Tanvex BioPharma (TWSE:6541) shareholders are up 12% this past week, but still in the red over the last five years

Tanvex BioPharma, Inc. (TWSE:6541) shareholders should be happy to see the share price up 14% in the last month. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Indeed, the share price is down a whopping 80% in that time. So we don't gain too much confidence from the recent recovery. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the last five years has been tough for Tanvex BioPharma shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Tanvex BioPharma

We don't think Tanvex BioPharma's revenue of NT$34,630,000 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Tanvex BioPharma comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Tanvex BioPharma has already given some investors a taste of the bitter losses that high risk investing can cause.

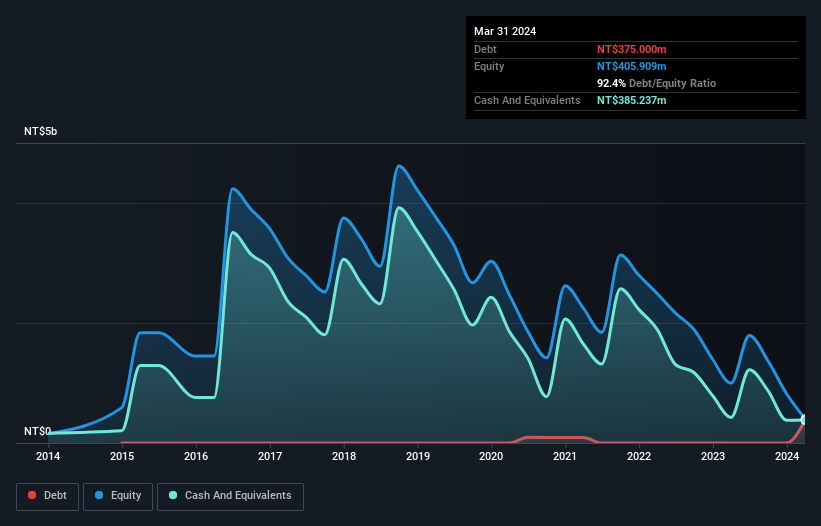

Our data indicates that Tanvex BioPharma had more in total liabilities than it had cash, when it last reported. That put it in the highest risk category, according to our analysis. But with the share price diving 13% per year, over 5 years , it's probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. You can click on the image below to see (in greater detail) how Tanvex BioPharma's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Investors in Tanvex BioPharma had a tough year, with a total loss of 40%, against a market gain of about 38%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Tanvex BioPharma you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tanvex BioPharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6541

Tanvex BioPharma

A biopharmaceutical company, researches, develops, manufactures, and sells biosimilar products in Taiwan and the United States.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives