Introducing Medigen Biotechnology (GTSM:3176), The Stock That Slid 62% In The Last Five Years

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the Medigen Biotechnology Corp. (GTSM:3176) share price is a whole 62% lower. We certainly feel for shareholders who bought near the top.

View 2 warning signs we detected for Medigen Biotechnology

Medigen Biotechnology wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Medigen Biotechnology saw its revenue increase by 5.6% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 17% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Medigen Biotechnology. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

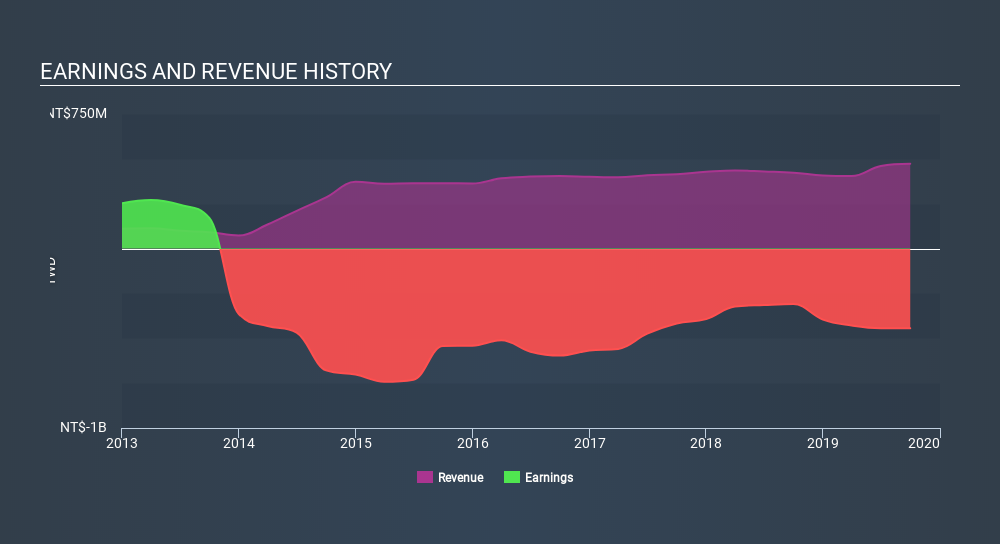

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Medigen Biotechnology shareholders have received a total shareholder return of 49% over the last year. There's no doubt those recent returns are much better than the TSR loss of 17% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Medigen Biotechnology (of which 1 is major) which any shareholder or potential investor should be aware of.

But note: Medigen Biotechnology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TPEX:3176

Medigen Biotechnology

A biopharmaceutical company, engages in the research and development of new drugs and vaccines, cytotherapy, advanced nucleic acid testing, generic drugs, aesthetic medicine, and vaccine-related products in Taiwan.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives