- Mexico

- /

- Healthcare Services

- /

- BMV:MEDICA B

Global Dividend Stocks: 3 Top Picks For Reliable Income

Reviewed by Simply Wall St

As global markets navigate through a complex landscape marked by economic uncertainty and potential shifts in monetary policy, investors are increasingly seeking stability and reliable income streams. In this environment, dividend stocks stand out as appealing options for their ability to provide consistent payouts, making them attractive for those looking to mitigate volatility while generating steady returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.81% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.19% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.96% | ★★★★★★ |

| NCD (TSE:4783) | 4.34% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.66% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.51% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.66% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.34% | ★★★★★★ |

Click here to see the full list of 1373 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

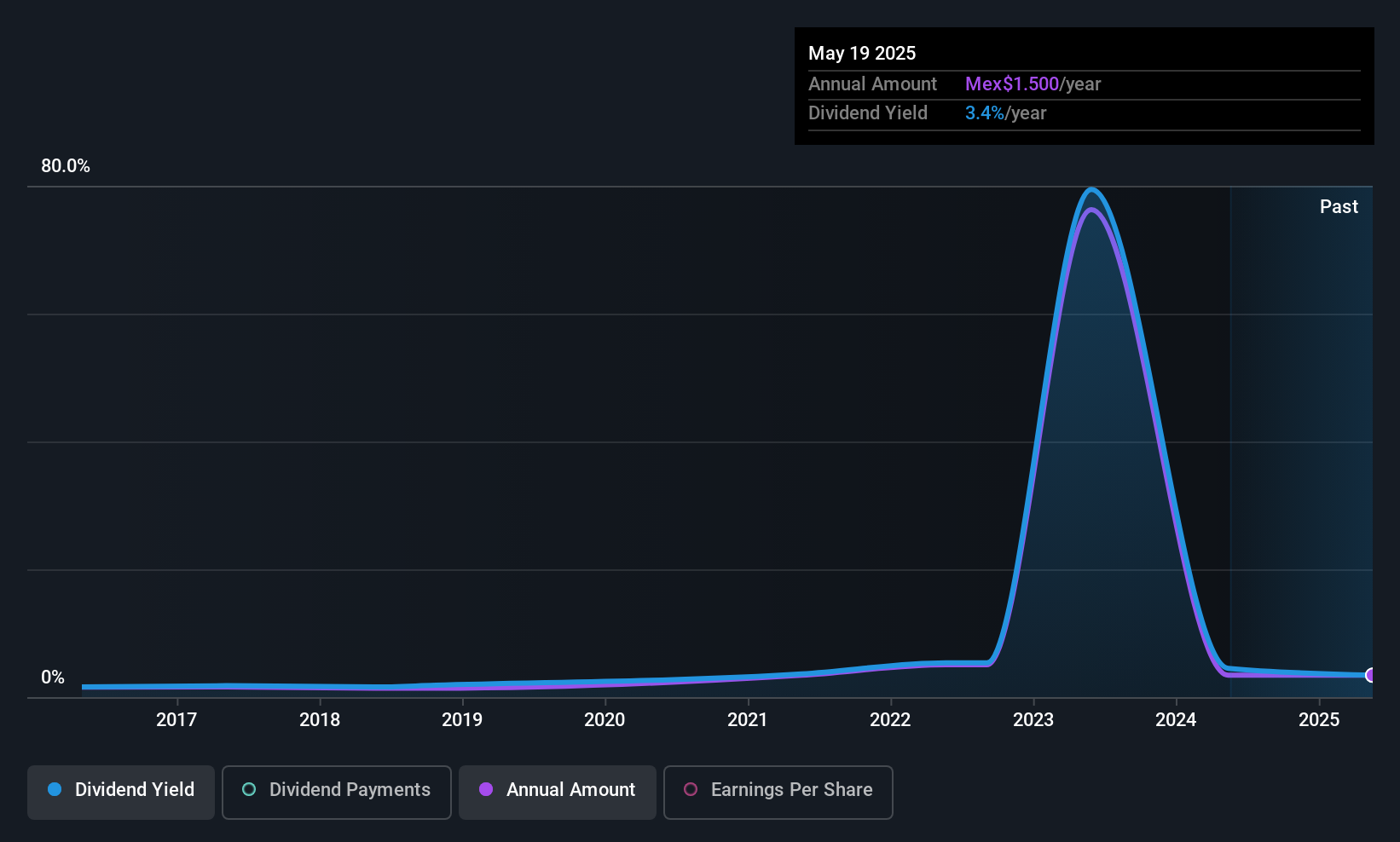

Médica Sur. de (BMV:MEDICA B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Médica Sur, S.A.B. de C.V. operates as a healthcare hospital in Mexico with a market cap of MX$5.29 billion.

Operations: Médica Sur, S.A.B. de C.V. generates revenue through its operations as a healthcare hospital in Mexico.

Dividend Yield: 3%

Médica Sur's recent earnings report shows a strong financial performance, with significant increases in sales and net income. Despite this growth, its dividend yield of 3% is below the top quartile of Mexican dividend payers. The company maintains a sustainable payout ratio with dividends well-covered by earnings and cash flows, at 30.2% and 20.7% respectively. However, its dividend history has been unstable over the past decade despite some growth in payments.

- Get an in-depth perspective on Médica Sur. de's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Médica Sur. de's share price might be too pessimistic.

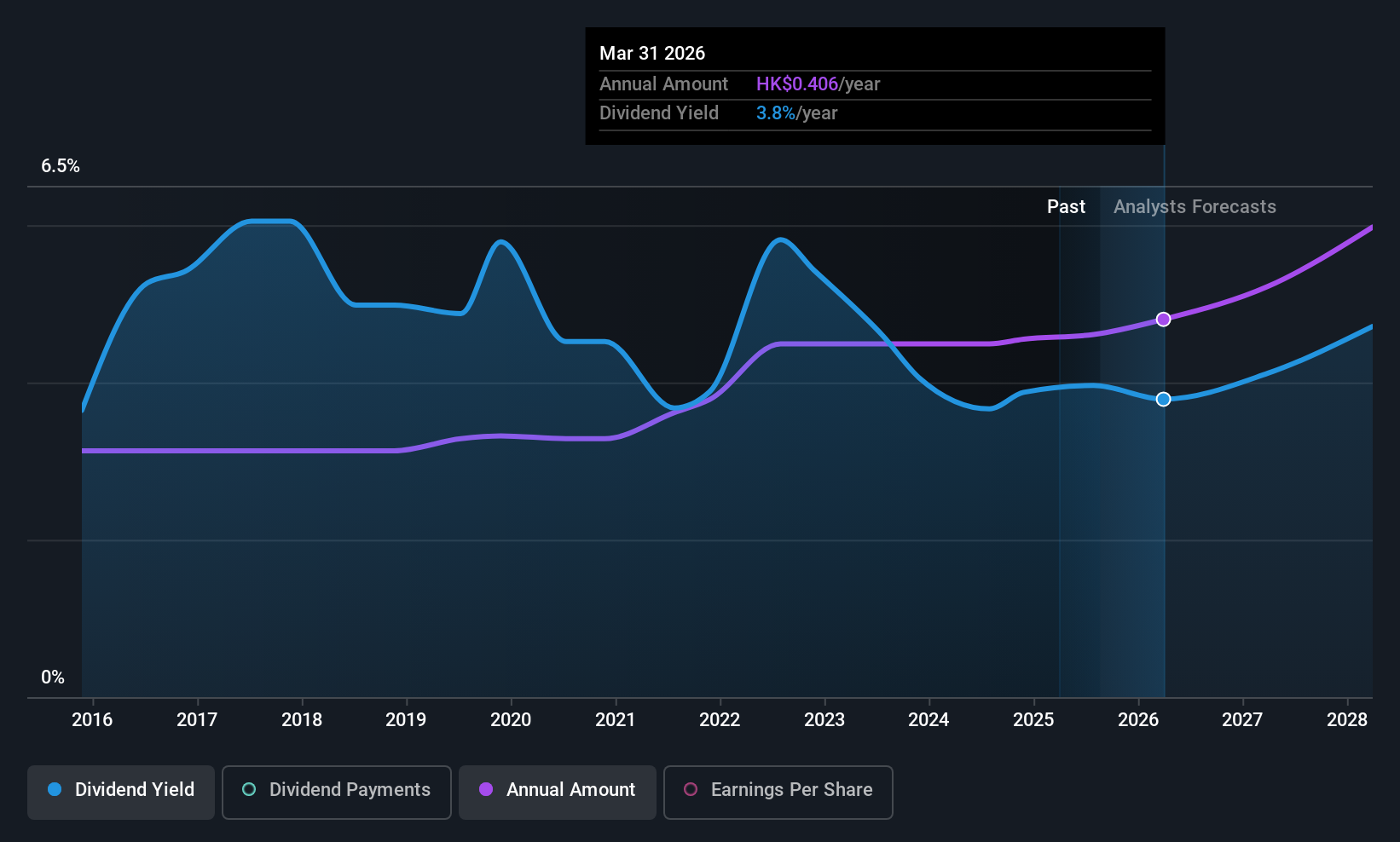

Lenovo Group (SEHK:992)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market cap of approximately HK$155.80 billion.

Operations: Lenovo Group's revenue is primarily derived from its Intelligent Devices Group, which includes PCs and Smart Devices, and its Data Center Group.

Dividend Yield: 3.1%

Lenovo Group's dividend yield of 3.08% is modest compared to the top Hong Kong dividend payers, yet its low payout ratio of 37.3% suggests dividends are well-supported by earnings. Although the company lacks free cash flow coverage, it has maintained stable and growing dividends over the past decade. Recent product innovations in AI and IT infrastructure could bolster future revenue streams, though significant insider selling raises some concerns about internal confidence in sustained growth.

- Click to explore a detailed breakdown of our findings in Lenovo Group's dividend report.

- Our comprehensive valuation report raises the possibility that Lenovo Group is priced lower than what may be justified by its financials.

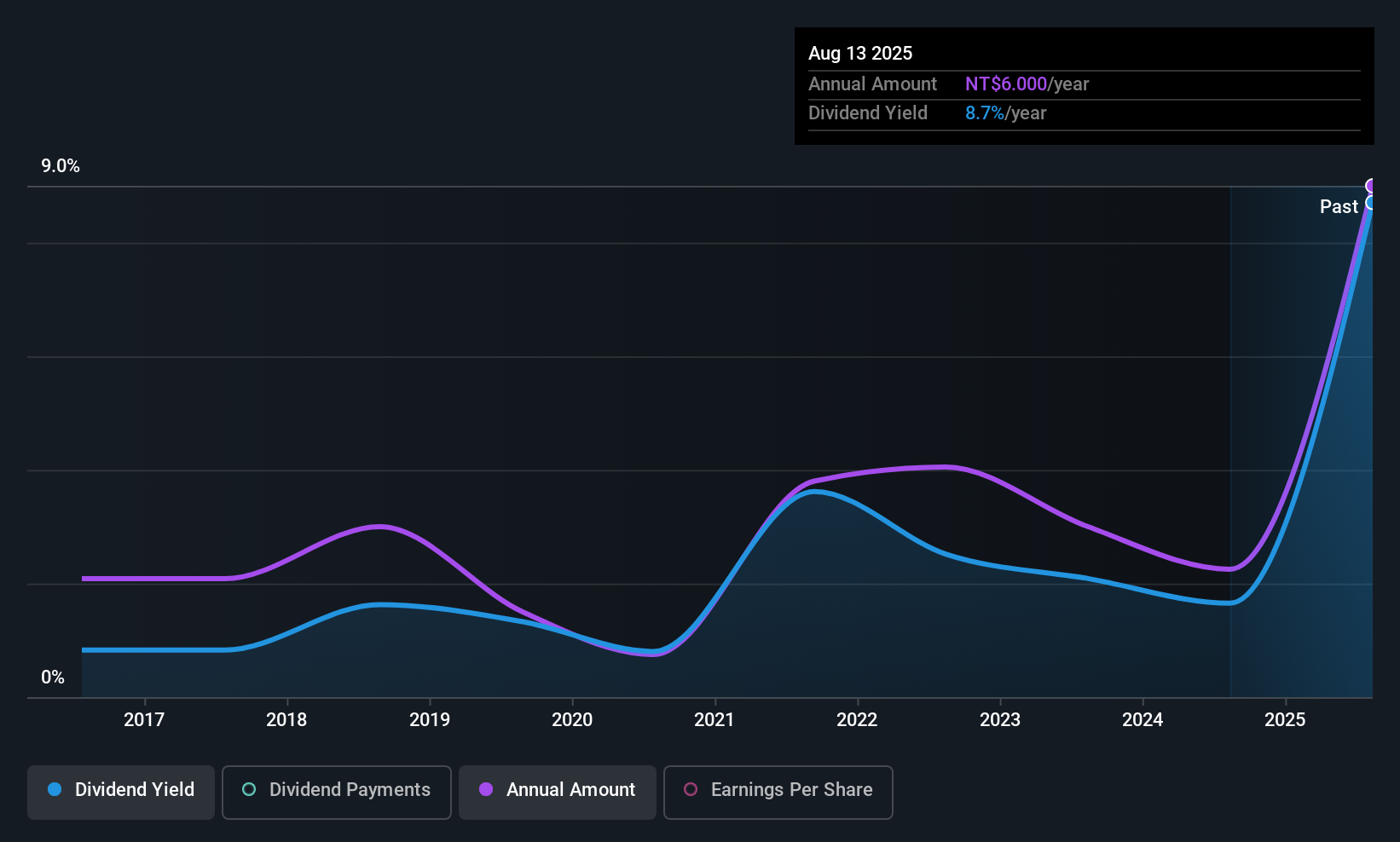

PharmaEngine (TPEX:4162)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PharmaEngine, Inc., a biopharmaceutical company based in Taiwan, focuses on developing drugs and therapeutic treatments for cancer with a market cap of NT$10.34 billion.

Operations: PharmaEngine generates revenue primarily from its New Medicine Development segment, amounting to NT$2.48 billion.

Dividend Yield: 8.3%

PharmaEngine's dividend yield ranks in the top 25% of Taiwan's market at 8.33%, supported by a reasonable payout ratio of 52.9%. Despite this, its dividend history has been volatile over the past decade, with notable fluctuations. Recent earnings reports show a decline in net income, potentially impacting future payouts. The company's collaboration with XtalPi on PEP08 offers promising therapeutic advancements but doesn't directly address dividend stability concerns for investors seeking consistent returns.

- Click here to discover the nuances of PharmaEngine with our detailed analytical dividend report.

- Our valuation report here indicates PharmaEngine may be undervalued.

Make It Happen

- Get an in-depth perspective on all 1373 Top Global Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:MEDICA B

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives