- Taiwan

- /

- Life Sciences

- /

- TWSE:4133

We Think You Should Be Aware Of Some Concerning Factors In Abnova (Taiwan)'s (TWSE:4133) Earnings

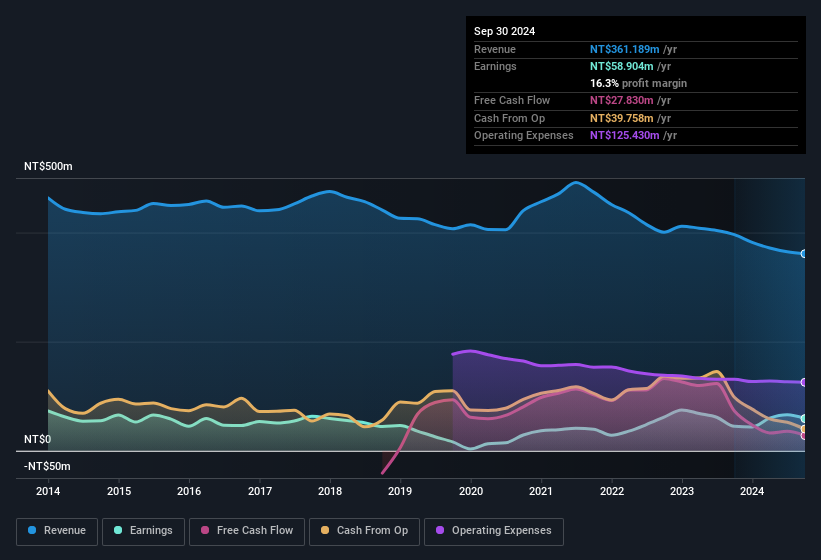

The recent earnings posted by Abnova (Taiwan) Corporation (TWSE:4133) were solid, but the stock didn't move as much as we expected. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

View our latest analysis for Abnova (Taiwan)

An Unusual Tax Situation

Abnova (Taiwan) reported a tax benefit of NT$3.7m, which is well worth noting. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Abnova (Taiwan).

Our Take On Abnova (Taiwan)'s Profit Performance

Abnova (Taiwan) reported that it received a tax benefit, rather than paid tax, in its last report. As a result we don't think its profit result, which includes that tax-boost, is a good guide to its sustainable profit levels. Because of this, we think that it may be that Abnova (Taiwan)'s statutory profits are better than its underlying earnings power. Nonetheless, it's still worth noting that its earnings per share have grown at 59% over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Abnova (Taiwan), you'd also look into what risks it is currently facing. For example - Abnova (Taiwan) has 2 warning signs we think you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Abnova (Taiwan)'s profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4133

Abnova (Taiwan)

Manufactures and sells various recombinant proteins and antibodies.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026