Announcing: Holy Stone Healthcare (GTSM:4194) Stock Increased An Energizing 193% In The Last Year

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. For example, the Holy Stone Healthcare Co., Ltd. (GTSM:4194) share price has soared 193% in the last year. Most would be very happy with that, especially in just one year! On top of that, the share price is up 186% in about a quarter. It is also impressive that the stock is up 104% over three years, adding to the sense that it is a real winner.

View our latest analysis for Holy Stone Healthcare

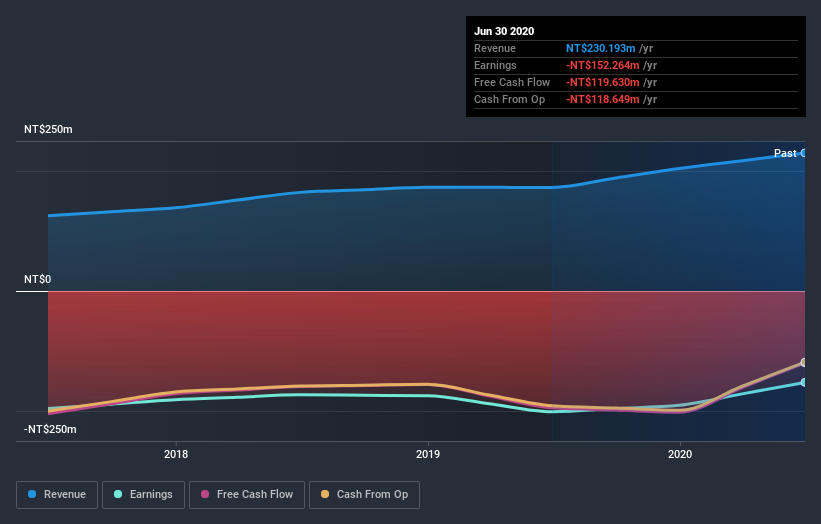

Given that Holy Stone Healthcare didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Holy Stone Healthcare saw its revenue grow by 33%. That's a fairly respectable growth rate. While that revenue growth is pretty good the share price performance outshone it, with a lift of 193% as mentioned above. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Holy Stone Healthcare's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Holy Stone Healthcare shareholders have received a total shareholder return of 193% over one year. That gain is better than the annual TSR over five years, which is 0.6%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Holy Stone Healthcare you should be aware of.

We will like Holy Stone Healthcare better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Holy Stone Healthcare, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Holy Stone Healthcare, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Holy Stone Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:4194

Holy Stone Healthcare

Develops and sells hyaluronic acid related therapeutic products.

Flawless balance sheet moderate.

Market Insights

Community Narratives