the available data.

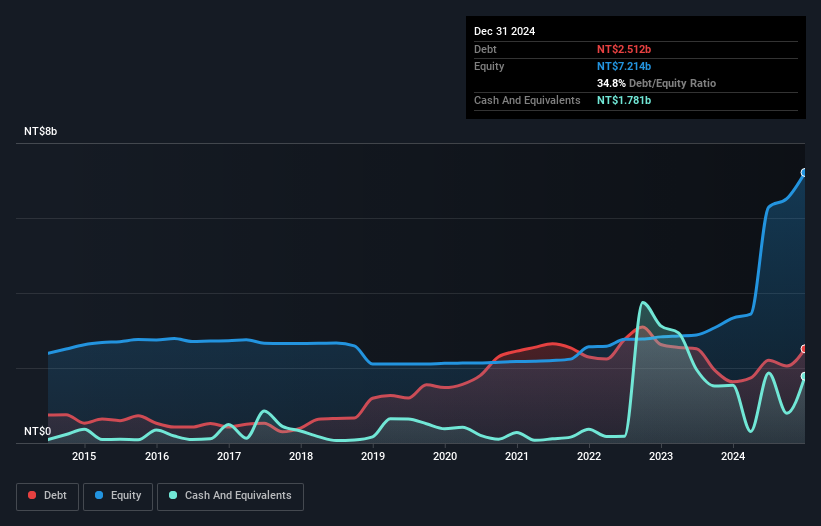

Hwang Chang General Contractor has shown impressive growth with earnings surging 295.6% over the past year, significantly outpacing the construction industry's 5.8%. The company's debt management seems prudent, as its debt to equity ratio improved from 69.5% to 34.8% in five years, and interest payments are well covered by EBIT at a robust 64.5x coverage. Despite recent shareholder dilution due to a TWD 2 billion follow-on equity offering, net income rose sharply from TWD 510 million to TWD 2 billion last year, reflecting strong operational performance amidst market volatility and strategic financial adjustments.

- Get an in-depth perspective on Hwang Chang General Contractor's performance by reading our health report here.

Learn about Hwang Chang General Contractor's historical performance.

Turning Ideas Into Actions

- Unlock our comprehensive list of 2704 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade King's Town Construction, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if King's Town Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2524

King's Town Construction

Engages in the residential and building development in Taiwan.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives