Sunmax Biotechnology Co., Ltd.'s (GTSM:4728) Stock Is Going Strong: Is the Market Following Fundamentals?

Most readers would already be aware that Sunmax Biotechnology's (GTSM:4728) stock increased significantly by 12% over the past three months. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. Specifically, we decided to study Sunmax Biotechnology's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Sunmax Biotechnology

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Sunmax Biotechnology is:

17% = NT$122m ÷ NT$728m (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.17 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Sunmax Biotechnology's Earnings Growth And 17% ROE

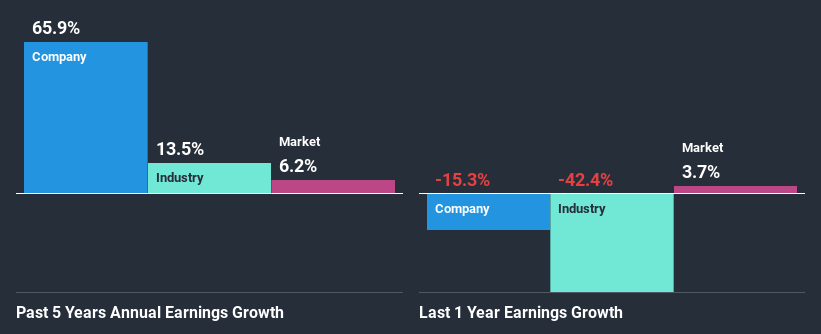

To begin with, Sunmax Biotechnology seems to have a respectable ROE. Further, the company's ROE compares quite favorably to the industry average of 3.5%. This probably laid the ground for Sunmax Biotechnology's significant 66% net income growth seen over the past five years. However, there could also be other causes behind this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

Next, on comparing with the industry net income growth, we found that Sunmax Biotechnology's growth is quite high when compared to the industry average growth of 14% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Sunmax Biotechnology is trading on a high P/E or a low P/E, relative to its industry.

Is Sunmax Biotechnology Using Its Retained Earnings Effectively?

Sunmax Biotechnology has a significant three-year median payout ratio of 63%, meaning the company only retains 37% of its income. This implies that the company has been able to achieve high earnings growth despite returning most of its profits to shareholders.

Besides, Sunmax Biotechnology has been paying dividends over a period of nine years. This shows that the company is committed to sharing profits with its shareholders.

Conclusion

On the whole, we feel that Sunmax Biotechnology's performance has been quite good. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Sunmax Biotechnology's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you decide to trade Sunmax Biotechnology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:4728

Sunmax Biotechnology

A biomedical company, develops, manufactures, and markets collagen-based medical devices in Taiwan and Mainland China.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026