- Taiwan

- /

- Real Estate

- /

- TWSE:1442

Undiscovered Gems With Strong Fundamentals To Explore This January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are grappling with a mix of inflation concerns and political uncertainties, leading to significant volatility across major indices. Small-cap stocks, in particular, have faced challenges as the Russell 2000 Index dipped into correction territory amid broader market turbulence. In such an environment, identifying stocks with strong fundamentals can be crucial for investors seeking to navigate these choppy waters effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

We'll examine a selection from our screener results.

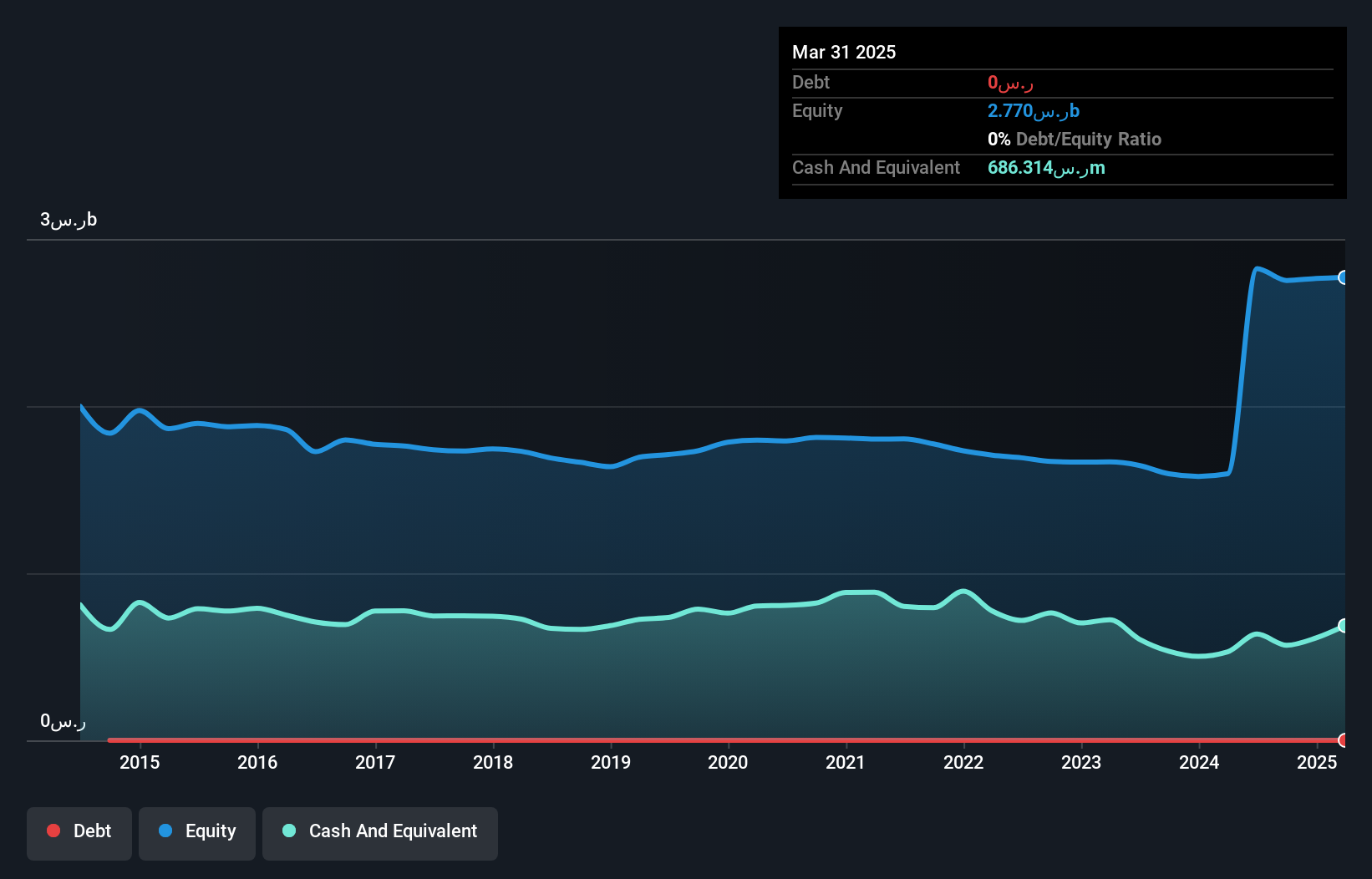

Qassim Cement (SASE:3040)

Simply Wall St Value Rating: ★★★★★★

Overview: Qassim Cement Company is involved in the manufacture and sale of cement within the Kingdom of Saudi Arabia, with a market capitalization of SAR5.73 billion.

Operations: Qassim Cement generates revenue primarily from its operating segment, with reported figures reaching SAR816.06 million.

Qassim Cement, a nimble player in the cement industry, has been making waves with its robust financials. The company is debt-free and boasts high-quality past earnings, which reflects stability. Its earnings surged by 69% last year, outpacing the Basic Materials industry's growth of 12%. Trading at 31.6% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Recent events include a cash dividend of SAR 0.65 and an upcoming shareholders meeting on December 25, 2024. These developments likely indicate proactive shareholder engagement and a commitment to returning value to investors.

- Click to explore a detailed breakdown of our findings in Qassim Cement's health report.

Understand Qassim Cement's track record by examining our Past report.

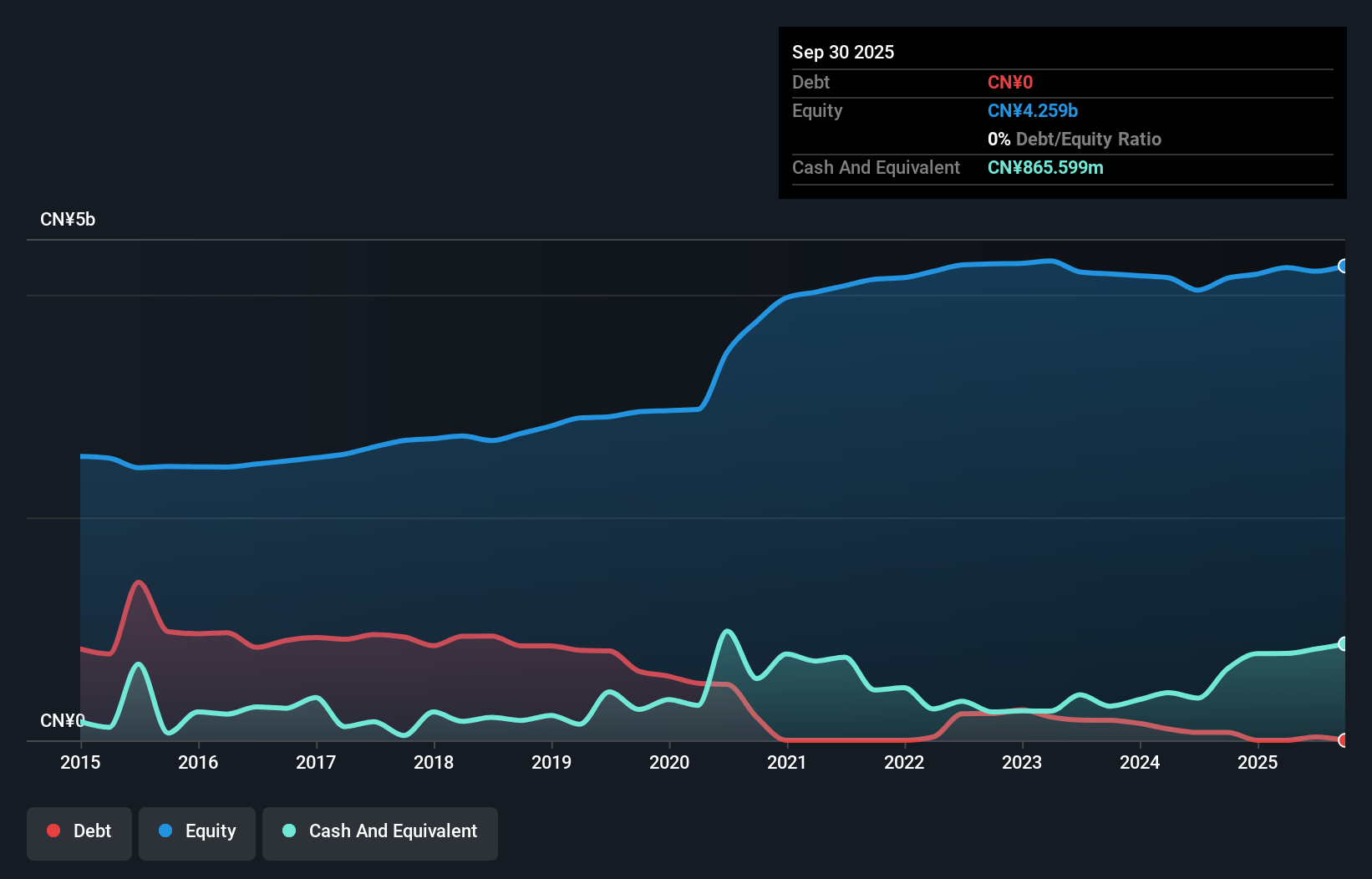

Gem-Year IndustrialLtd (SHSE:601002)

Simply Wall St Value Rating: ★★★★★★

Overview: Gem-Year Industrial Co., Ltd. focuses on the research, development, production, and distribution of fasteners in China with a market capitalization of CN¥4.02 billion.

Operations: Gem-Year Industrial Co., Ltd. generates its revenue primarily from the sale of fasteners, with a focus on the Chinese market. The company's cost structure includes expenses related to research, development, and production activities. Its financial performance is influenced by fluctuations in raw material costs and operational efficiencies.

Gem-Year Industrial Ltd. has shown impressive earnings growth of 886% over the past year, significantly outpacing the Machinery industry's slight decline. The company is trading at a substantial discount, approximately 91.7% below its estimated fair value, suggesting potential undervaluation. Recent financial results reveal sales of CNY 1.73 billion for the first nine months of 2024, up from CNY 1.68 billion in the previous year, with net income reaching CNY 81 million compared to a loss last year. Additionally, their debt-to-equity ratio has decreased notably from 21% to just under 2% over five years, indicating improved financial health.

- Get an in-depth perspective on Gem-Year IndustrialLtd's performance by reading our health report here.

Learn about Gem-Year IndustrialLtd's historical performance.

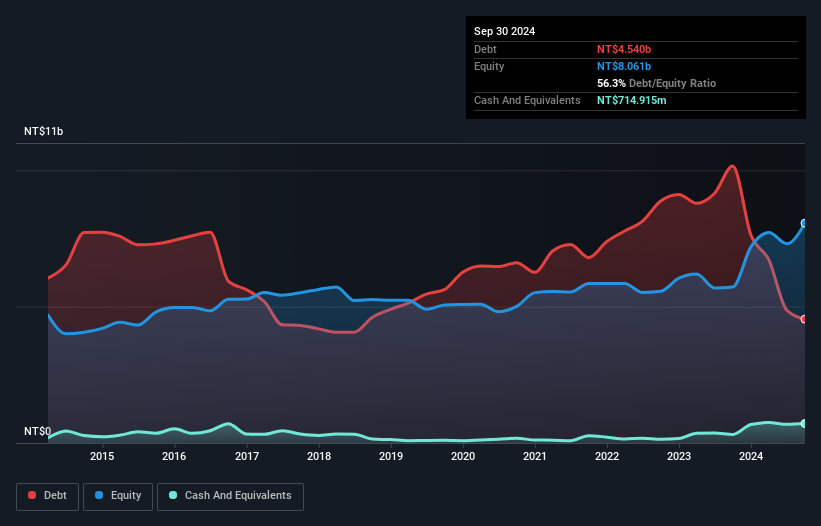

Advancetek EnterpriseLtd (TWSE:1442)

Simply Wall St Value Rating: ★★★★★☆

Overview: Advancetek Enterprise Co., Ltd. is involved in the construction, rental, and sale of residential and commercial buildings in Taiwan, with a market capitalization of approximately NT$26.99 billion.

Operations: Advancetek generates revenue primarily from the construction, rental, and sale of residential and commercial properties in Taiwan. The company's net profit margin is 12.5%, reflecting its ability to manage costs effectively within its operations.

Advancetek's recent performance highlights its potential as an intriguing investment opportunity. The company's earnings have surged, with a remarkable net income of TWD 754.67 million in the third quarter, up from TWD 37.55 million the previous year. Sales also saw a significant jump to TWD 2,461.54 million from TWD 301.31 million year-on-year for the same period, showcasing robust growth dynamics within its industry context. Despite high volatility in share price over recent months, Advancetek's debt management appears strong with interest payments well-covered by EBIT at a multiple of 41x, indicating solid financial health and operational efficiency moving forward.

Next Steps

- Embark on your investment journey to our 4562 Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1442

Advancetek EnterpriseLtd

Engages in the construction, rental, and sale of residential and commercial buildings in Taiwan.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives